Processing Accounting Information

advertisement

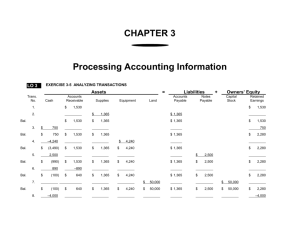

ACG2021 Financial Accounting Processing Accounting Information 1 The Accounting Information System 1) Inputs Process 1. 2. 3. 4. Outputs 2) 3) Income Statement Balance Sheet Cash Flow Accounts Journal General Ledger Trial Balance 2 Learning Objective 1 Analyze business transactions. 3 Accounting for Business Transactions Transaction - any event that both affects the financial position of the business entity and can be reliably recorded Reliably Recorded (2 accounting principles, what are they?) 4 Transactions are Recorded in The Account Basic summary device Paper based Computer based ???? based Accounts - grouped into three broad categories Assets Liabilities Stockholders’ Equity Used to Accumulate $’s of every business transaction How much cash did we receive/spend? How much revenue did we earn? How much was spent on rent for the year? 5 Chart of Accounts The chart of accounts lists all accounts and their account numbers. Accounts can be grouped under the financial statement headings: Balance Sheet: Assets, Liabilities, and Stockholders’ Equity Income Statement: Revenues and Expenses 6 Example Chart of Accounts 7 Recording Transactions (Processing) Journalizing process: Specify each account affected by the transaction Classify each account as either asset, liability, stockholders’ equity, revenue, or expense Determine whether each account is increased or decreased (use rules of debit and credit) Record the transaction in a journal with a brief explanation. 8 The Account Assets - economic resources that benefit the business now and in the future •Cash •Accounts •Land receivable •Inventory •Notes receivable •Prepaid expenses •Buildings •Equipment, furniture, and fixtures 9 The Account Liabilities - debts of the company Notes payable o Accounts payable o Accrued liabilities o Long-term liabilities (bonds) o 10 The Account Stockholders’ (owners’ or shareholders’) equity - owners’ claims against the assets of a corporation Common Stock o Retained Earnings o Revenues o Expenses o 11 Accounting for Business Transactions 1. The Lyons invest $50,000 to begin the business, and Air & Sea Travel issues common stock. Analysis of Transactions Assets= Trans Cash (1) 50,000 Accounts Office Receivable Supplies Liabilities Land Stockholder's Equity Accounts Common Retained payable Stock Earnings 50,000 12 Accounting for Business Transactions 2. Air & Sea purchases land for an office location, paying $40,000 in cash Trans (1) (2) Bal Cash 50,000 (40,000) 10,000 Accounts Office Receivable Supplies Land 40,000 40,000 Accounts Common Retained payable Stock Earnings 50,000 50,000 13 Accounting for Business Transactions 3. The business buys office supplies, agreeing to pay $500 to the officesupply store within 30 days. Assets= Trans (1) (2) Bal (3) Bal Cash 50,000 (40,000) 10,000 10,000 Liabilities Accounts Office Receivable Supplies Land Accounts Common Retained payable Stock Earnings 50,000 40,000 40,000 500 500 40,000 Stockholder's Equity 50,000 500 500 50,000 14 Accounting for Business Transactions 4. Air & Sea Travel earns service revenue of $5,500 and collects this amount in cash. Assets= Trans Bal (3) Bal (4) Bal Cash 10,000 10,000 5,500 15,500 Liabilities Accounts Office Receivable Supplies 500 500 500 Stockholder's Equity Accounts Common Retained Land payable Stock Earnings 40,000 50,000 500 40,000 500 50,000 40,000 500 50,000 5,500 5,500 15 Accounting for Business Transactions 5. Air & Sea Travel performs services for customers on account for $3,000. Trans Bal (3) Bal (4) Bal (5) Bal Cash 10,000 Accounts Office Receivable Supplies 500 500 10,000 5,500 15,500 15,500 500 3,000 3,000 500 Accounts Common Retained Land payable Stock Earnings 40,000 50,000 500 40,000 500 50,000 5,500 40,000 500 50,000 5,500 40,000 500 50,000 3,000 8,500 16 Accounting for Business Transactions 6. Air & Sea Travel pays $2,700 for cash expenses: office rent $1,100, employee salary $1,200, and utilities $400. Trans Bal (4) Bal (5) Bal Accounts Office Cash Receivable Supplies 10,000 500 5,500 15,500 500 3,000 15,500 3,000 500 (6) Bal (2,700) 12,800 3,000 500 Accounts Common Retained Land payable Stock Earnings 40,000 500 50,000 5,500 40,000 500 50,000 5,500 3,000 40,000 500 50,000 8,500 40,000 500 50,000 (2,700) 5,800 17 Accounting for Business Transactions 7. Air & Sea Travel pays $400 to the store from which it purchased office supplies in Transaction 3. Trans Bal (5) Bal (6) Bal (7) Bal Accounts Office Cash Receivable Supplies 15,500 500 3,000 15,500 3,000 500 (2,700) 12,800 3,000 500 (400) 12,400 3,000 500 Accounts Common Retained Land payable Stock Earnings 40,000 500 50,000 5,500 3,000 40,000 500 50,000 8,500 (2,700) 40,000 500 50,000 5,800 40,000 (400) 100 50,000 5,800 18 Accounting for Business Transactions 8. The owners remodel their home at a cost of $30,000, paying cash from personal funds. Assets= Trans Bal (6) Bal (7) Bal Accounts Office Cash Receivable Supplies 15,500 3,000 500 (2,700) 12,800 3,000 500 (400) 12,400 3,000 500 Liabilities Stockholder's Equity Accounts Common Retained Land payable Stock Earnings 40,000 500 50,000 8,500 (2,700) 40,000 500 50,000 5,800 (400) 40,000 100 50,000 5,800 This is a personal transaction, not a business transaction! 19 Accounting for Business Transactions 9. The business collects $1,000 from a customer on account. Assets= Trans Bal (6) Bal (7) Bal (9) Bal Accounts Office Cash Receivable Supplies 15,500 3,000 500 (2,700) 12,800 3,000 500 (400) 12,400 3,000 500 1,000 (1,000) 13,400 2,000 500 Liabilities Stockholder's Equity Accounts Common Retained Land payable Stock Earnings 40,000 500 50,000 8,500 (2,700) 40,000 500 50,000 5,800 (400) 40,000 100 50,000 5,800 40,000 100 50,000 5,800 20 Accounting for Business Transactions 10. Air & Sea Travel sells land for a price of $22,000, which is equal to the amount it paid for the land. Assets= Trans Bal (10) Bal Liabilities Accounts Office Cash Receivable Supplies 13,400 2,000 500 22,000 35,400 2,000 500 Stockholder's Equity Accounts Common Retained Land payable Stock Earnings 40,000 100 50,000 5,800 (22,000) 18,000 100 50,000 5,800 21 Accounting for Business Transactions 11. The corporation declares a dividend and pays $2,100 cash to the stockholders. Assets= Trans Bal (10) Bal (11) Bal Liabilities Accounts Office Cash Receivable Supplies 13,400 2,000 500 22,000 35,400 2,000 500 (2,100) 33,300 2,000 500 Stockholder's Equity Accounts Common Retained Land payable Stock Earnings 40,000 100 50,000 5,800 (22,000) 18,000 100 50,000 5,800 18,000 100 50,000 (2,100) 3,700 22 Income Statement Air and Sea Travel, Inc. Income Statement Month Ended April 30, 20X3 Revenue Service Revenue..................... $8,500 Expenses Salary expense ....................... $1,200 Rent expense .......................... 1,100 Utilities expense..................... 400 Total expenses........................ Net Income................................... 2,700 $5,800 23 Statement of Retained Earnings Air and Sea Travel, Inc. Statement of Retained Earnings Month Ended April 30, 20X3 Retained Earnings, April 1, 20X3 .................... Add: Net Income for the month ...................... Less: Dividends.............................................. Retained Earnings, April 30, 20X3 .................. $ 0 5,800 5,800 (2,100) $3,700 24 Balance Sheet Air and Sea Travel, Inc. Balance Sheet April 30, 20X3 Assets Cash................................... $33,300 Accounts receivable .......... 2,000 Office supplies .................. 500 Land .................................. 18,000 ______ Total Assets....................... $53,800 Liabilities Accounts payable....................$ 100 Stockholders’ Equity Common stock ...................... 50,000 Retained earnings.................. 3,700 Total stockholders’ equity .. 53,700 Total liabilities and ______ Stockholders’ equity ......... $53,800 25 Air & Sea Travel Statement of Cash Flows Month Ended April 30, 20x3 Cash flows from operating activities: Collections from customers ($5,500 + $1,000) $ 6,500 Cash payments to suppliers and employees ($2,700 + $400) (3,100) Net cash inflow from operating activities $ 3,400 Cash flows from investing activities: Acquisition of land $(40,000) Sale of land 22,000 Net cash outflow from investing activities (18,000) Cash flows from financing activities: Issuance (sale) of stock $50,000 Payment of dividends (2,100) Net cash inflows from financing activities $47,900 Net increase (decrease) in cash $33,300 Cash balance, April 1, 20x5 0 Cash balance, April 30, 20x5 $33,300 26 Learning Objective 2 Understand how accounting works. 27 ACG2021 Financial Accounting Double-Entry Accounting Understanding Debits/Credits 28 Double-Entry Accounting Record the dual effects of each business transaction. 29 Double Entry Accounting Each accounting transaction affects at least two accounts. T-accounts can be used to represent accounts and their increases and decreases. Every business transactions involves both a debit and a credit Cash (Left Side) (Right Side) Debit Credit 30 Using T-Accounts Assets = Liabilities + Stockholders Equity Assets Debit + Credit - Cash Debit for Increase, $50,000 = Liabilities Debit - Credit + Stockholders’ Equity Debit - Credit + Common Stock Credit for increase, $50,000 31 Stockholders’ Equity Accounts Expanded Accounting Equation Liabilities Assets = Stockholders’ Equity Common Stock + Retained Earnings Dividends + Revenues Expenses 32 Using T-Accounts Expanded Assets Debit + Dividends Debit + Credit - Accounts that are increased with debits and have normal debit balances Credit Expenses Debit + Credit 33 Using T-Accounts Expanded Accounts that are increased with credits and have normal credit balances Liabilities Debit - Credit + Retained Earnings Debit - Credit + Stockholders’ Equity Debit - Credit + Revenue Debit - Credit + 34 Using T-Accounts Cash 50,000 Credit for decrease, 40,000 Bal. 10,000 Land Debit for Increase, 40,000 Bal. 40,000 Common Stock Bal. 50,000 The balance in an account is the difference between the sum of the debits and the sum of the credits. 35 Recording Transactions Accounting transactions are entered in chronological order in the journal Lists the Sequence of Business Events What happened What Accounts were effected What $’s were exchanged 36 Recording Transactions Journalizing process: Specify each account affected by the transaction Classify each account as either asset, liability, stockholders’ equity, revenue, or expense Determine whether each account is increased or decreased (use rules of debit and credit) Record the transaction in a journal with a brief explanation. Debits are at the left margin and credits are indented 37 Posting from Journal to Accounts / General Ledger DATE ACCOUNTS AND EXPLANATION Apr 2 Cash ………………………………. 50,000 Common Stock ………...….... Issued common stock Cash 50,000 DEBIT CREDIT 50,000 Common Stock 50,000 38 Posting to Accounts / General Ledger Journal does not sort Business Events by Account Thus, journal entries are periodically Posted to their respective Accounts The Ledger 39 Flow of Accounting Data Transaction occurs Transaction analyzed Transaction entered in journal Amounts posted to the ledger accounts 40 Trial Balance A trial balance lists all accounts with their balances Accounts are listed with assets first, then liabilities, then stockholders’ equity, revenues, and finally expenses The trial balance summarizes account balances shows whether total debits equal total credits 41 Example Trial Balance 42 Finding Errors Find the difference between total debits and total credits. Search for a missing account with that balance. Divide the difference by 2 and search for a debit recorded as a credit or viceversa. Divide the difference by 9. If you get an even amount, you may have either a slide or a transposition. 43 End of Chapter 2 44