Accounting Syllabis 2014_2015

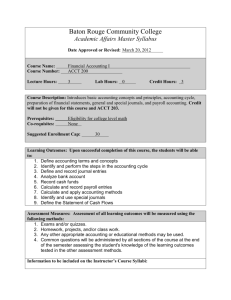

advertisement

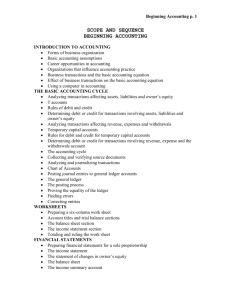

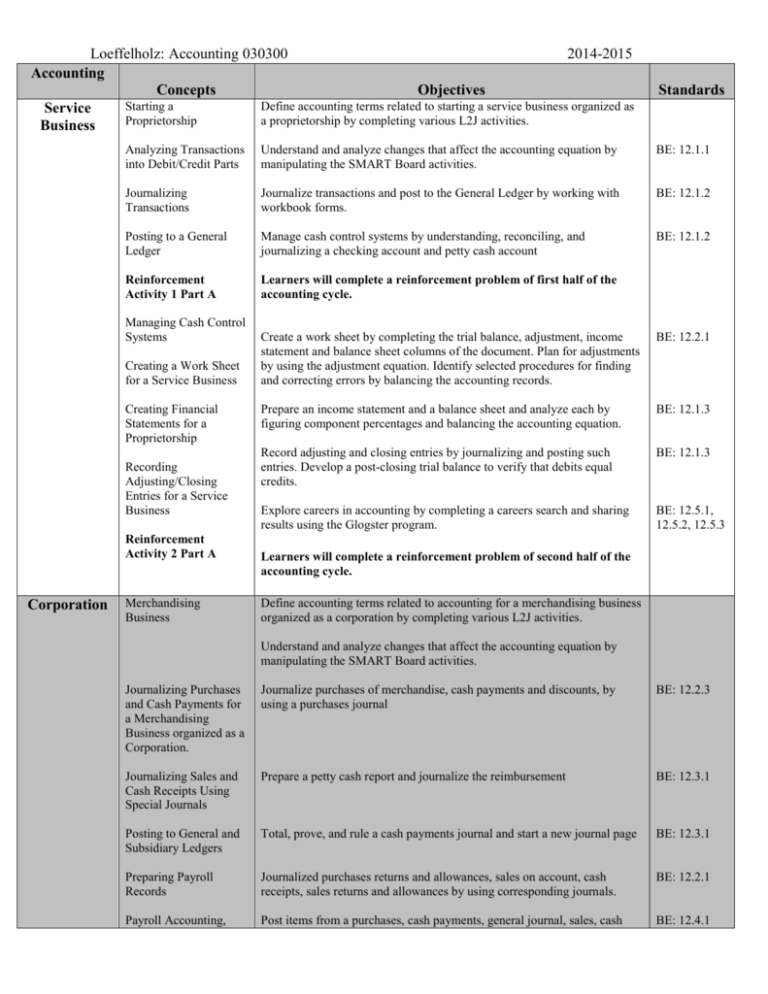

Loeffelholz: Accounting 030300 2014-2015 Accounting Concepts Objectives Starting a Define accounting terms related to starting a service business organized as Service Proprietorship a proprietorship by completing various L2J activities. Business Analyzing Transactions into Debit/Credit Parts Understand and analyze changes that affect the accounting equation by manipulating the SMART Board activities. BE: 12.1.1 Journalizing Transactions Journalize transactions and post to the General Ledger by working with workbook forms. BE: 12.1.2 Posting to a General Ledger Manage cash control systems by understanding, reconciling, and journalizing a checking account and petty cash account BE: 12.1.2 Reinforcement Activity 1 Part A Learners will complete a reinforcement problem of first half of the accounting cycle. Managing Cash Control Systems Creating a Work Sheet for a Service Business Creating Financial Statements for a Proprietorship Recording Adjusting/Closing Entries for a Service Business Reinforcement Activity 2 Part A Corporation Standards Merchandising Business Create a work sheet by completing the trial balance, adjustment, income statement and balance sheet columns of the document. Plan for adjustments by using the adjustment equation. Identify selected procedures for finding and correcting errors by balancing the accounting records. BE: 12.2.1 Prepare an income statement and a balance sheet and analyze each by figuring component percentages and balancing the accounting equation. BE: 12.1.3 Record adjusting and closing entries by journalizing and posting such entries. Develop a post-closing trial balance to verify that debits equal credits. BE: 12.1.3 Explore careers in accounting by completing a careers search and sharing results using the Glogster program. BE: 12.5.1, 12.5.2, 12.5.3 Learners will complete a reinforcement problem of second half of the accounting cycle. Define accounting terms related to accounting for a merchandising business organized as a corporation by completing various L2J activities. Understand and analyze changes that affect the accounting equation by manipulating the SMART Board activities. Journalizing Purchases and Cash Payments for a Merchandising Business organized as a Corporation. Journalize purchases of merchandise, cash payments and discounts, by using a purchases journal BE: 12.2.3 Journalizing Sales and Cash Receipts Using Special Journals Prepare a petty cash report and journalize the reimbursement BE: 12.3.1 Posting to General and Subsidiary Ledgers Total, prove, and rule a cash payments journal and start a new journal page BE: 12.3.1 Preparing Payroll Records Journalized purchases returns and allowances, sales on account, cash receipts, sales returns and allowances by using corresponding journals. BE: 12.2.1 Payroll Accounting, Post items from a purchases, cash payments, general journal, sales, cash BE: 12.4.1 Loeffelholz: Accounting 030300 Inventory 2014-2015 Taxes, and Reports receipts, special journal, correcting entries, to the corresponding ledgers. Reinforcement Activity 2 Part A Learners will complete a reinforcement problem for first half of the accounting cycle for a corporation. Distributing Dividends and Preparing a Work sheet for a Complete, record, and prepare records associated with payroll. BE: 12.2.3 Merchandising Business Complete a worksheet for a merchandising business by journalizing the declaration and payment of a dividend, by planning work sheet adjustments. BE: 12.4.2 Financial Statements for a Corporation Prepare an income statement, stockholder’s equity statement, and a balance sheet for a merchandising business organized as a corporation. BE: 12.2.3 Recording Adjusting and Closing Entries for a Corporation Record adjusting and closing entries by journalizing and posting such entries. Develop a post-closing trial balance to verify that debits equal credits. BE: 12.1.3 Reinforcement Activity 2 Part B Learners will complete a reinforcement problem for second half of the accounting cycle for a corporation. Accounting for Uncollectible Accounts Receivable Calculate, journalize, and post estimated uncollectible accounts expense. Accounting for Plant Assets and Depreciation Record buying of plant assets, calculate and journalize depreciation expense, figure book value, prepare plant asset records and record disposal of plant assets. BE: 12.2.1 Prepare a stock record. BE: 12.4.1 Accounting for Inventory Determine the cost of merchandise inventory using fifo, lifo, and weightedaverage inventory. BE: 12.4.1 L2J Vocabulary Learners will understand vocabulary related to accounting by matching L2J words and definitions. Journalize and post entries related to writing off and collecting uncollectible accounts receivable Advanced Accounting BE: 12.2.1 BE: 12.2.1