chapter 3 - Myweb @ CW Post

advertisement

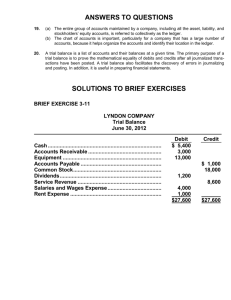

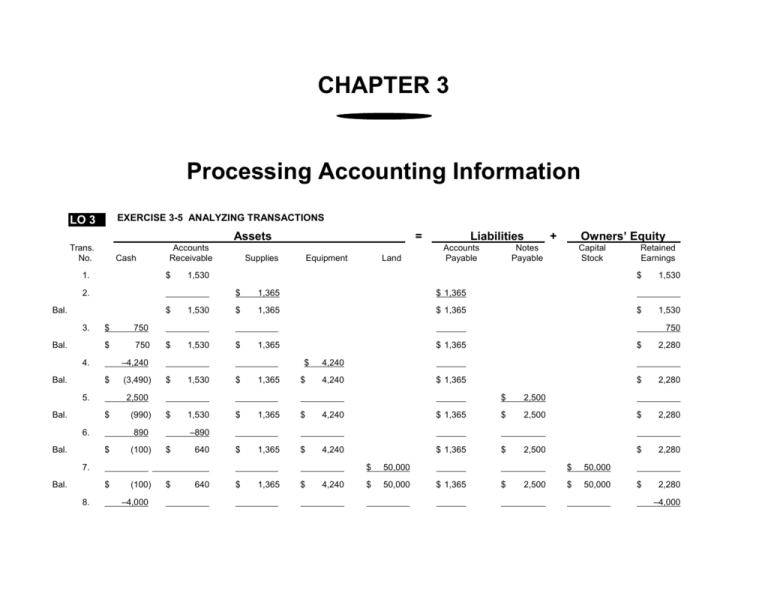

CHAPTER 3 Processing Accounting Information EXERCISE 3-5 ANALYZING TRANSACTIONS LO 3 Assets Trans. No. Cash 1. Accounts Receivable $ $ 3. Bal. $ 750 $ 750 $ 5. Bal. 6. (990) (100) 1,530 1,365 $ 1,365 $ 1,365 $ 1,365 $ 1,530 $ 1,365 $ 8. (100) –4,000 Capital Stock Retained Earnings $ 1,530 $ 1,530 $ 1,530 $ 1,365 $ $ 1,365 $ 2,280 $ 1,365 $ 2,280 4,240 4,240 $ 1,530 $ 2,500 $ 1,365 $ 4,240 $ 1,365 $ 2,500 $ 2,280 $ 1,365 $ 4,240 $ 1,365 $ 2,500 $ 2,280 $ 2,280 –890 $ 640 7. $ Owners’ Equity + Notes Payable 750 890 $ Bal. Land 2,500 $ Bal. (3,490) Equipment $ –4,240 4. Bal. Supplies Liabilities Accounts Payable 1,530 2. Bal. = $ 640 $ 1,365 $ 4,240 $ 50,000 $ 50,000 $ 1,365 $ 2,500 $ 50,000 $ 50,000 –4,000 Bal. $ $ 640 $ 1,365 $ 4,240 $ 50,000 $ 1,365 –500 9. Bal. (4,100) $ (4,600) $ 2,500 $ 50,000 $ (1,720) $ 2,500 $ 50,000 $ (1,720) –500 $ 640 $ 1,365 $ TOTAL ASSETS: $51,645 4,240 $ 50,000 $ 865 TOTAL LIABILITIES AND OWNERS’ EQUITY: $51,645 LO 1,3 1. PROBLEM 3-6 TRANSACTION ANALYSIS AND FINANCIAL STATEMENTS BLUE JAY DELIVERY SERVICE TRANSACTIONS FOR THE MONTH OF JANUARY 2004 Assets Trans. Date Cash = Accounts Receivable Land Warehouse 1/2 $100,000 1/3 –80,000 $20,000 $60,000 Bal. $20,000 $20,000 $60,000 1/4 50,000 Bal. $70,000 1/6 –45,000 Bal. $25,000 1/31 Liabilities Accounts Notes Payable Payable + Owners’ Equity Capital Retained Stock Earnings $100,000 $100,000 $50,000 $20,000 $60,000 $50,000 $100,000 $50,000 $100,000 $45,000 $20,000 $60,000 $45,000 $15,900 Bal. $25,000 $15,900 1/31 7,490 –7,490 Bal. $32,490 $8,410 1/31 Bal. Delivery Trucks ______ $32,490 TOTAL ASSETS: $165,900 $8,410 $15,900 $20,000 $60,000 $45,000 $50,000 $100,000 $15,900 $20,000 $60,000 $45,000 $50,000 $100,000 $15,900 ______ $20,000 $3,230 $60,000 $45,000 $3,230 TOTAL LIABILITIES AND OWNERS' EQUITY: $165,900 3,230 $50,000 $100,000 $12,670 2. BLUE JAY DELIVERY SERVICE INCOME STATEMENT FOR THE MONTH ENDED JANUARY 31, 2004 Service revenue Gas and oil expense Net income 3. $ 15,900 3,230 $ 12,670 BLUE JAY DELIVERY SERVICE BALANCE SHEET JANUARY 31, 2004 Assets Current assets: Cash Accounts receivable Total current assets Property, plant, and equipment: Land Warehouse Delivery trucks Total property, plant, and equipment Total assets Liabilities and Stockholders' Equity Current liabilities: Accounts payable Long-term debt: Notes payable Total liabilities Capital stock Retained earnings $ 32,490 8,410 $ 40,900 $ 20,000 60,000 45,000 125,000 $ 165,900 $ 3,230 50,000 $ 53,230 $ 100,000 12,670 Total stockholders' equity Total liabilities and stockholders' equity 112,670 $ 165,900 4. Additional information needed: Jan. 3: Is the warehouse new? How large is it? What volume of business can it support? Jan. 4: What is the interest rate on the loan? Are there any restrictions on the company's operations in the debt agreement Were any assets offered as collateral? (covenants)? Jan. 6: How long are the trucks expected to last? Will they have any salvage value? What volume of business can they support? Jan. 31: When will customers pay the remaining balance? What is the credit standing of the customers? Jan. 31: Is there a limit on how much the company charges? What if the company cannot pay by the tenth?