discuss7 - Haas School of Business

advertisement

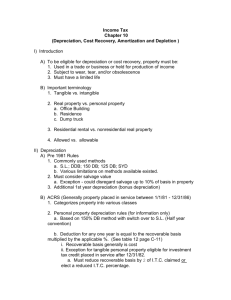

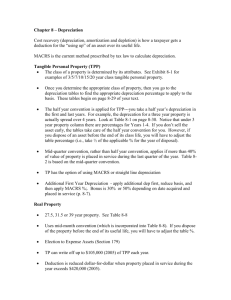

Agenda 3-15 BA 128A-1 • • • • • Questions from lecture Form groups Review Chapter 10&11 Assignment - I10-27,29,42 I11-44,46 Additional - I10-24,34, I11-37,51 Depreciation, Depletion and Amortization • For assets/property used in trade or business or held for production of income • Disallowed depreciation - personal use assets , indefinite life assets - e.g. land/securities • Rules – before 1981 - same as financial accounting standards – 1981-1986 - ACRS - provide stimulus for investment – After 1986 - MACRS - follow economic useful life of assets • Deduction allowed in year asset place into service • Capitalization vs. Expenses Types of property • Tangibles - land, building, equipment natural resources (depletion) • Intangibles - goodwill (amortization), patents, stocks, bonds • Personal use property • Personal property - equipment, vehicles, furniture • Real Property - land and structure permanently attached to the land Rules • Conversion of personal use asset to business valued at lesser of adjusted basis or FMV as of conversion date • Pre 1981 - Financial accounting methods of depreciation - Straight line, Declining Balance, Sum of the years digit • Useful life determined by experience and business practice • Can elect ADR system (asset depreciation range system) for useful life references ACRS • Stimulate private investment, accelerated cost recovery system • Improve business productivity, simplify taxpayer compliance and facilitate IRS administration • Provide great tax benefits • Personal property - ACRS table or straight line, half year convention for 3,5,10,15 recovery period, all assets treated as if acquired in the mid point of the year, no cost recovery in the year of sale/disposition • Real property - residential/nonresidential real property used in trade or business or held for the production of income • recovery periods 15.18.19 years for different property acquired at different dates P I10-6 • After 6/22/84, mid month convention is used • Can elect to use st. line 3- year ACRS can have recovery periods of e.g. 3,5,12 years (See page I10-6), similar to ACRS, half year convention for personal property, mid month for real estate and no cost recovery for personal property in year of disposition MACRS • Class lives generally lengthened • No salvage value for both ACRS and MACRS • Personal property - half year convention, conversion to st. line if yields larger amount, amount reduced by half in year of disposition, recovery period is 3,5,7,10,15 years • Requires the use of mid-quarter if aggregate basis of all personal property in service in the last 3 months > 40% of the cost of all personal property placed in service during the tax year (exclude section 179 property and property place and disposed in the same year) - however this does not mean half year convention always yields more. • Disposal calculation needs to be consistent, half year or quarter • May elect straight line, same recovery period or use the ADS MACRS- real property • Residential - 27.5 years recovery period, 80% of income has to derive from dwelling purpose • Non-residential, 39 years • mid-month • Straight line • Capital improvements depreciated over its econ. life, not the life of the building Alternative depreciation System (ADS) • Certain property is required or taxpayers can elect - property outside the US is required, recovery period is much longer • Use of straight over lengthened period and same convention - midyear, month or quarter • Annual election Section 179 • Apply only to tangible personal business property • $18500 in 1998 in year of acquisition and has to be placed in service the same year • Not applied to real estate • Election made on annual basis • Limitations – cannot be related party transaction – Phase out >$200,000 property acquired $ for $ – Cannot exceed taxpayer’s income, excess carryforward to unlimited # of years, cost basis is reduced immediately MACRS restrictions • >50% business use, if not, ADS system is used • MACRS recapture if business use fall below 50%, excess depreciation included in ordinary income • Use ADS subsequently even if business >50% later • Luxurious automobile restriction, leasing restriction Depletion • Intangible drilling and development costs applies to oil, gas and geothermal wells • Deducted or capitalized • Amount of depletion claimed each year = greater of % of depletion and cost depletion amounts. • Methods - cost depletion(units sold) and % of depletion (15% of gross income) Amortization • Straight line • Apply to goodwill & other purchased intangibles • Research and experimental expenditures • Start-up expenditures and others • Section 197 - acquisition of substantial part of business - 15 year amortization period definition of 197 assets PI10-19 (including goodwill, licenses, workforce/customer lists Amortization • Partial disposal of Section 197 assets - no recognition of loss allowed - other assets’ basis is increased • R&E expenditures - election - expense in the year occurred, defer/amortized the costs. If no election capitalized • Expense not qualify as R&E (table I10-5) • Capital expenditures in connection with R&E cannot be expensed • Amortization commences the month in which benefits from the expenditures are realized Chapter 11 - Accounting period • • • • Period to recognize income and expense Tax year = fiscal year If no fiscal year - tax year = calendar year Tax year determined when first tax return is filed, need IRS approval for change • Partnerships - follow the tax year of majority partners, if partners do not have the same tax years, use the period that results in the smaller deferral of income • S-corp, PSC - generally use calendar year unless there is a business purpose • Allow tax year to fall on same last day of the month or day closest to the end of the month Change in accounting period • Generally required IRS approval, need a substantial business purpose (e.g. natural business year) • Exceptions - newly married spouse, change to 5253 weeks with same calendar month, partnership changes, corporation (with no accounting change in the last 10 years, no NOL, no change in corporate status, taxable income from short year is >= 90% of preceding full tax year • Taxpayers changing accounting period have to annualize their income - prevent income to be taxed at lower rate Accounting methods • Cash method (no inventory) • Accrual method (all events and economic tests) – all events - rights to receive, amount determined at reasonable accuracy or liability is established for expenses – economic performance - services/property provided • Hybrid Inventories • Accounted for using best accounting practice (GAAP) or clearly reflect income • At cost or lower of cost or market • If use LIFO, cannot use lower of cost or market • COGM - uniform capitalization method full absorption method • if use LIFO, financial accounting needs to use LIFO, other inventory methods allowed to use, FIFO, specific identification, avg costs methods • LIFO - $ value LIFO, LIFO pools, use government price indices for different pools conversion from FIFO to LIFO Long Term contracts • Construction of property/good that cannot be completed within the tax year period after it has begun • Methods to account for income – % of completion - (according to % of work completed) – completed contract method - (income reported in year contract is completed) – modified % of completion - (if cost is hard to estimate, recognized income until 10% of costs incurred) – Look back interest adjustments (compare to actual costs) • Costs include DL, DM and OH, indirect costs such as selling, marketing, advertising R&D can be deducted currently, G&A expenses and interest costs need to be allocated Installment sale • Installment sale - at least 1 payment is received after close of the taxable year in which the disposition occurs. • Not applicable to inventory by dealers and publicly traded property • Computations PI1-17, compute Gross profit, contract price and compute gross profit %. Subject to depreciation recapture and excess mortgage Installment sale • Installments as gifts - taxable event - recognize gain/loss between face value and adjusted basis • Repossession of property sold on installment basis is a taxable event - recog gain/loss between value of repossessed property and adjusted basis of installment obligation • Borrowed funds from installment obligation • Related party installment sales Imputed interest • Installment basis contract with no interest or low rate of interest • IRS apply rate according to fed government rate on borrowed funds • If principal < $2.8 million, interest rate limited to 9%, related party rate limited to 6% • Exemption - personal use property, original issue discount (bond), < 6months due payments • e.g. compensation related loans, gift loans or corporate shareholder loans Change in accounting methods • Requires IRS approval except changing to LIFO • negative or positive adjustment (e.g. from cash to accrual or vice versa) • involuntary change • voluntary change • may spread amount over a period (table I115)