Answers to exercises

advertisement

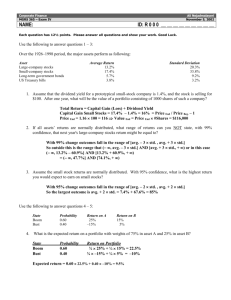

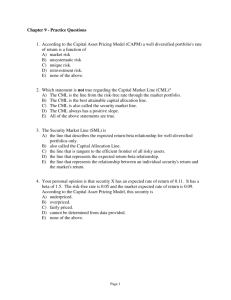

Modern Portfolio Theory: A Dialectic Approach Answers to exercises CAPM Exercises 1 The security market line can be used to determine the required return and the price of a stock, as the expected return for a risky asset is derived from the risk-free rate and the asset’s risk premium. The components of an asset’s risk premium are its beta and the prevailing market risk premium. 1. The expected return on the stock market is 10% with a standard deviation of 20%. The risk-free rate is 6%. The Acme Corporation common stock’s returns are 40% correlated with the stock market return and has a standard deviation of 80%. What is the expected return for Acme stock? Answer COV = (.4)(.2)(.8) = 0.64 Beta = .064/(.2)(.2) = 1.6 R = 6% + 1.6(10 – 6) = 12.4% 2. An investor has already calculated the betas for three stocks: βA = .70, βB = 1.00, βC = 1.40. Using CAPM, what are the required rates of returns for these three stocks assuming the market risk premium is 6% and the risk-free rate is 4%? Answer RA = 4% + .7(6%) = 8.2% RB = 4% + 1.0(6%) = 10% RC = 4% + 1.4(6%) = 12.4% 3. The same three stocks as above are being considered for purchase. An investor has determined the following information: Stock A B C Current Price $20 $30 $75 Expected Price in one year $22 $31 $84 Expected Annual Dividend $1.00 $1.50 $0.00 Determine whether each stock is undervalued, overvalued, or properly valued. Answer E(RA) = (22 – 20 + 1)/20 = 15%, which is greater than required 8.2% undervalued. E(RB) = (31 – 30 + 1.5)/30 = 8.3%, which is less than required 10% overvalued. E(RC) = (84 – 75 + 0)/75= 12%, which is less than required 12.4% overvalued. CAPM Exercises 2 1. You are planning to invest $100, with a portion in a risky asset and the rest in a risk-free asset. The risky asset has an expected return of 12% and a standard deviation of 15%, while the risk-free asset has an expected return of 5%. What allocation between these assets will result in a portfolio with an expected return of 9%? What will that portfolio’s variance be? Answer w(.12) + (1 – w)(.05) = .09 .12w + .05 – 05w = .09 .07w = .04 w = .04/.07 = .57 Invest $57 in risky asset and $43 in risk-free asset. 2portfolio = (1 – wRf)22i = (.57)2(.15) 2 = .0073 2. What is the expected return for each asset class in the following situation? Scenario A B C Probability 0.5 0.3 0.2 Expected Returns Stocks Bonds T-bills 18.0% 14.0% 11.0% (15.0)% 35.0% 7.0% 10.0% (8.0)% 12.0% Answer E(Rstocks) = (0.5)(18) + (0.3)(-15) + (0.2)(10) = 9 – 4.5 + 2 = 6.5% E(Rbonds) = (0.5)(14) + (0.3)(35) + (0.2)(-8) = 7 + 10.5 – 4 = 13.5% E(Rtbills) = (0.5)(11) + (0.3)(7) + (0.2)(12) = 5.5 + 2.1 + 2.4 = 10% 3. Assuming a market variance of .5, what is the beta of a stock with a covariance relative to the market 0.075? Answer βi = COVi,M / M2 = (.075)/(.5) = .15 4. The expected return on the stock market is 12% with a standard deviation of 37.4%. If the risk-free rate is 3%, calculate the expected return of a stock that has a covariance of 0.14 with the market return. Answer βi = COVi,M / M2 = (.14)/(.374) 2 = 1.00089 R = 3% + 1.00089(12% - 3%) = 12.0% 5. You hold the following portfolio; Stock AAA BBB CCC DDD Shares 100 100 100 100 Price / Share $70 $100 $20 $10 Beta 1.1 0.8 1.5 1.3 If the stock market index produced a return that was 10% greater than the risk-free rate, how much would you expect your portfolio to outperform the risk-free rate? Answer Stock Shares AAA 100 BBB 100 CCC 100 Price / Share $70 $100 $20 Beta 1.1 0.8 1.5 Weight 35% 50% 10% Weighted Beta .385 .4 .15 DDD 100 $10 1.3 5% .065 betaportfolio = .385 + .4 + .15 + .065 = 1 Thus, the portfolio should return exactly the market risk premium of 10% above the risk-free rate. 6. A portfolio consists of $10,000 in bonds and $40,000 in stocks. The expected return on bonds is 5% and its standard deviation is 1%. The expected return on stocks is 12% and its standard deviation is 6%. Assuming that the bonds and stocks are uncorrelated, determine the standard deviation of this portfolio. Answer 2p = w2121 + w2222 + 2 w1w2r12i2 2p = (0.2)2(1%)2 + (0.8)2(6%)2 + 2(0.2)(0.8)(0)(1%)(6%) = 23.08% p = √23.08% = 4.8% 7. The correlation between hedge fund returns and common stocks is .25. The respective standard deviations are 15% and 13.4%. What is the covariance between these two asset classes? Answer COVxy = rxyxy COVxy = (.25)(.15)(.134) = .005025 8. Assume a portfolio is formed by investing equally in four assets: stock X, stock Y, the risk-free asset, and the market portfolio. The beta of stock X is 0.80 and the beta of stock Y is 1.60. What is the value of beta for the portfolio? Answer βP = wXβX + wYβY + wRfβRf + wMβM βP = (.25)(.8) + (.25)(1.6) + (.25)(0) + (.25)(1) = .2 + .4 + 0 + .25 = .85 9. Given the following information determine the expected return on the XYZ mutual fund, using the capital market line model. Risk-free rate Expected market return XYZ fund return variance Market return variance 6% 10% .0625 .0400 Answer RP = RF + (RM – RF) (P/M) = 6 + (10 – 6) (√0.0625/√0.0400) = 11% 10. The S&P has a standard deviation of 18%. If stock ABC has a standard deviation of 15% and a correlation coefficient (r) of .6 with the S&P, what is the beta for the stock? Answer COVxy = rxyxy = (.6)(.18)(.15) = .0162 βi = COVi,M / M2 = (.0162)/(.18) 2 = .5 APT Exercise 1 Suppose there are two factors that determine the returns on stocks; the economy as measured by the growth rate of real GDP and interest rates. Assume the risk-free rate is 5%. The following parameters have been determined using statistical regression: FGDP = .03 Fr = .02 βGDPx = 1.2 βrx = 0.1 The market requires an extra 3% return premium for every 1% uncertainty with respect to predicting real GDP. The market requires an extra 2% return premium for every 1% uncertainty with respect to predicting interest rates. The response of stock X to unanticipated changes in the rate of growth of GDP is 1.2 times the amount of the change. The response of stock X to unanticipated changes in interest rates is 0.1 times the amount of the change. Project the expected long run return on stock X. Answer E(RP) = RF + βP,iFi + βP,jFj E(RP) = .05 + 1.2(.03) + .1(.02) = 0.088 = 8.8% APT Exercise 2 1. A portfolio manager has an investment horizon of one year. She assumes that the expected returns on Techmar stock and Riexa stock are 10% and 9%, respectively. She also makes the following projections and calculates the factor betas (factor sensitivities) for the two stocks. Variable Inflation GDP Growth Expected Value 2.0% 3.0% Factor Betas Techmar Riexa -2.0 1.0 4.0 2.0 Write the multifactor equations for each stock. If the actual levels of inflation and GDP growth are 2.5% and 2.7% respectively, what does the model predict will be the return on the stocks and on a portfolio consisting of 50% Techmar and 50% Riexa? Answer Return Techmar = 10% - 2.0(Inflation surprise) + 4.0(GDP surprise) Return Riexa = 9% + 1.0(Inflation surprise) + 2.0(GDP surprise) Inflation surprise = 2.5% - 2.0% = +.5% GDP surprise = 2.7% - 3.0% = -.3% Predicted returns: Techmar return = 10% - 2(.5%) + 4(-.3%) = 7.8% Riexa return = 9% + 1(.5%) + 2(-.3%) = 8.9% Portfolio return = .5(7.8%) + .5(8.9%) = 8.35% 2. An analyst has determined that the return on XYZ stock can be explained by the following model: RXYZ = 2.0% + 0.5(IP) + 2.0(INFL) + 1.0(EXCH) where: IP = % change in industrial production INFL = Inflation Rate EXCH = % change in the $ exchange rate For 20X8, IP is expected to rise by 3%, inflation is expected to be 5%, and the dollar is expected to fall 2% against a broad basket of currencies. The market is expected to earn a 10% return in 20X8 and the risk-free rate is 6%. Based on the information provided, calculate the expected return for XYZ in 20X8. Answer RXYZ = 2.0% + 0.5(IP) + 2.0(INFL) + 1.0(EXCH) RXYZ = 2.0% + 0.5(3) + 2.0(5) + 1.0(-2) = 11.5%