Returns

advertisement

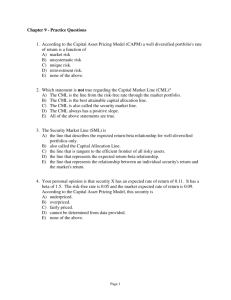

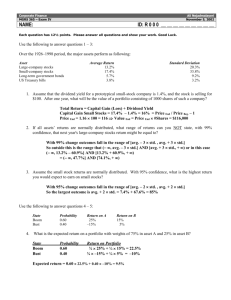

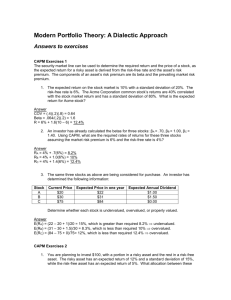

1. The normal distribution is useful in analyzing security returns because: a. We frequently deal with finite data sets. b. Of its bell-shaped appearance. c. 95% of all observations fall within two standard deviations of the mean. d. The distribution of security returns is usually different from a normal distribution. e. It can be completely described by its mean and standard deviation. 2. You purchased a bond for $900 one year ago. Today, you receive your only interest payment for the year of $100. The bond can currently be sold for $975. What is your total percentage return on investment? Ignore tax effects. a. 8.3% b. 11.1% c. 18.0% d. 19.4% e. 23.8% 3. You purchased 200 shares of preferred stock on January 1, 1998 for $42.27 per share. The stock pays an annual dividend of $5 per share. On December 31, 1998 the market price is $43.88 per share. What is your percentage return on investment for the year? a. 4.9% b. 8.0% c. 14.9% d. 15.1% e. 15.6% 4. Risk that affects a large number of assets, each to a greater or lesser degree, is called: a. Idiosyncratic risk. b. Diversifiable risk. c. Systematic risk. d. AssetSpecific risk. e. Total risk. 5. The principle of diversification tells us that: a. Concentrating an investment in two or three large stocks will eliminate all of your risk. b. Concentrating an investment in two or three large stocks will reduce your overall risk. c. Spreading an investment across many diverse assets cannot (in an efficient market) eliminate any risk. d. e. Spreading an investment across many diverse assets will eliminate all of the risk. Spreading an investment across many diverse assets will eliminate some of the risk. 6. The amount of systematic risk present in a particular risky asset, relative to the systematic risk present in an average risky asset, is called the particular asset’s: a. Beta coefficient. b. Reward to risk ratio. c. Law of One Price. d. Diversifiable risk. e. Treynor index. 7. You are looking at two different stocks. IBX has a beta of 1.25 and Microsquish has a beta of 1.95. Which statement is true about these investments? a. IBX is always a better addition to your portfolio. b. Microsquish is always a better addition to your portfolio. c. The expected return on IBX will be the higher of the two. d. You cannot tell which of the two will have the higher expected return without further information. e. The stock in IBX has the same reward to risk ratio as does Microsquish. 8. Which of the following describes a portfolio that plots below the security market line? a. The security is undervalued. b. The security is providing a return that is greater than expected. c. The security’s reward to risk ratio is too low. d. The security’s beta is too low. e. The security provides a return that exceeds the average return on the market. 9. Given the following information: The risk-free rate is 7%, the beta of stock A is 1.2, the beta of stock B is 0.8, the expected return on stock A is 13.5%, and the expected return on stock B is 11.0%. Further, we know that stock A is fairly priced and that the betas of stocks A and B are correct. Which of the following regarding stock B must be true? a. Stock B is also fairly priced. b. The expected return on stock B is too high. c. The expected return on stock A is too high. d. The price of stock B is too high. e. The price of stock A is too high. 10. What is the expected return on asset A if it has a beta of 0.3, the expected market return is 14%, and the risk-free rate is 5%? a. 6.0% b. 9.2% c. 7.2% d. 7.7% 11. What is the portfolio beta if 75% of your money is invested in the market portfolio, and the remainder is invested in a risk-free asset? a. 0.50 b. 0.25 c. 1.25 d. 1.00 e. 0.75 Use the following information to answer questions #12 through #15. Security A B Risk-free asset Return 15% 12% 5% Standard Deviation Beta 8% 1.2 14% 0.9 ??? ??? 12. Which of A and B has the least total risk? The least systematic risk? a. A; A b. A; B c. B; A d. B; B e. Cannot be determined without more information. 13. What is the value of systematic risk for a portfolio with 75% of the funds invested in A and 25% of the funds invested in B? a. 0.98 b. 1.13 c. 1.28 d. 1.40 e. 1.60 14. What is the portfolio expected return and the portfolio beta if you invest 30% in A, 30% in B and 40% in the risk-free asset? a. 9.6%; 1.32 b. 9.6%; 1.00 c. 10.1%; 0.95 d. 10.1%; 0.72 e. 10.1%; 0.63 15. What is the portfolio expected return with 125% invested in A and the remainder in the risk-free asset via borrowing at the risk-free interest rate? a. 9.8% b. 11.3% c. 16.8% d. 17.5% e. 20.1% Problem1: Using the following returns, calculate the aver age returns, the variances, and the standard deviations for X and Y. Returns Year 1 2 3 4 5 X 16% 4 —8 10 6 V 32% —8 —17 30 18 Problem2: Suppose the return on long-term government bonds is normally distributed. Based on the historical record, what is the approximate probability that your return will be less than -3.6 percent in a given year? What range of returns would you expect to see 95 percent of the time? How about 99 percent of the time? Problem3: You own a stock portfolio invested 30 percent in Stock Q, 20 percent in Stock R, 25 percent in Stock S, and 25 percent in Stock T. The betas for these four stocks are 1.40, .95, 1.20, and .80, respectively. What is the portfolio beta? Problem4: A stock has a beta of 1.2, the expected return on the market is 17 percent, and the risk-free rate is 8 percent. What must the expected return on this stock be? Problem5: Stock M has a beta of 1.4 and an expected return of 25 percent. Stock N has a beta of .85 and an expected return of 15 percent. If the risk-free rate is 6 percent and the market risk premium is 10.3 percent, are these stocks correctly priced? Which one is undervalued? Overvalued? Problem6: You have $100,000 to invest in Stock D, Stock F, or a risk-free asset. You must invest all of your money. Your goal is to create a portfolio that has an expected return of 14 percent and is as risky as the overall market, if D has an expected return of 18 percent and a beta of 1.50, F has an expected return of 15.2 percent and a beta of 1.15, and the risk-free rate is 6 percent, and if you invest $50,000 in Stock D, how much will you invest in Stock F? Problem 7: An all-equity firm is considering the following projects: Project Beta Expected Return W .75 12% X .85 14 Y 1.20 18 Z 1.50 19 The T-bill rate is 5 percent, and the expected return on the market is 15 percent. Which projects have a higher expected return than the firm’s 14 percent cost of capital? Which projects should be accepted? Which projects will be incorrectly accepted or rejected if the firm’s overall cost of capital is used as a hurdle rate?