Construction Contract Accounting: Problem Set

advertisement

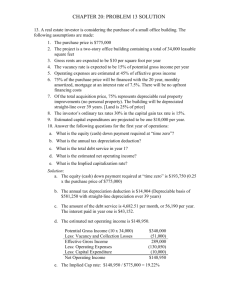

On June 15, 2006, Sanderson Construction entered into a long-term construction contract to build a baseball stadium in Washington, D.C. for $220 milliion. The expected completion date is April 1 of 2008, just in time for the 2008 baseball season. Costs incurred and estimated costs to complete at year-end for the life of the contract are as follows ($ in millions): 2006: 2007: 2008: Costs incurred during the year $40 $80 $50 Estimated costs to complete as of 12/31 120 60 - 1: Determine the amount of gross profit or loss to be recognized in each of the 3 years using the Percentage-of-completion method. 2: How much revenue will Sanderson report in its 2006 and 2007 income statements related to this contract using the percentage-of-completion method? 3: Determine the amount of gross profit or loss to be recognized in each of the 3 years using the Completed contract method. 4: Suppose the estimated costs to complete at the end of 2007 are $80 million instead of $60 million. Determine the amount of gross profit or loss to be recognized in 2007 using the Percentage-of-Completion method. Need to show work, all calculations and or equations used. Requirement 1 ($ in millions) Contract price Actual costs to date Estimated costs to complete Total estimated costs Estimated gross profit (actual in 2008) 2006 $220 40 120 160 $ 60 2007 $220 120 60 180 $ 40 Gross profit (loss) recognition: 2006: $40 = 25% x $60 = $15 $160 2007: $120 = 66.67% x $40 = $26.67 - $15 = $11.67 $180 2008: $220 – 170 = $50 – ($15 + 11.67) = $23.33 Requirement 2 2006: $220 x 25% = $55 2008 $220 170 -0170 $ 50 2007: $220 x 66.67% = $146.67 – 55 = $91.67 2008: $220 – 146.67 = $73.33 Requirement 3 Year 2006 2007 2008 Total project income Gross profit (loss) recognized -0-050 $50 Requirement 4 2007: $120 = 60% x $20* = $12 - 15 = $(3) loss $200 *$220 – ($40 + 80 + 80) = $20