MEFA Presentation

advertisement

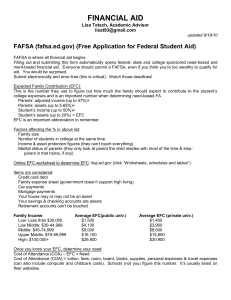

MEFA’s Guide to College Financing Today’s Presenter: Joe Farragher, Ed.D. Celebrating 30 years of Excellence Planning, Saving & Paying for College 1 Facts About MEFA • Massachusetts Educational Financing Authority • Not-for-profit state authority that works to make higher education more accessible and affordable • Created in 1982 by the State Legislature • Helping families: o Plan: Extensive community outreach o Save: U.Fund® and U.Plan® college savings plans o Pay: Affordable fixed interest rate college loans for over 30 years 2 You Can Do This 3 mefa.org/seniors Videos/ Social Media What’s Next: Your to-do list Next Guidance: Financial Aid Info & Tips Slide Tools & Resources 4 mefa.org/seniors Email Signup What’s Next: Your to-do list e-Book Tools & Resources Ask a MEFA Expert 5 6 Agenda • What is financial aid? • How do students apply? • How are financial aid decisions made? • Financial aid awards • Paying for college • Free resources 7 Overview of Financial Aid Undergraduate Student Aid 2011-12 ($185.1 Billion) Source: The College Board, Trends in Student Aid 2012 8 Sources of Financial Aid • Federal – Grants, work-study, loans, tax incentives • Massachusetts – Grants, scholarships, tuition waivers, loans – www.osfa.mass.edu • College/University (institutional aid) – Grants, scholarships, loans • Outside Agencies – Scholarships 9 Merit-Based Aid • Awarded in recognition of student achievements (academic, artistic, athletic, etc.) • Applicants often compared against one another • May or may not be renewable • Not offered at every school 10 Need-Based Aid • Awarded based on family’s financial eligibility as determined by standardized formula • Includes grants, loans and/or work-study • Most federal, state and institutional aid is awarded based on financial eligibility 11 The FAFSA • Free Application for Federal Student Aid (FAFSA) – – – – – Required by all colleges for federal and MA state aid Open January 1st: FAFSA.gov Must sign with a PIN: PIN.ed.gov IRS Data Retrieval Tool – available February 1st Requires data from all parents who live together, married or not Must be completed every year! 12 Other Financial Aid Applications • CSS/Financial Aid PROFILE® – Some colleges require for institutional aid – $25 for 1st school, $16 for each additional – Online application required: CollegeBoard.org – Noncustodial Parent PROFILE required when applicable – 31 MA Colleges and Universities • College Financial Aid Application – Required by some colleges – Usually part of the admissions packet Don’t wait until you’re accepted to apply! 13 What Happens After You Apply? 1. Colleges & state receive data electronically 2. You will receive (electronically or by mail): – Student Aid Report (SAR) – CSS/Financial Aid PROFILE® acknowledgement report 3. Review both & keep for records 4. Colleges may request Verification documents 5.With any special circumstances, contact Financial Aid Office at each college 14 Cost of Attendance (COA) Total expenses for one year of college 15 Expected Family Contribution (EFC) • Calculated amount the family has the ability to absorb for one year of college expenses • Same federal formula used for every family • Family has the primary responsibility for paying • Not necessarily what the family will pay Visit mefa.org/seniors to use an EFC calculator 16 EFC Formulas • Federal & institutional formulas are different – Federal formula for MA & federal aid – Institutional formula for aid from some colleges • Includes income & asset protection allowances • Parent & student info treated differently • Does not include personal debt (credit cards, auto loans or personal loans) 17 Asset Impact on EFC An example. 4 in the family, 1 child in college: Parent Income Parent Assets EFC Family A Family B Family C $60,000 $60,000 $60,000 $0 $75,000 $150,000 $4,227 $5,461 $10,815 $1,234 $6,588 Difference Based on 2014-15 Federal Methodology 18 Income Impact on EFC An example. 4 in the family, 1 child in college: Family A Family B Family C Parent Income $60,000 $100,000 $150,000 Parent Assets $50,000 $50,000 $50,000 $4,591 $16,552 $32,084 $11,961 $27,493 EFC Difference Based on 2014-15 Federal Methodology 19 Financial Aid Formula Cost of Attendance (COA) – Expected Family Contribution (EFC) = Financial Aid Eligibility Colleges fill in Financial Aid Eligibility with financial aid from multiple sources 20 Cost of Attendance How the Formula Works $50,000 $45,000 $40,000 $35,000 $30,000 $25,000 $20,000 $15,000 $10,000 $5,000 $0 Eligibility EFC College A College B College C College D 21 Financial Aid Awarding COA = $30,000 Unmet Need $3,000 Federal Work-Study $1,500 Student Loan $5,500 Grant $7,500 Scholarship $7,500 EFC $5,000 EFC = $5,000 ANY college costs not covered by financial aid are the FAMILY’s This example is an estimate only. responsibility! 22 Comparing Award Letters: Award Totals Vary COA: $30,000 EFC: $5,000 Total Eligibility: $25,000 College A College B College C $18,000 $15,000 $10,000 Student Loans $5,500 $5,500 $5,500 Work-Study $1,500 $1,500 $1,500 $25,000 $22,000 $17,000 $0 $3,000 $8,000 Grants/Scholarships Total Unmet Need Family Pays? $6,500 $9,500 $14,500 23 Comparing Award Letters: Award Totals Are Equal COA: $30,000 EFC: $5,000 Total Eligibility: $25,000 College A College B College C $15,000 $5,000 $0 $5,500 $5,500 $5,500 Parent Loan $0 $10,000 $16,500 Work-Study $1,500 $1,500 $0 $22,000 $22,000 $22,000 $3,000 $3,000 $3,000 Grants/Scholarships Student Loans Total Unmet Need Family Pays? $9,500 $19,500 ???? ???? $24,500 24 UMass-Amherst 25 Bentley University 26 How to Fill the Unmet Need Favorite College EXAMPLE Balance Due Past Income Present Income Future Income $20,000 Student Savings -$1,500 Parent Savings -$4,000 Student Contribution to Payment Plan -$1,000 Parent Contribution to Payment Plan -$3,500 Education Loan -$10,000 $0 27 Federal Direct Student Loans • Student is the sole borrower • No credit check • Annual limits • 3.86% fixed interest rate for 2013-14 • Repayment – No payments due while enrolled – Approximately $300/month for 10 years for $27,000 debt 28 Alternative Loan Considerations Be a Wise Consumer! • Interest rate and APR • Fixed or variable interest rate – Fixed: stable, monthly payments – Variable: changes based on market conditions • Primary borrower (student or parent) • Start of loan repayment • Monthly payment amount and years in repayment 29 FAFSA Day Massachusetts Free assistance in completing the FAFSA! • Over 25 locations across Massachusetts • Sunday, January 26, 2014 at 1:00 p.m. • Sunday, February 23, 2014 at 1:oo p.m. • Additional dates and all locations listed at fafsaday.org 30 Continued Spring Guidance After The Acceptance Seminars • 25 Locations across MA in late March/April • One-on-one guidance • Provides key, timely info on: – – – – Understanding financial aid award letters College bills and payment plans Loan options (parent and student) Working with the Financial Aid Office • Register for MEFA emails to receive location details 31 What You Can Do Now • Research financial aid deadlines & requirements • Partner with MEFA: – Sign up for MEFA emails – Download the College Financing e-book – Bookmark mefa.org/seniors • Net Price Calculator Site: – http://collegecost.ed.gov/netpricecenter.aspx • You Can Do This 32 Thank You Questions or Comments? Please take a moment to complete the seminar evaluation Presenter: Joe Farragher, Ed.D. 33