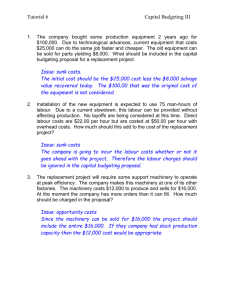

chapter10 - Finance Learning Center

advertisement