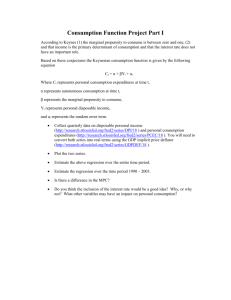

Aggregate Consumption Function: Economics Handout

advertisement

HO #4

Aggregate Consumption Function

Let’s start with the simple Keynesian

consumption function:

C = Ac + b1 (Y - T)

where:

Ac

b1

Y

T

autonomous consumption

marginal propensity to consume

national income

taxes

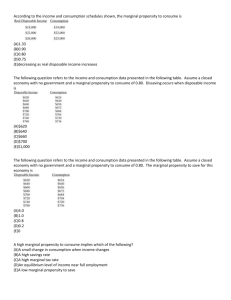

Marginal propensity to consume

b1 = MPC = C/(Y – T)

Marginal propensity to save

MPS = 1 – MPC

= S/(Y – T)

Saving:

S=Y–T–C

Let’s assume that consumption increases from

$3,600 to $4,300 as income increases from $3,000

to $4,000. This means the marginal propensity to

consume is (MPC) would be equal to:

MPC = (4,300 – 3,600)/(4,000 – 3,000)

= 700/1,000

= 0.70

If autonomous consumption is $1,500, then the

aggregate consumption function would take the

form:

C = 1,500 + 0.70 (Y - T)

If the disposable personal income were to fall to

$3,000, then aggregate consumption would fall to:

C = 1,500 + 0.70 (3,000)

= 3,600

If the marginal propensity to consume 0.70, then

the marginal propensity to save would be:

MPS = 1 – MPC

= 1 – 0.70

= 0.30

If the disposable personal income is 3,000, then

the level of saving would be:

S = 3,000 – 3,600

= -600

which represents a “dis-saving” of $600.

Absolute Income Theory

Consumption depends on income from current

work and from the level of consumer real wealth,

or:

C = Ac + b1(Y - T) + b2(W)

where:

W

existing real wealth

b1

marginal propensity to consume out of

income

b2

marginal propensity to consume out of

wealth

This equation thus reflects the “real wealth effect”

that is often referred to when discussing

consumption behavior

Permanent Income Theory

Transitory income does not change consumer

spending on non-durable goods. This theory

suggests that consumers’ permanent income

changes this consumption, or:

Yperm,t = a1(Y – T)t + a2(Y – T)t-1 + a3(Y – T)t-2 + …

where:

(Y – T)t disposable personal income in time “t”

Yperm permanent income

Consumer spending on non-durable goods

according to this theory is therefore also

influenced by consumers’ permanent income, or:

CN,t = b2(Yperm,t)

Substituting the lagged dependent variable into

the initial Keynesian equation, the consumption

equation for non-durable goods is given by:

CN,t = Ac,n + b1(Y – T)t + b2 Yperm,t-1

Life Cycle Hypothesis

Consumption in a particular year is part of

lifetime consumption decisions, reflecting utility

derived from spending and asset accumulation.

Ct = {(Y – T)t + (N-T) Yperm + ASt}/Lt

where:

ASt

assets in time period t

N–T

remaining earning years

Lt

lifetime expressed in years

This reflects the observation that young

consumers tend to have a much higher level of

consumption that older consumers. Their number

of remaining earning years is greater. This is

particularly true if the current disposable income

(Y – T)t and assets (ASt) for the two age groups

are identical.

In summary, the variables that can affect

aggregate consumption behavior include:

Current income

Wealth

Permanent income

Life expectancy

Prices

Interest rates

Regularity of income

Demographics

Consumer attitudes