c+i+g+(xm) practice exam

advertisement

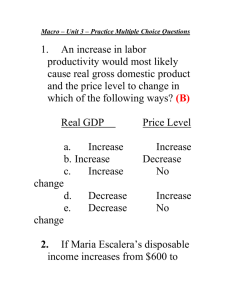

C+I+G+(X-M) PRACTICE EXAM ***ANSWERS CAN BE FOUND ON THE LAST PAGE: 1.The most important determinant of consumption and saving is the: A) level of bank credit. B) level of income. C) interest rate. D) price level. 2.The consumption schedule shows: A) a direct relationship between aggregate consumption and accumulated wealth. B) a direct relationship between aggregate consumption and aggregate income. C) an inverse relationship between aggregate consumption and accumulated financial wealth. D) an inverse relationship between aggregate consumption and aggregate income. 3.In contrast to investment, consumption is: A) relatively unstable. B) relatively stable. C) measurable. D) unmeasurable. i. 4.The above diagram shows consumption schedules for economies A and B. We can say that the: A) MPC is greater in B than in A. B) APC at any given income level is greater in B than in A. C) MPS is smaller in B than in A. D) MPC is greater in A than in B. 5.The greater the marginal propensity to consume, the: A) smaller is the marginal propensity to save. B) higher is the interest rate. C) lower is the average propensity to consume. D) lower is the price level 6.Refer to the above graph. A shift of the consumption schedule from C1 to C2 might be caused by a: A) recession. B) wealth effect of an increase in stock market prices. C) increase in income tax rates. D) increase in saving. 7.Refer to the above graph. A movement from a to b along C1 might be caused by a: A) recession. B) wealth effect of an increase in stock market prices. C) increase in income tax rates. D) increase in real GDP. 8.The investment demand slopes downward and to the right because lower real interest rates: A) expand consumer borrowing, making investments more profitable. B) boost expected rates of returns on investment. C) enable more investment projects to be undertaken profitably. D) create tax incentives to invest. 9.Suppose that a new machine tool having a useful life of only one year costs $80,000. Suppose, also, that the net additional revenue resulting from buying this tool is expected to be $96,000. The expected rate of return on this tool is: A) 80 percent. B) 8 percent. C) 2 percent. D) 20 percent. 10. Other things equal, a 10 percent decrease in corporate income taxes will: A) decrease the market price of real capital goods. B) have no effect on the location of the investment-demand curve. C) shift the investment-demand curve to the right. D) shift the investment-demand curve to the left. 11. Which of the following would shift the investment demand curve from ID1 to ID3? A) a lower interest rate B) lower expected rates of return on investment C) a higher interest rate D) higher expected rates of return on investment 12. The multiplier effect: A) reduces the MPC. B) magnifies changes in spending into larger changes in output and income. C) promotes stability of the general price level. D) lessens upswings and downswings in business activity. 13. If a $200 billion increase in investment spending creates $200 billion of new income in the first round of the multiplier process and $160 billion in the second round, the multiplier in the economy is: A) 4. B) 5. C) 3.33. D) 2.5. 14. If the marginal propensity to save is 0.2 in an economy, a $20 billion rise in investment spending will increase: A) GDP by $120 billion. B) GDP by $20 billion. C) saving by $25 billion. D) consumption by $80 billion. 15. If the dollar appreciates relative to foreign currencies, we would expect: A) the multiplier to decrease. B) a country's exports and imports to both fall. C) a country's net exports to rise. D) a country's net exports to fall 16. If the United States wants to increase its net exports, it might take steps to: A) increase its GDP. B) reduce existing tariffs and import quotas. C) decrease the dollar price of foreign currencies. D) increase the dollar price of foreign currencies 17. Which of the following is correct? A) Government expenditures and taxes both increase GDP. B) Government expenditures and taxes both decrease GDP. C) Government expenditures increase, but taxes decrease, GDP. D) Government expenditures decrease, but taxes increase, GDP. 18. Which of the following would reduce GDP by the greatest amount? A) a $20 billion increase in taxes B) $20 billion increases in both government spending and taxes C) $20 billion decreases in both government spending and taxes D) a $20 billion decrease in government spending ANSWERS TO PRACTICE EXAM: 1. 2. 3. 4. 5. 6. 7. 8. 9. 10. 11. 12. 13. 14. 15. 16. 17. 18. B B B D A B D C D C B B A D D C C D