Financial Aid Powerpoint - Little Rock Christian Academy

advertisement

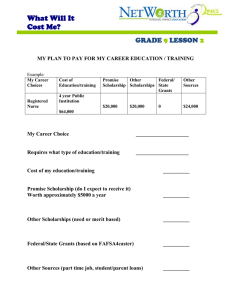

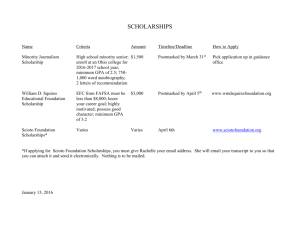

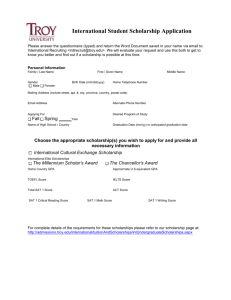

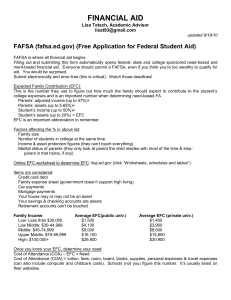

What is FINANCIAL AID? MONEY FROM A SOURCE OTHER THAN THE FAMILY TO ASSIST WITH THE COST OF ATTENDING COLLEGE. NEED BASED NON NEED BASED INCLUDING MERIT GIFT AID SELF-HELP AID SCHOLARSHIPS GRANTS WORK-STUDY LOANS HIGHER EDUCATION TAX CREDITS Sources of Aid: • • • • Colleges Private Sources State Federal Government Federal Financial Aid • Grants Awarded Based on Financial Need – Federal Pell Grant – Federal Supplemental Educational Opportunity Grant (FSEOG) • Non-Need Based Grants – Teacher Education Assistance for College and Higher Education (TEACH) Grant **Federal Grants do not require repayment with the potential exceptions for TEACH grants.** Federal Financial Aid • Federal Student Loans – Both Need Based and Non-Need Based – Loans must be repaid upon graduation – Two programs available to undergraduate students: Direct Loan and Perkins Loan Programs – One Program available for Parents of Dependent Undergraduate Students: Parent PLUS Federal Financial Aid • Federal Work-Study – Need based employment program – Student is paid an hourly wage – Funds are earned as the student works; no “up front” disbursement – Majority of employment positions are on campus Qualifying for Need-Based Aid Definition of Financial Need: Cost of Attendance − Expected Family Contribution (EFC) = Financial Need What will it cost? • Cost of Attendance figures are typically an average calculation, rather that actual costs for an individual student including: – – – – Tuition and Fees Books and Supplies Room and Board Miscellaneous & Personal Expenses **May also include allowances for dependent care, study abroad & expenses associated with a disability** Expected Family Contribution (EFC) Is a Result of Federal Needs Analysis Formula… • Which includes the following components: – – – – Student contribution from income Student contribution from assets Parent contribution from income Parent contribution from assets **EFC may be zero!! Apply For Federal Aid www.fafsa.gov Fall 2015 Freshmen complete the 2015-2016 FAFSA Available January 1, 2015 + Sources for Scholarships Local, Regional and National Organizations Colleges and Universities www.fundmufuture.info www.scholarships.com www.collegeboard.com www.arcf.org Create your Scholarship Resume • Education & Scholastic Achievement • Experience, Training, Internships, and Employment • Honors, Awards & Memberships in Professional Organizations • Leadership and Community Service • Extra-curricular Activities • Career Ambition: Statement of Goals • Develop Your Personal Brand Scholarship Tips • • • • • It’s a numbers game Small is the new big Pay attention to details Searching is a year round sport There are scholarships for everyone! Academic Challenge Award 4 Year Institutions 2 Year Institutions $2,000 Freshman $2,000 Freshman & Sophomore $3,000 Sophomore $4,000 Junior $5,000 Senior **Maximum award is eight (8) Semesters with five (5) maximum of eight at 2 Year Institution** Governor’s Scholars • Governor’s Distinguished Scholarship – Rank based on Test Score, GPA, Rank in Class and Leadership – Up to $10,000 per year and 300 awards statewide – 32 ACT/1410 SAT and 3.5 academic GPA or National Merit or National Achievement Finalists • Governor’s Scholarship - $4,000 per year and 75 awards - 27 ACT/1220 SAT or 3.5 academic GPA Higher Education Tax Benefits • Tax Credits directly reduce the amount of tax you pay: – The American Opportunity Tax Credit – The Lifetime Learning Tax Credit • Tax Deductions reduce the amount of your income that is taxed: - Tuition and Fees Tax Deduction - Student Loan Interest Tax Deduction Financial Aid Tips • Apply early and respond to requests for additional data promptly. • Remember communication will be addressed to the students – Family Education Rights & Privacy Act • Know additional requirements to receive and keep aid - Be a responsible consumer - Avoid Scams Contact Information Carlia Smith Director of Financial Aid Email: cgsmith@ualr.edu Telephone: (501) 569-3035