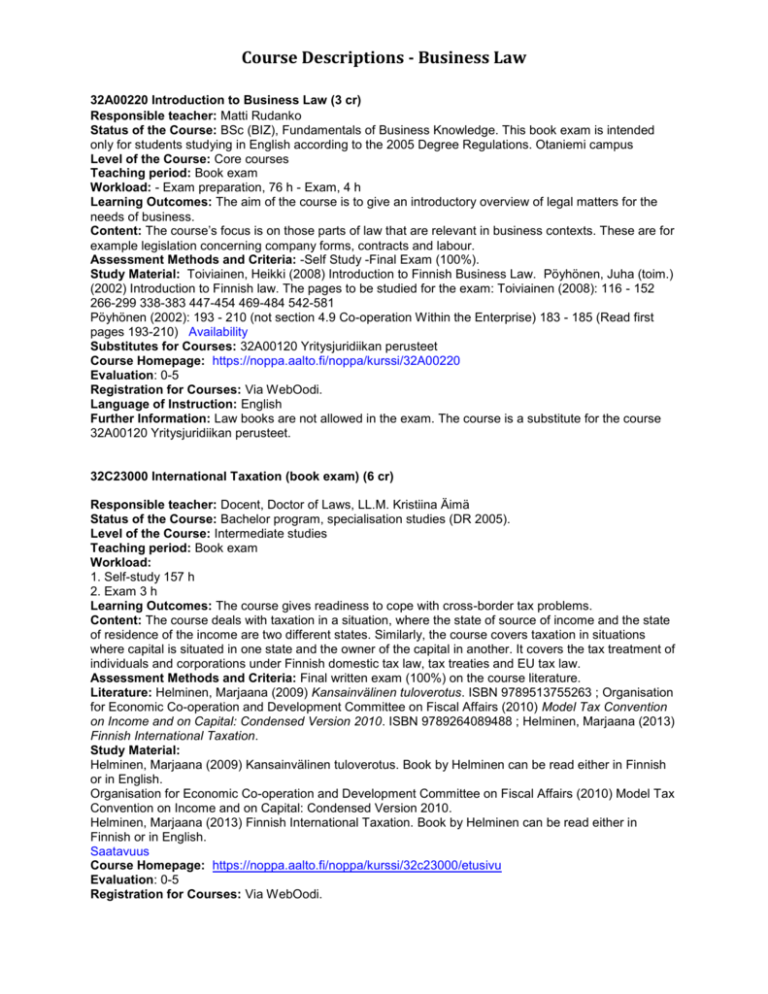

Course Descriptions - Business Law

advertisement

Course Descriptions - Business Law 32A00220 Introduction to Business Law (3 cr) Responsible teacher: Matti Rudanko Status of the Course: BSc (BIZ), Fundamentals of Business Knowledge. This book exam is intended only for students studying in English according to the 2005 Degree Regulations. Otaniemi campus Level of the Course: Core courses Teaching period: Book exam Workload: - Exam preparation, 76 h - Exam, 4 h Learning Outcomes: The aim of the course is to give an introductory overview of legal matters for the needs of business. Content: The course’s focus is on those parts of law that are relevant in business contexts. These are for example legislation concerning company forms, contracts and labour. Assessment Methods and Criteria: -Self Study -Final Exam (100%). Study Material: Toiviainen, Heikki (2008) Introduction to Finnish Business Law. Pöyhönen, Juha (toim.) (2002) Introduction to Finnish law. The pages to be studied for the exam: Toiviainen (2008): 116 - 152 266-299 338-383 447-454 469-484 542-581 Pöyhönen (2002): 193 - 210 (not section 4.9 Co-operation Within the Enterprise) 183 - 185 (Read first pages 193-210) Availability Substitutes for Courses: 32A00120 Yritysjuridiikan perusteet Course Homepage: https://noppa.aalto.fi/noppa/kurssi/32A00220 Evaluation: 0-5 Registration for Courses: Via WebOodi. Language of Instruction: English Further Information: Law books are not allowed in the exam. The course is a substitute for the course 32A00120 Yritysjuridiikan perusteet. 32C23000 International Taxation (book exam) (6 cr) Responsible teacher: Docent, Doctor of Laws, LL.M. Kristiina Äimä Status of the Course: Bachelor program, specialisation studies (DR 2005). Level of the Course: Intermediate studies Teaching period: Book exam Workload: 1. Self-study 157 h 2. Exam 3 h Learning Outcomes: The course gives readiness to cope with cross-border tax problems. Content: The course deals with taxation in a situation, where the state of source of income and the state of residence of the income are two different states. Similarly, the course covers taxation in situations where capital is situated in one state and the owner of the capital in another. It covers the tax treatment of individuals and corporations under Finnish domestic tax law, tax treaties and EU tax law. Assessment Methods and Criteria: Final written exam (100%) on the course literature. Literature: Helminen, Marjaana (2009) Kansainvälinen tuloverotus. ISBN 9789513755263 ; Organisation for Economic Co-operation and Development Committee on Fiscal Affairs (2010) Model Tax Convention on Income and on Capital: Condensed Version 2010. ISBN 9789264089488 ; Helminen, Marjaana (2013) Finnish International Taxation. Study Material: Helminen, Marjaana (2009) Kansainvälinen tuloverotus. Book by Helminen can be read either in Finnish or in English. Organisation for Economic Co-operation and Development Committee on Fiscal Affairs (2010) Model Tax Convention on Income and on Capital: Condensed Version 2010. Helminen, Marjaana (2013) Finnish International Taxation. Book by Helminen can be read either in Finnish or in English. Saatavuus Course Homepage: https://noppa.aalto.fi/noppa/kurssi/32c23000/etusivu Evaluation: 0-5 Registration for Courses: Via WebOodi. Course Descriptions - Business Law Language of Instruction: English Further Information: Students may answer in Finnish or English in the exam. Law books and the OECD Model Convention may not be used in the examination. This course is a book exam for students studying according to the 2005 Degree Regulations. 32E11100 Legal Aspects of Finance (6 cr) Responsible teacher: Matti Rudanko Status of the Course: Master program, advanced studies (DR 2005 & DR 2013). Level of the Course: Advanced studies Teaching period: I (Fall 2015). Workload: 1. Lectures 18 h and seminar (group work or essay) - 6 h (not compulsory) - Self study 133 h - Final exam 3 h Learning Outcomes: The aim of the course is to get acquainted with the regulative framework for securities markets and to gain an understanding of the cooperation between legal and business economic factors affecting various forms of corporate finance. Among the practical objectives of the course there are various skills of market related corporate finance, such as an ability to evaluate the influence of legal rules for the choice of optimum forms of corporate finance and skills to produce and interpret information provided in legal rules for securities markets. Content: The contents of the course include legal rules of listing, disclosure duties of issuers of securities, legal duties related to public bids, mergers and acquisitions, regulation of insiders and market abuse and the customer relationships of investment service firms. Also law and economics, sociological and information science aspects of information in securities markets and investor relations are discussed. Assessment Methods and Criteria: 1. Lectures 18 h and seminar (group work or essay) 6 h (not compulsory), Professor Matti Rudanko. 2. Final exam (100%) on the course literature. Study Material: Rudiger Veil (Editor), Rebecca Ahmling (Translator) (2013) European Capital Markets Law. Hart Publishing Ltd. Availability Course Homepage: https://noppa.aalto.fi/noppa/kurssi/32E11100 Evaluation: 0-5 Registration for Courses: Registration for the lectures and for the final exam via WebOodi. Language of Instruction: English Further Information: Law books are not allowed in the exam. 32E29000 European and International Tax Law (6 cr) Responsible teacher: New tax law Professor Status of the Course: Masters program, advanced studies Level of the Course: Advanced Teaching period: II (Fall 2015). Workload: Lectures 30 h Preparing for lectures 20h Preparing for exam 87h Preparing for lecture exam 28h Exam 3h Learning Outcomes: After the course students will have basic knowledge of International and European Tax Law. The course gives readiness to cope with cross-border tax problems. The course focuses on direct taxation. Indirect taxation will be touched upon briefly. Students will become familiar with landmark Course Descriptions - Business Law tax case law of the European Court of Justice. In addition, the students will learn how to find information about International and European Tax Law from the internet. Content: The course deals with taxation in a situation, where the state of source of income and the state of residence of the income are two different states. Similarly, the course covers taxation in situations where capital is situated in one state and the owner of the capital in another. It covers the tax treatment of individuals and corporations under Finnish domestic tax law, tax treaties and EU tax law. During the course current case law and legislative development will be discussed. Current tax issues will be studied from an international angle. EU tax directives and tax implications of the Treaty on the Functioning of the European Union will also be discussed. Landmark tax cases of the European Court of Justice will be examined. Assessment Methods and Criteria: 1. Lectures 30 h, Docent, Doctor of Laws, LL.M. Kristiina Äimä. Lectures are followed by a written lecture exam 3h. Lectures will be followed by a written lecture exam. The credit points received in the exam may be used to substitute the book Helminen Marjaana: Finnish International Taxation 2013. The credit points received in the exam correspond to 50 % of the final mark. 2. Additional 5 credit points (12,5% of the final grade) will be received by delivering a tax case presentation. The case must concern international and/or European tax law. Preferably the tax case should be decided by European Court of Justice, European Court of Human, Supreme Administrative Court of Finland or Central Tax Board. Also supreme tax courts of other states qualify. Students may book a date with the teacher in class or contact her by email/phone. Tax case presentations and discussions in class enable the students learning how to apply international and European Tax law in practice. Students may present one of the cases included in the course materials. They may also agree on choosing another case with the teacher. The length of the presentation is 10-15 minutes if held by one student and 15-20 minutes if held by a group of 2-3 students. 3. Final book exam 3h. Study Material: Helminen, Marjaana (2013) Finnish International Taxation. Lang, M. - Pistone, P. - Schuch, J. - Staringer, C. (2012) Introduction to European Tax Law on Direct Taxation. Organisation for Economic Co-operation and Development Committee on Fiscal Affairs (2010) Model Tax Convention on Income and on Capital: Condensed Version 2010. Recommended (not compulsory) further readings on the course website Availability Substitutes for Courses: This course replaces the courses 32E22000 European Tax Law and 32C23000 International Taxation. If a student has completed either of these courses, he/she cannot register for this course. Course Homepage: https://noppa.aalto.fi/noppa/kurssi/32E29000 Evaluation: 0-5 Registration for Courses: Via Weboodi. Language of Instruction: English. Further Information: The lecture exam is an open book exam meaning that books and other materials on International and European tax law and a dictionary may be used. The open book lecture exam measures whether the learning outcomes of the course are met. It will be graded in line with how well the students apply the course materials to the questions. There will be four 4 questions with limited space to answer (A4 on both sides; half of page for each question). The questions are based on the power-point slides. The questions are only in English. Students may answer in English, Finnish or Swedish. The lecture exam is evaluated on scale 0-20 credit points (50% of the course). The Treaty on the Functioning on the European Union and cases of the European Court of Justice may be used in the real exam. The TFEU Treaty and the ECJ’s cases can be underlined and Articles of the Treaty and paragraphs of the cases can be referred to. Other notes are not allowed. In addition, the use of a dictionary is allowed. Students may answer in English, Finnish or Swedish. Course Descriptions - Business Law 32E30000 Tax Planning of International Enterprises (6 cr) Responsible teacher: Tax law professor (to be announced). Status of the Course: M.Sc. –degree, advanced course in business law (DR 2013). Level of the Course: Advanced. Teaching period: II (Fall 2015) Workload: Classroom hours 16 h Class preparation 76 h Exam preparation 28 h Exam 4 h Learning Outcomes: The students learn how to use the concepts of International corporate taxation and the role of taxation in the decision making process of the international enterprises. You will also learn the logic behind taxing international transactions and methods of transfer pricing. Content: The course focuses on major problems of international corporate taxation. The course offers various tax planning techniques applied by international enterprises. Taxation problems are dealt from an international angle taking into account EU law and income tax treaties. Assessment Methods and Criteria: Exam (100%) Study Material: In Noppa. Course Homepage: https://noppa.aalto.fi/noppa/kurssi/32E30000 Prerequisites: Bachelor’s degree. The course is an advanced MSc level course Evaluation: 0-5 Registration for Courses: Via Weboodi. 32E32000 Fundamentals of Intellectual Property Law I (6 cr) Responsible teacher: Prof. Marcus Norrgård (Hanken) Status of the Course: Master’s degree, Advanced studies in Business Law (DR 2005 & DR 2013). Level of the Course: Advanced Teaching period: I (Fall 2015) See more specific schedule in Hanken’s web pages. Please note that the course starts already on 31st of August. Workload: Lectures, exercises, self-study, term paper. Learning Outcomes: After having successfully completed the course the course the students will be able to: - master general knowledge of fundamental concepts of intellectual property law - analyze and apply principles of IP law in a global setting Content: The aim of the course is to give a thorough understanding of the key concepts and principles of substantive intellectual property law (especially copyright, trademark, patent, and design law). Topics include the requirements for protection & scope of protection of IP rights in the European Union. Assessment Methods and Criteria: Written examination (80 % of the grade), which is based on the literature (including lectures), term paper (20 % of the grade) Study Material: MacQueen, H., Waelde, C. & Laurie, G. (2010). Contemporary Intellectual Property. Law and Policy. Oxford University Press. Lecture notes, slides, articles and cases as pointed out by the instructor. All articles, slides as well as cases are required for the exam. Course Homepage: http://www.hanken.fi/student/en/StudyHandbook/Course/course/3774/?location=1 Evaluation: 0-5 Registration for Courses: Via WebOodi using code 32E32000. See the registration time in WebOodi. Language of Instruction: English. Further Information: The students are also expected to learn the contents of lecture notes. The lecture notes will be made available during the course on the website. The course will be lectured at Hanken. A maximum of 40 Aalto Econ MSc students will be accepted to the course in order of registration. Course Descriptions - Business Law 32E33000 Taxes and Corporate Finance (6 cr) Responsible teacher: Prof. Matti Kukkonen (Hanken) Status of the Course: Master’s degree, advanced studies (DR 2005 & DR 2013) Level of the Course: Advanced Teaching period: III-IV (Spring 2016) See more specific teaching schedule in Hanken’s web pages. Workload: 214 hours divided into Scheduled (contact) hours: Non-scheduled work: Learning Outcomes: By the end of this course students will be able to: - describe the general individual and corporate tax issues relating to corporate finance - apply basic tools and practices in the context of customary debt or payout policy planning of the Finnish enterprises Assessment Methods and Criteria: Written examination (70 % of the grade), which is based on the course material (including lectures), and term paper (a case study, 30 % of the grade). Study Material: Lecture notes and an extensive package of readings will be distributed. Additional readings: Kukkonen, M: Capital Gains Taxation and Realization Behaviour. HSE A-168, 2000. Course Homepage: http://www.hanken.fi/student/en/StudyHandbook/Course/course/3786/?location=1 Prerequisites: Introductory course in tax law is recommended. Evaluation: 0-5 Registration for Courses: Via Weboodi. Language of Instruction: English. Further Information: Please see the Hanken study guide and website for more information. Hanken course code is 3786. Please note that registering for the course will be via Aalto WebOodi using code 32E33000. The course will be lectured at Hanken. A maximum of 40 Aalto Econ MSc students will be accepted to the course in order of registration. Only students of Aalto Econ MSc programs can be accepted to the course. Priority will be given to students of the Business Law MSc program. 32E36000 Monetizing IPR in Creative Industries (6 cr) Responsible teacher: Petri Kuoppamäki Status of the Course: Master’s degree, Advanced studies in Business Law. Level of the Course: Advanced Teaching period: III-IV (Spring 2016) Workload: Project work in teams 94 h Classroom hours 30 h Individual work 30 h Team meetings with facilitator 6 h Total 160 h (6 op) Learning Outcomes: The course will enhance the understanding of future business leaders and buyers of design on the strategic importance of intellectual property rights. On the other hand the course will give to the future experts of creative industries insights on IPR they will in their creative work. After completing the course, students will be able to • identify, analyze and solve IPR related problems from a multi-disciplinary viewpoint • apply the knowledge and skills gained during their studies to real-life tasks and challenges • manage complex projects and work in diverse teams • present a case report both orally and in writing • critically reflect on their learning process and outcomes Content: The course deals with intellectual property rights in creative industries. Creative industries rely upon complex systems of intellectual property rights, from copyright, patent, design rights, to trademark laws that can be used either alone or in various combinations in order to protect innovative designs and implementations. The course will deal with IPR issues in creative industries in a problem-oriented and practical manner from the perspective of monetization of these intangible assets. Course Descriptions - Business Law The monetization angle creates the “backbone” of the course in terms of business economics and enables a common language between the business and art students. In the lecturers a two speaker model will be utilized. One lecturer will cover the topic from a practical, substantive and business development angle and the other primarily from the perspective of IPR creation, protection and monetization. This informal and discursive setting aims at making it easier for the student to bring her own questions and experiences to the discussion. The course consists of an applied, real-life problem-based projects and IPR related cases that students identify, analyze and solve in multi-disciplinary teams. In the course, there are ten 3 hour seminar lectures. The lectures will take place at the beginning of the period III. After the lectures each working team (4-5 students from different disciplines) identifies a real-life IPR related problem they select. After getting the project idea approved by the course leaders, the team works independently to provide a solution for the identified problem. The case and the solution are then presented in the closing seminar towards the end of the period IV by each team. Between the seminars, each student team meets with their facilitator (at least) twice, to report on their progress and to receive feedback. Assessment Methods and Criteria: The course consists of mandatory attendance and three main assignments, the first of which is divided into three parts as follows: 1. Written team case report 50% a. Progress report 1 b. Progress report 2 c. Final report 2. Oral team case presentation 30% 3. Individual student portfolio 20% All assignments must be completed to pass the course. Late assignments are not accepted. All the assignments are assessed on a 0-5 scale based on the following rubrics that are all available in the course workspace in Moodle: • The written team case report is assessed based on the Business writing and Capstone rubrics • The oral team case report is assessed based on the Business presentations rubric • The individual student portfolio is assessed based on the Capstone rubric Study Material: With their team, students are expected to identify and use readings from several different sources such as textbooks, articles, newspapers, magazines, and the Internet. Including but not limited to: Walter Isaacson: Steve Jobs. Simon & Schuster 2011 John Palfrey: Intellectual Property Strategy. MIT Press Essential Knowledge 2011 Prerequisites: Degree students studying in the Master’s Programs in the School of Business and School of Arts are eligible for the course. A maximum number of 50 students will be admitted to the course (with a 50 % allocation of seats to each School). Also exchange students can be admitted to the course. Evaluation: 0-5 Registration for Courses: Via Weboodi. Language of Instruction: English Further Information: • Attendance in all sessions is mandatory • Students will be divided into the working teams by the teachers in charge • Course workspace in Moodle: https://moodle.aalto.fi/course/view. course enrolment key given to registered students • Evaluation rubrics available in Moodle