College Financial Aid Night

advertisement

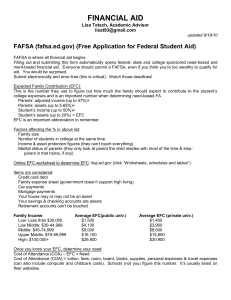

Principles of Financial Aid Key Concepts Completing the FAFSA Types of Aid Available Comparing Aid Offers & Net Price Calculators The family is primarily responsible for college Families with like circumstances will be treated in a similar manner Federal Methodology (FM) formula is not a cash flow analysis Family contribution from FM assumes a “three-legged stool” concept (savings, current income, future income) Savings Current Income Loans Tuition Fees Room & Board Books & Supplies Personal/Miscellaneous Travel Determined by filing the FAFSA - Free Application for Federal Student Aid Indicator of your family’s financial strength Income Income is primary determinant of financial strength Goal of NA is to determine recurring sources of income All sources of taxed and untaxed income need to be analyzed Assets Assets allow more choice Assets help families plan for expenditures •Retirement •Emergencies •Other educational expenses Income Assets Family size Number of children in college Age of the older parent Financial Need is a simple equation: COA -EFC =Need Public College Private College Cost $ 22,826 EFC -$10,000 Need$12,826 Cost $44,750 EFC -$10,000 Need $34,750 Source: The College Board Average Estimated Budgets, 2013-14 To complete the FAFSA you will need to: Gather your and your parent’s 2014 tax information File your taxes electronically and use the IRS Data Retrieval Tool Apply for a Personal Identification Number (PIN) Changing to the FSA ID in Spring 2015 Parent must have his/her own PIN. PIN serves as electronic signatures for the FAFSA and promissory notes www.pin.ed.gov www.FAFSA.gov The FAFSA is student specific. Select the appropriate school year Complete all sections about you, your school plans and the financial information (use the IRS Data Retrieval Tool). List your school code(s). You may list up to 10 schools on the electronic FAFSA. Provide electronic signatures (PINs/FSA IDs) Submit your information Keep copies for your records The earliest you may file the FAFSA for the 20152016 school year – January 1, 2015. Check with the colleges where you plan to apply for deadlines and institutional requirements (i.e.CSS Profile or institutional application). You do not need to wait until tax returns are filed; It is o.k. to estimate. Dependency Status Who is considered a parent? You must re-apply for aid every year. Here’s what happens after you file: Your EFC is calculated Results are sent electronically to the college(s) you selected. You will receive a Student Aid Report (SAR). If you have extraordinary circumstances notify the Financial Aid Office. After you are admitted to a college, a financial aid award will be sent to you. You may be required to verify the information submitted on your FAFSA (use the IRS Data Retrieval Tool). Gift Scholarships Grants Self-help Employment Loans Academic - merit based Talent Service ROTC Private www.fastweb.com www.thesalliemaefund.org https://bigfuture.collegeboard.org/college-search Need-based Federal Grants Pell SEOG TEACH State Grants Wisconsin Grant Institutional Grants Two types: Federal Work Study Regular Campus Employment Can be used for personal expenses Does not adversely affect grades Federal Stafford Subsidized Unsubsidized Federal Perkins Interest Rate – 5% No loan fee (anyone can borrow) Interest Rate – 4.66% Loan fee – 1.073% Freshmen - $3500 Sophomores - $4500 Juniors/Seniors - $5500 Additional Unsub $2000/year 6 month grace period 10 year repayment interest deferred while in school Available Funding determines loan amount at each institution 9 month grace period 10 year repayment *Program set to expire 2015 Parent PLUS Loan Student Alternative Loans – Private Lenders Private Scholarship MUST be reported to the school Payment Plan Tax Credits 529 Plans Private Private (In State) Public (Out of State) (FAFSA and CSS PROFILE meets need) (FAFSA only – does not meet need) $28,204 $41,126 $59,855 $33,550 $4,496 $4,496 $4,496 $4,496 - - $4,956 - Federal Pell Grant $1,100 $1,100 $1,100 $1,100 Other Federal & State Grants $4,720 $0 $1,800 $500 University Scholarships & Grants $2,478 $5,500 $49,200 $10,000 $8,298 $6,600 $52,100 $11,600 $19,906 $34,526 $7,755 $21,950 School Information Total Cost of Attendance Public EFC (Family Share) FAFSA CSS PROFILE Grants and Scholarships Total Gift Aid Net Price Comparison, continued Net Price Public Private Private (In State) Public (Out of State) (FAFSA and CSS PROFILE meets need) (FAFSA only – does not meet need) $19,906 $34,526 $7,755 $21,950 $2,000 $2,000 $0 $1,000 $3,500 $3,500 $3,259 $3,500 $2,000 $2,000 $2,241 $2,000 $7,500 $7,500 $5,500 $6,500 $12,406 $27,026 $2,255 $15,450 Loan Options (Borrowed) Federal Perkins Loan Federal Direct Loan (subsidized) Federal Direct Loan (unsubsidized) Total Loans Student’s Out of Pocket Cost (Net Price less Total Loans) Early financial aid estimation tool The average yearly price actually charged to fulltime, first-year undergraduate students receiving student aid at an institution of higher education. Estimate net price=COA - grants & scholarships Not all NPCs are built equally General Information www.StudentAid.gov http://www.consumerfinance.gov/paying-for- college http://nces.ed.gov/collegenavigator/?s=all&ct=2&i c=1 Scholarship Search Engines www.Fastweb.com www.Thesalliemaefund.org www.Bigfuture.collegeboard.org/college-search College Goal Wisconsin is a Statewide event that will offer free assistance to families in completing the FAFSA Four consecutive Saturdays beginning on February 7, 2015 and Wednesday, February 25, 2015 Assistance with paper and online FAFSAs Scheduled at 32 sites throughout Wisconsin http://www.collegegoalwi.org/ Marquette University Office of Student Financial Aid (414) 288-4000 marquettecentral@marquette.edu website: www.marquette.edu/mucentral