Stock Valuation

advertisement

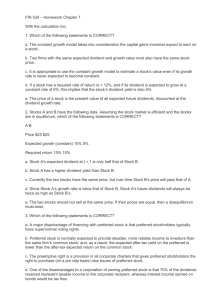

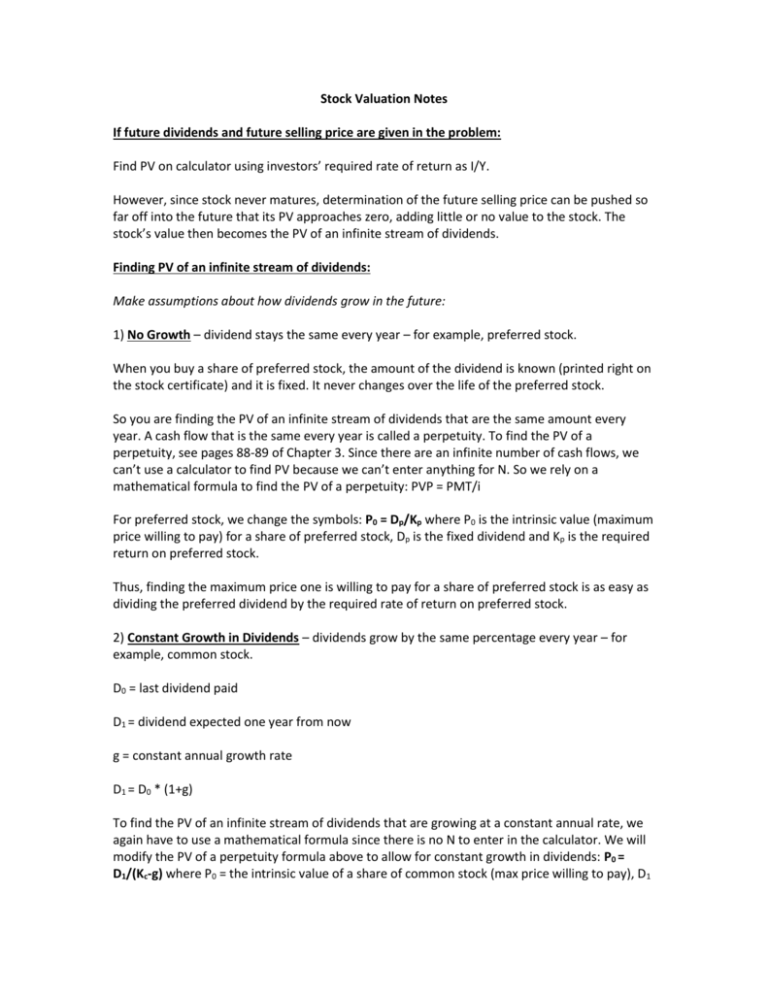

Stock Valuation Notes If future dividends and future selling price are given in the problem: Find PV on calculator using investors’ required rate of return as I/Y. However, since stock never matures, determination of the future selling price can be pushed so far off into the future that its PV approaches zero, adding little or no value to the stock. The stock’s value then becomes the PV of an infinite stream of dividends. Finding PV of an infinite stream of dividends: Make assumptions about how dividends grow in the future: 1) No Growth – dividend stays the same every year – for example, preferred stock. When you buy a share of preferred stock, the amount of the dividend is known (printed right on the stock certificate) and it is fixed. It never changes over the life of the preferred stock. So you are finding the PV of an infinite stream of dividends that are the same amount every year. A cash flow that is the same every year is called a perpetuity. To find the PV of a perpetuity, see pages 88-89 of Chapter 3. Since there are an infinite number of cash flows, we can’t use a calculator to find PV because we can’t enter anything for N. So we rely on a mathematical formula to find the PV of a perpetuity: PVP = PMT/i For preferred stock, we change the symbols: P0 = Dp/Kp where P0 is the intrinsic value (maximum price willing to pay) for a share of preferred stock, Dp is the fixed dividend and Kp is the required return on preferred stock. Thus, finding the maximum price one is willing to pay for a share of preferred stock is as easy as dividing the preferred dividend by the required rate of return on preferred stock. 2) Constant Growth in Dividends – dividends grow by the same percentage every year – for example, common stock. D0 = last dividend paid D1 = dividend expected one year from now g = constant annual growth rate D1 = D0 * (1+g) To find the PV of an infinite stream of dividends that are growing at a constant annual rate, we again have to use a mathematical formula since there is no N to enter in the calculator. We will modify the PV of a perpetuity formula above to allow for constant growth in dividends: P0 = D1/(Kc-g) where P0 = the intrinsic value of a share of common stock (max price willing to pay), D1 is the dividend expected at the end of one year from now, Kc is the required rate of return on common stock, and g is the constant annual growth rate in dividends. 3) Nonconstant Growth in Dividends – sometimes, one estimates that dividends will grow at different rates over the years, eventually settling into a constant annual rate that will last indefinitely. In this case, the dividend stream is divided into two parts – one that is finite and known (has a beginning and an end) and one that is infinite (unending). We must find the PV of both parts, using the required rate of return as the discount rate. For the finite stream, we can use the calculator to find PV because we know when the dividends are received and how many periods of interest to back out. For the infinite stream, we can use the constant growth formula above to find the PV. What you must remember is that price is always based on the next expected dividend. Thus, if D4 starts the infinite stream, then the price you are finding with the constant growth formula is P3, the price you’re willing to pay in 3 years. You will then have to discount this price back to P0 to find the price you are willing to pay today, using the required rate of return as the discount rate. You then add the PVs of the finite dividend stream to the PV of the infinite dividend stream to get the total price you are willing to pay today. Example: D1 = $.50, D2 = $.75, D3 = $1.00 and dividends are expected to grow at a constant annual rate of 5% thereafter. Find the maximum price you are willing to pay if you require a 10% rate of return. 1. Find the PV of the first 2 dividends using your calculator. Sum the 2 PVs and save this number ($1.07), which is what you are willing to pay to get just the first 2 dividends. 2. Find the PV of the unending stream of dividends that starts at $1.00 and grows indefinitely at 5% using the constant growth model. This works out to be $20, which is the price you are willing to pay for Dividends 3 through infinity. But note that this is not the price you are willing to pay today for those dividends – it is the price you are willing to pay at the end of 2 years from now. (Price is always based on the next expected dividend, so D3 yields P2.) 3. Discount that $20 future price back 2 periods at 10% interest to get the price you are willing to pay today for Dividends 3 through infinity. That price equals $16.53. 4. Add the price you are willing to pay for the first 2 dividends ($1.07) to the price you are willing to pay for the rest of the dividends ($16.53) to get the total price you are willing to pay today for the stock ($17.60).