Consumption Function Project Part I

advertisement

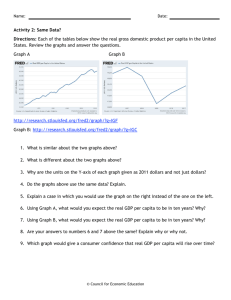

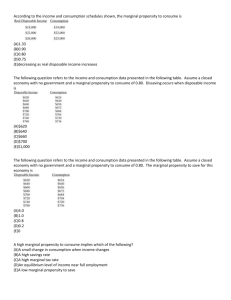

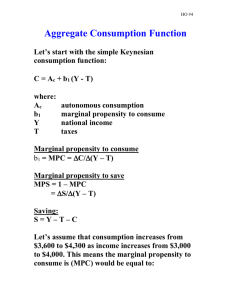

Consumption Function Project Part I According to Keynes (1) the marginal propensity to consume is between zero and one, (2) and that income is the primary determinant of consumption and that the interest rate does not have an important role. Based on these conjectures the Keynesian consumption function is given by the following equation Ct = α + βYt + ut Where Ct represents personal consumption expenditures at time t, α represents autonomous consumption at time t, β represents the marginal propensity to consume, Yt represents personal disposable income, and ut represents the random error term. Collect quarterly data on disposable personal income (http://research.stlouisfed.org/fred2/series/DPI/18 ) and personal consumption expenditures (http://research.stlouisfed.org/fred2/series/PCEC/18 ). You will need to convert both series into real terms using the GDP implicit price deflator (http://research.stlouisfed.org/fred2/series/GDPDEF/18 ). Plot the two series. Estimate the above regression over the entire time period. Estimate the regression over the time period 1990 – 2003. Is there a difference in the MPC? Do you think the inclusion of the interest rate would be a good idea? Why, or why not? What other variables may have an impact on personal consumption?