21316919_MRF AR 2k13_4Clr Pages copy

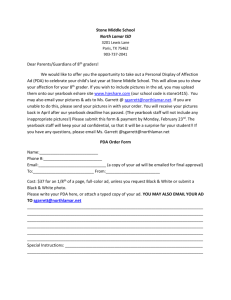

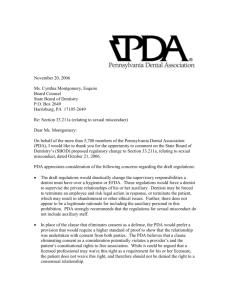

advertisement