financial aid - Enrichment Classes of Carrollton

FINANCIAL AID

Lisa Tetsch, Academic Advisor lisat93@gmail.com

updated 9/18/10

FAFSA (fafsa.ed.gov) (Free Application for Federal Student Aid)

FAFSA is where all financial aid begins.

Filling out and submitting this form automatically opens federal, state and college sponsored need-based and merit-based financial aid. Everyone should submit a FAFSA, even if you think you’re too wealthy to qualify for aid. You would be surprised.

Submit electronically and error-free (this is critical). Watch those deadlines!

Expected Family Contribution (EFC):

This is the number they use to figure out how much the family should expect to contribute to the student’s college expenses and is an important number when determining need-based FA.

Parents’ adjusted income (up to 47%)+

Parents’ assets (up to 5.65%)+

Student’s income (up to 50%)+

Student’s assets (up to 20%) = EFC

EFC is an important abbreviation to remember.

Factors affecting the % in above list:

Family size

Number of students in college at the same time

Income & asset protection figures (they can’t touch everything)

Marital status of parents (they only look at parent the child resides with most of the time & step-

parent in that home, if any)

Online EFC worksheet to determine EFC : ifap.ed.gov (click “Worksheets, schedules and tables”)

Items not considered:

Credit card debt

Family expense sheet (government doesn’t support high living)

Car payments

Mortgage payments

Your house may or may not be an asset

Your savings & checking accounts are assets

Retirement accounts can’t be touched

Family Income Average EFC(public univ.) Average EFC (private univ.)

Low: Less than $30,000. $1,500 $1,400

Low Middle: $30-44,999 $4,100 $3,900

Middle: $45-74,999 $9,000 $8,600

Upper Middle: $75-99,999 $16,100 $15,800

High: $100,000+ $29,800 $30,900

Once you know your EFC, determine your need:

Cost of Attendance (COA) – EFC = Need

Cost of Attendance (COA) = tuition, fees, room, board, books, supplies, personal expenses & travel expenses

(can also include computer and childcare costs). Schools (not you) figure this number. It’s usually listed on their websites.

Strategies to lower your EFC:

Keep your child poor

529 Savings Plan = asset of the contributor (usually the parents)

Don’t have money in your child’s name (they’ll want 20% of it to go to college)

Custodial accounts = asset of student

G et it out before January 1st of student’s high school Jr. year . Remember FA is based on previous year’s tax returns . Use that money for a mission trip, car, computer, etc.

Very important: The student’s Jr. year is the year, for both parents and student, to complete taxes ASAP after

Jan. 31. Plan to file very close to Jan 1 using accurate estimates, using a "will file" status (meaning you will be filing your taxes for the previous tax year). Then complete your taxes ASAP after Jan 31. You can amend the

FAFSA online and resubmit indicating that you have filed.

Trust funds = asset of students

Savings bonds = asset of students (if in student’s name)

*Balance tax advantages vs. financial aid when putting your money in your child’s name.

Turn in FAFSA as close to January 1st as possible (but after January 1st) and absolutely no later than

February 15th. This is an inflexible deadline and there are no loopholes to get around it.

Money is awarded on a first come basis.

Must complete renewal FAFSA form every year.

FINANCIAL AID PACKAGE

Your financial aid package will come in bits and pieces, if you get more than one award. You will accept or reject each piece. Make sure you know what you’re looking at. Many times parents accept loans thinking they’re grants. You will receive one FA package from each college you apply to and each package is different.

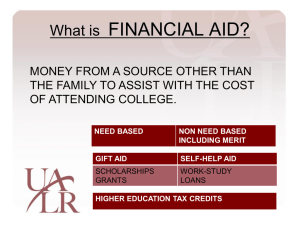

There are three types of Financial Aid: Grants, loans & work-study

1. Grants

Federal Pell Grants

For undergrad students who have the most financial need

EFC $4,617. or less

Maximum amount received $5,350.

Federal Supplemental Educational Opportunity Grants (FSEOG)

For undergrads with the most financial need

Schools administer this program

Amount received varies case by case $100-$4,000/yr.

Academic Competitive Grants

For freshmen and sophomores who completed “rigorous” (as defined by studentaid.ed.gov) course

of study in high school.

$750 for 1st year of college

$1,300 for 2nd year of college

Grants from the college

Need or merit-based

State Grants

Need or merit-based

Administered by the state, but some are distributed to college to administer

2. Loans

Federal PLUS Loans

For undergrads enrolled at least half-time, grads & professional degree students. Unsubsidized

loans for which financial need is not a requirement.

Federal Perkins Loans

For undergrads & grads, low-interest loans for students with extreme financial need

Can borrow up to $5,500/yr. as an undergrad and $8,000/yr. as a grad.

5% fixed interest rate, no additional fees

Subsidized and Unsubsidized Federal Stafford Loans

Two types:

A. Direct Stafford Loans – US government is the lender

B. FFEL Stafford Loans – Lender is a participating bank, credit union, etc.

Borrow up to $5,500 as freshman, $6,500 as sophomore, $7,500 as junior and/or senior.

If you’re a dependent you can borrow more if your parents are denied a parent loan.

If the loan is subsidized, the government pays for the interest that accrues while you’re in college

and before you start to repay it.

*Consider taking the subsidized loan (no fees attached, no interest accrued until after college)

Don’t touch the money. Just put it into an interest bearing account or invest it.

Use it only for emergencies (then you don’t have to take out an emergency student loan which

has fees and a very high interest rate attached). If you fear your ch ild will spend it, don’t

accept it.

3. Work-study

Federal Work-Study

Undergrads & grads earn money while attending school. They earn a paycheck and spending is unchecked (though it’s intended to pay for school).

State Work-Study

Similar to federal program

If you need more than your FA package offers:

1. Ask college for a re-evaluation

Request an appointment, have documents ready, remember the squeaky wheel gets the grease.

Provide financial aid office with concrete reasons why their initial assessment was wrong.

Helpful if you list special circumstances not reflected by the numbers on your FAFSA.

(medical bills, parent suddenly unemployed, loss of benefits, care of aging relative, etc.)

Have a number in mind, be polite and honest.

2. Go to college’s department to seek a grant.

Make an appointment with the Dean of your major/dept. Speak only with the Deanhe’s the only one who can approve the distribution of funds from that department.

Because these scholarships are available only to students in a particular major, there is less competition.

3. Matching Grants

Ask the college FA office if the college has a policy of matching grants. For example, a $1,000 scholarship from the Lion’s Club (private scholarship) turns into a $2,000 award. Ask if they match dollar for dollar.

*Always remember that if your financial aid package isn’t great, you have the option to continue in Dual

Enrollment and try again next year. Just keep knocking out those core courses.

F inancial Aid Incentives or “Teasers”:

Most books and online sources for college FA don’t include the following information.

You will get a letter from the college(s) you’ve applied to before March 1st. This is a letter of acceptance and a financial aid offer which cannot be retracted by the school. They want you to accept this offer, but don’t!

There’s no need to accept or reject it. Just wait. If you accept it, it will stop all financial aid from being processed at other schools and you’ll be locked in to this one FA package. The best teasers offer 50% of total cost of attending. A good size teaser is $15,000 for a private college (state schools don’t usually offer teasers).

Never accept a teaser. Wait for final offers.

Teasers come before March 1st

Final offers come March 1st-May 1st (almost always much greater packages than the teasers)

Must accept an offer by May 1st (usually)

You should apply to at least 3-5 colleges so you can negotiate financial aid after you get teasers. Consider all state schools as one school in total.

CSS PROFILE (collegeboard.com) (College Scholarship Service)

For non-federal financial aid only

More detailed than FAFSA

FAFSA vs. CSS PROFILE

All colleges use FAFSA

Some colleges also require CSS Profile

Check with your college to see which applications are required

FAFSA is free, CSS costs money ($5 registration fee, $18 processing fee, $24 for 1st college,

$18 for each additional college)

FAFSA ignores more family assets and is best if parents make under $50,000./yr. (adjusted), have

lots of debt.

Different deadlines

Different needs analysis formulas (EFC-Estimated Family Contribution)

PRIVATE SCHOLARSHIPS

Private scholarships must be pursued individually. These come from organizations, businesses, etc.

Requirements and awards vary greatly and are usually worth the pursuit. Most are need-based or meritbased, but can be based on anything (ethnicity, religious affiliation, athletic achievements, etc.). Apply for everything you are eligible for. Applying takes time, but can be richly rewarding.

Beware of scams.

Lists of Private Scholarships: studentaid2.ed.gov/getmoney/scholarship

**fastweb.com

*collegeboard.com

collegeanswer.com

brokescholar.com

freschinfo.com (nice that you don’t have to register) review.com (Princeton Review site) fastaid.com

aie.org

scholarships.com

*petersons.com

collegenet.com

collegejournal.com/partners/scholarship_search/ einaudi.cornell.edu/funding/search.asp

For international students, but many items offered are also open to non-international students.

Red Flags and Scholarship Scam Warnings:

Never pay an upfront fee (or any fee for that matter)

Never give out account numbers or credit card numbers

Person on phone doesn’t reveal name, address & phone number

“Guaranteed Scholarship” in exchange for a fee

MISC. INFO & INFO TO FURTHER INVESTIGATE

Tuition-Free Colleges: cooper.edu NY deepsprings.edu CA cofo.edu MO webb-institute.edu NY curtis.edu PA berea.edu KY alc.edu KY and U.S. military academies (highly competitive)

These schools are tricky. Some parents have their minds set on their students attending one of these schools but they might not understand the acceptance process.

Military duty = $ for school

Consider micro-investing:

Upromise.com or babymint.com

Register credit/debit cards (family members can help too – grandparents, aunts, uncles, etc.)

Goes into tax-free 529 Savings Plan

Can change beneficiary

529 Plans – Get one for the entire family unless you have more than three children. It hurts FA

opportunities.