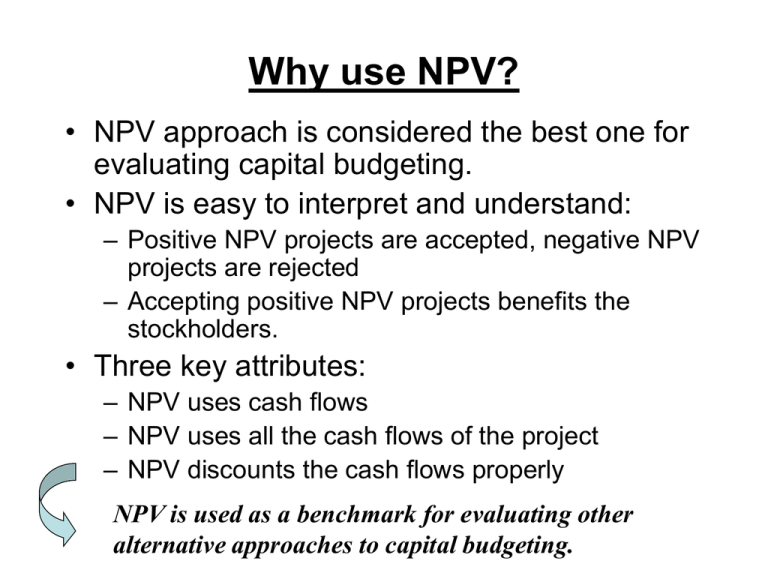

Why use NPV?

advertisement

Why use NPV? • NPV approach is considered the best one for evaluating capital budgeting. • NPV is easy to interpret and understand: – Positive NPV projects are accepted, negative NPV projects are rejected – Accepting positive NPV projects benefits the stockholders. • Three key attributes: – NPV uses cash flows – NPV uses all the cash flows of the project – NPV discounts the cash flows properly NPV is used as a benchmark for evaluating other alternative approaches to capital budgeting. Managerial perspective - PBP • Payback rule is often used by large companies when making relatively small investment decisions. • Used for decisions made by lower-level management. • Its simple to use and allows upper management to delegate responsibility. • Important in terms of management control (short term verification of manager’s assessment of cash flows). • For bigger investment decisions, the payback rule is seldom used (when questions of controlling and evaluating the manager become less important than making the right investment decision). Internal rate of return (IRR) • The IRR is very similar to the NPV approach. • Basic rationale: it tries to find a single number that summarizes the merits of a project. • That number does not depend on the interest rate that prevails in the capital market. • The number is internal or intrinsic to the project and does not depend on anything except the cash flows of the project. IRR • IRR rules: – The firm should accept the project if the discount rate is below 10% (IRR > discount rate). – The firms should reject the project if the discount rate is above 10% (IRR < discount rate). Advantages of the IRR • Rule that summarizes the information about a project in a single rate of return. • Simple way of discussing a project. • However, in order to apply the IRR, you must compare it with r. So, the discount rate is needed for making a decision under both approaches.