II. Present Use versus Future Use

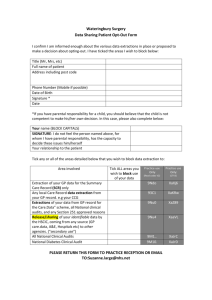

advertisement

Intertemporal Production Decisions for Depletable Resources Qian Shujing International College. Ningbo University Ningbo, Zhejiang Province, P.R.China qianshujing@nbu.edu.cn Abstract—A depletable resource in the ground is like money in the bank and it tends to be overused in the present unless there are institutions created that provide resource users with a way to benefit from conservation. If complete property rights exist, profit-maximizing extraction firms take user cost as well as extraction cost into consideration when they make intertemporal production decisions. They will conserve any resources that would be more profitably extracted in the future. And if resources produced by a monopolist, he will charge a high price and depletes the resources more slowly. Keywords-depletable resources; interest rate;user cost; incomplete property right; monopolist I. INTRODUCTION When production today affects sale or costs in the future, we faces intertemporal production decisions. One of the good examples is the production of a depletable resources. Resources such as oil, natural gas, coal, copper, iron, lead, zinc are all depletable because there are actual fixed supply in the earth and are renewed so slowly from a human time perspective, say oil and coal will take millions of years to form out of decaying plants and animals. When the owner of an oil well pumps oil today, less oil is available for future production. As decision maker choose how much to produce today, they have to take the characteristic of depletable resources into account. Such decisions involve comparison between costs and benefits today with costs and benefits in the future. Once decision maker can weigh the costs and benefits of present use against the costs and benefits of future use, decision maker can choose the optimal amount of production now. The key and popular tool to use is present value. We introduce it first and see how it works. Then we will exploit our understanding by discussion production decision making in following situation: (1) Incomplete property right exist (2) Decision maker is a monopolist rather than a competitive industry. want to get $100 in 5 years, how much money do we need to save today? The answer is $78.35 because if $78.35 is invested at an interest rate of 5% per year, it will grow into $100 in 5 5 years ( 78.35 (1 5%) 100 ). Say, $78.35 today can be thought of as being equivalent to $100 in 5 years because it is possible to transform $78.35 today into $100 in 5 years by simply investing it at the market rate of interest. B. The Production Decision of an Individual Resource Producer Suppose you have an oil well. The well contains 1000 barrels of oil and the marginal and average cost are constant at $10 per barrel. Should you produce all the oil today to should you save it for future use? Use the general rule of MR=MC, you might think the optimal output is when market price of oil is $10 per barrel. However, this choice ignores the opportunity cost of using up the oil today so that it is not available for future. Every bit of resource that is extracted and sold today comes at the cost of not being able to extract it and sell it in the future, we call this cost as the user cost of extraction. As shown in Figure 1, the company’s marginal production cost or extraction cost is $10. the user cost is the difference between price and marginal extraction cost. It rises over time because as the resource remaining in the ground becomes scarcer, the opportunity cost of depleting another unit becomes higher. Figure 1. Extraction Cost and User Cost of a Depletable Resources II. PRESENT USE VERSUS FUTURE USE A. Intuition of calculating present value Intuition of calculating present value is simple. Suppose that the current market rate of interest is 5% per year. If we Therefore production decision rule is simply: Keep all your oil if you expect its price less its extraction cost to rise faster than the rate of interest (Pindcky et al. 2008). Extract and sell all of it if you expect price less extraction cost to rise at less than the rate of interest. If the expected price less extraction cost to rise at exactly the rate of interest, then it would be indifferent between extracting the oil now and leaving it in the ground for future use. Letting Pt be the price of oil this year, Pt+1 the price next year, and c the cost of extraction, we can write this production rule as follows: If ( P t 1 c) (1 R)( Pt c) , keep the oil in the ground. If ( P t 1 c) (1 R)( Pt c) , sell all the oil now. If ( P t 1 c) (1 R)( Pt c) , makes no difference. Given the expectation about the growth rate of oil prices, we can use this rule to determine production. But how are interest rates determined? C. Determines of Interest Rate We have seen how market interest rates are used to help make intermporal production decisions. The interest rate is the price that borrowers pay lenders to use their funds. Like any market price, interest rates are determined by supply and demand for loanable funds. As shown in Figure 2, the supply of loanable funds comes from households who wish to save part of their incomes in order to consume more in future. The demand for loanable funds has two components. First, some households want to consume more than their current incomes. Because their incomes are low now but are expected to grow, or because they want to make a large purchase that must be paid by future income. These households are willing to pay interest in return for not having to wait to consume in the future. It is the curve labeled DH. The second source of demand for loanable funds is firms that want to make capital investments. Often firms borrow to invest because the flow of profit from an investment comes in the future. It is labeled DF. Changes in demand or supply cause changes in interest rates. III. OPTIMAL EXTRACTION LEVEL IN COMPETITIVE INDUSTRY A. Perfect Competition leads to Conserve Resources An exhaustible resource in the ground is like money in the bank and must earn a comparable return. Therefore, the goal of profit-maximizing extraction firms is not to simply pump as fast as possible. Instead, they are interested in extracting resources at whatever rate will maximize their streams of profit over time. Suppose there were no OPEC cartel and there were many competitive oil producers. If any producers want to maximize their profit, they will follow the rules we stated above. This means that price less marginal cost must rises at exactly the rate of interest. If price less cost were to rise faster than the rate of interest, no one would sell any oil. Then this would drive up the current price. If price less cost were to rise at a rate less than the rate of interest, everyone would try to sell all of their oil immediately. Consequently, this would drive the current price down. See figure 3, if a firm only takes account of current extraction costs, shown as EC, it will produce Q0 units of output currently. If a firm also takes account of user costs, shown as UC, it will produce only Q1 units of output. At this production level, price for all selling units are exceeds the sum of extraction costs and user cost. Figure 3 Choosing the Optimal Extraction Level See figure 4, with the opportunity cost of depleting another unit becomes higher, shown as increasing user cost from UC0 to UC1, the firm reduces current production from Q0 to Q1 in order to be able to extract more in the future and take advantage of the increase in future profitability. Figure 2 Supply and Demand for Loanable Funds Government policy can determine the interest rate too. For example, when government runs a large deficit, it will have to borrow to balance the deficit, shifting the total demand for loanable fund to the right; government can create money, shifting the supply of loanable funds to the right. Change in demand and supply cause changes in interest rate. Although there are several interest rates, rather than a single market interest rate, it stills a workable tool to be used in assessing present value. Figure 4 An Increase in Expected Future Profits Leads to Less Current Extraction This incentive structure is very useful to society because it means that our limited supplies of nonrenewable resources will be conserved for future extraction and use if extraction firms expect that demand and hence profits in the future will be higher than they are today. B. Icomplete Property Right Lead to Excessive Present Use We just demonstrated that profit-maximizing extraction companies are happy to decrease current extraction if they can benefit financially from doing so. This pleasant result breaks down completely if weak of uncertain property rights do not allow extraction companies to profit from conserving resources for future use (McConnell et al, 2009). As a result, the firm will take into account only current extraction costs. One of good example is conflict diamonds. In war zones in African, diamonds are mined in order to provide the hard currently to finance military activities. However, most of these civil war are very unpredictable, so that control of the mines is slipping from one army to another depending on the tide of war. Because nobody can be sure of controlling a mine for more than a few months, extraction rates are always extremely high. This behavior is very wasteful because once the war finally ends and money is needed to rebuild the country, whichever side wins will find precious few diamonds left to help pay for the reconstruction. Unfortunately, incomplete property rights lead to extraction at far too rapid a pace. It is no surprise that if resource users have no way of benefiting from the conservation of a resource, they will use too much of it in the present and not save enough of it for future use, even if future use would be more beneficial than present use. IV. OPTIMAL EXTRACTION LEVEL IN MONOPOLIST INDUSTRY What if the resource is produced by a monopolist rather than by a competitive industry? Should price less marginal cost still rise at the rate of interest? Suppose a monopolist is deciding between keeping an incremental unit of a resource in the ground, or producing and selling it. The value of that unit is the marginal revenue less the marginal cost. The unit should be left in the ground if its value is expected to rise faster than the rate of interest; it should be produced and sold if its value is expected to rise at less than the rate of interest. Since the monopolist controls total output, it will produce at optimal level: ( MRt 1 c) (1 R)( MRt c) This rule also holds for a competitive firm. For a competitive firm, however, marginal revenue equals the market price. For a monopolist who faces a downward-sloping demand curve, price is greater than marginal revenue. See Figure 3. Figure 3 Monopolist’s Marginal Revenue and Price Therefore, if marginal revenue less marginal cost rises at the rate of interest, price less marginal cost will rise at less than the rate of interest. Showed as following: ( Pt 1 c) ( MRt 1 c) (1 R)( MRt c) Till now we draw an interesting result that a monopolist is more conservationist than a competitive industry. In exercising monopoly power, the monopolist charges a higher price and depletes the resource more slowly. V. CONCLUSIONS In economic theory, a depletable resource in the ground is like money in the bank. If complete property rights exist, profit-maximizing extraction firms take user cost as well as extraction cost into consideration when they make intertemporal production decisions. They will conserve any resources that would be more profitably extracted in the future. And if resources produced by a monopolist, he will charge a high price and depletes the resources more slowly. But in reality, resource depletion has not been very important as a determinant of resource prices over the past few decades. See Table 1, the user cost of crude oil and natural gas is a substantial component of price. For other resources, user cost almost had nothing with price fluctuations. Much more important have been market structure and changes in market demand. Mainly because oil and natural gas are more depletable than others. For example, known and potentially discoverable inground reserves of oil and natural gas are equal to only 50 to 100 years of current consumption. While coal and iron have a proven and potential reserve base equal to several hundred or even thousands of years of current consumption. Resource Crude Oil Natural Gas Uranium Copper Bauxite Nickel Iron Ore Gold User Cost/ Competitive Price 0.4 to 0.5 0.4 to 0.5 0.1 to 0.2 0.2 to 0.3 0.05 to 0.2 0.1 to 0.3 0.1 to 0.2 0.05 to 0.1 Table 1. User Cost as a Fraction of Competitive Price We should keep in mind that the role of depletion should not be ignored. Over the long term, it will be the ultimate determinant of resource prices. REFERENCES [1] [2] C.R.McConnell, S.L.Brue, and S.M.Flynn, Economics. McGraw-Hill, 2009. R.S. Pindyck, Micoroeconomics, Peasron, 2008