Multipliers - Conroe High School

advertisement

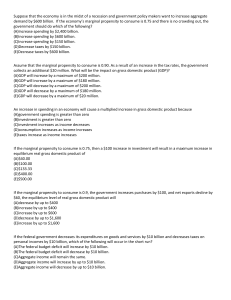

Multipliers Key Idea: A small change in spending leads to a large change in output/income LRAS PL SRAS PL1 AD Y1 YF GDP GAP GDPR • The difference between Y1 and YF is called the GDP GAP • Do you need to spend the whole amount of gap to close the gap? Key formulas: • ∆ AE (C,I,G,XN) * M = ∆ GDP • 1/MPS = M • Tax multiplier 1-M Practice Problems • Suppose that autonomous consumption is $400 and that MPC is 0.8. If disposable income increases by $1,200, consumer spending will increase by a) b) c) d) e) $1,600 $1,360 $1,200 $960 $400 Practice Problems • In a closed economy with only lump-sum taxation, if the marginal propensity to consume is equal to .75, a $70B increase in government spending could cause a maximum increase in output of. a) b) c) d) e) $52.5b $70b $122.5b $210b $280b Practice Problems • If the MPC is 0.9, the government increases purchases by $100, and net exports decline by $60, the equilibrium level of real gross domestic product will a) b) c) d) e) Decrease by up to $400 Increase by up to $400 Increase by up to $600 Decrease by up to $1,600 Increase by up to $1,600 Practice Problems • If the federal government decrease its expenditures on goods and service by $10b and decreases taxes on personal incomes by $10b, which of the following will occur in the short run? a) b) c) d) e) The federal budget will increase by $10b The federal budget will decrease by $10b Aggregate income will remain the same Aggregate income will increase by up to $10b Aggregate income will decrease by up to $10b Practice Problems • Assume that Jane’s MPC is 0.8, and that in 2004 Jane spent $36,000 from her disposable income of $40,000. If her disposable income in 2005 increased to $50,000, her consumption spending increased by a) b) c) d) e) $4,000 $8,000 $9,000 $10,000 $14,000 Practice Problems • A high marginal propensity to consume implies which of the following? a) A small change in consumption when income changes b) A high savings rate c) A high marginal tax rat d) An equilibrium level of income near full employment e) A low marginal propensity to save • 1. Assume the United States economy is operating at fullemployment output and the government has a balanced budget. A drop in consumer confidence reduces consumption spending, causing the economy to enter into a recession. a) Using a correctly labeled graph of the short-run Phillips curve, show the effect of the decrease in consumption spending. Label the initial position “A” and the new position “B”. What is the impact of the recession on the federal budget? Explain. Assume that current real gross domestic product falls short of fullemployment output by $500 billion and the marginal propensity to consume is 0.8. b) c) i. ii. d) e) Calculate the minimum increase in government spending that could bring about full employment. Assume that instead of increasing government spending, the government decides to reduce personal income taxes. Will the reduction in personal income taxes required to achieve full employment be larger than or smaller than the government spending change you calculated in part (c)(i) ? Explain why. Using a correctly labeled graph of the loanable funds market, show the impact of the increased government spending on the real interest rate in the economy. How will the real interest rate change in part (d) affect the growth rate of the United States economy? Explain.