3.1 - Washington Co USD 108

advertisement

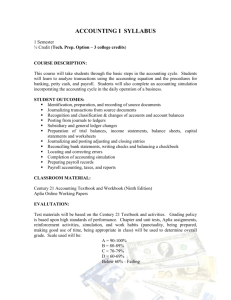

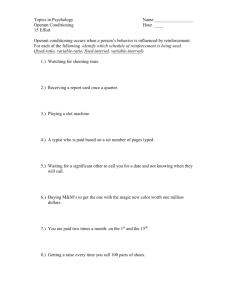

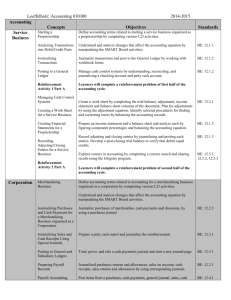

Accounting I Course Description This class provides students with personal or entry-level skills in the accounting profession as a general accounting clerk and/or to provide students with a foundation for study in Computerized Accounting II. The course provides an introduction to double-entry accounting principles and procedures as they apply to proprietorships, partnerships, and corporations. Students will also complete an automated accounting simulation. This class is required in most business curriculums beyond high school. Any student considering entering a business program should seriously consider taking this course. Length: 1 year Prerequistes: Business Essentials and Entrepreneurship Textbook Southwestern Century 21 Accounting 9E text and workbook 2008 Microsoft Excel 2007 Method of Instruction Students will be assigned the reading of the section before class. During class, teacher-led discussion will focus on the day’s assigned section. After discussion, the class and teacher will complete the work together problem. Then students will complete the assigned activities. At the end of a chapter, students will complete the study guide, which will be graded in class. Students will also complete the mastery or challenge problem depending on which one will better prepare the students for the test. The test will consist of two parts. The true-false, multiple choice, and/or matching questions will be taken online as part of preparing for the online state assessments. The majority of points on the test will come from the application part where students complete financial statements learned in the chapter. Grading 60% Homework (projects and chapter worksheets) 40% Tests (via the Internet and hands on) CLASSROOM EXPECTATIONS 1. You are to be in your assigned seat when the bell rings with needed materials. 2. I expect you to conduct yourselves as ladies and gentlemen when you walk into the business room. When you do enter the room, I expect you to sit down immediately, open your book, prepare your computer, and begin your lesson. The business room is not a lounge or a room for horseplay. 3. You will be required to make up all work missed for any excused absence. Late assignments count one-half credit. Washington County Finance Pathway Page 1 4. I do not give extra credit except for this syllabus. If you make each minute and each second of class time count, if you give good effort and work hard early in the school year, then you will progress rapidly, gain confidence, and find accounting an enjoyable experience. 5. Finally, it is a very competitive world we live in. Work hard, ask questions, and give me 100% effort. Together we can help you realize your full potential—and you will have a skill you can carry for a lifetime. Rules 1. Be respectful of others. This includes their property and their feelings. 2. Be respectful of school property. It is a privilege, not a right that you use the materials provided by the school. Course Outline Week 1 2 3 4 5 Chapter Name Course Objectives UNIT 1: ACCOUNTING FOR A SERVICE BUSINESS ORGANIZED AS A PROPRIETORSHIP 1.10.01 Starting a Proprietorship: Changes That Affect the 1.13.01 1 1.13.02 1.11.01 Accounting Equation 1.01.05 2 Analyzing Transactions into Debit and Credit Parts. 1.01.03 1.01.06 3 Recording Transactions in a General Journal 1.02.01 Posting from a General Journal to a General 1.01.04 4 1.01.07 Ledger. 5 Cash Control Systems. 6 7 6 Reinforcement Activity 1--Part A. Work Sheet for a Service Business. 8 7 Financial Statements for a Proprietorship. 8 Recording Adjusting and Closing Entries for a Service Business 9 10 Reinforcement Activity 1--Part B. 11 Simulation 1 1.01.19 1.02.02 1.02.03 1.02.04 1.02.05 2.01.03 1.13.01 1.01.08 1.01.01 1.01.17 1.01.18 1.01.15 1.01.02 1.01.09 1.01.10 1.13.01 1.02.06 1.02.07 1.02.08 1.13.02 1.01.12 1.01.16 1.01.13 1.01.14 1.01.11 2.01.01 2.01.04 1.13.02 1.02.09 1.13.01 1.13.02 UNIT 2: ACCOUNTING CYCLE FOR A MERCHANDISING BUSINESS ORGANIZED AS A CORPORATION. Washington County Finance Pathway Page 2 12 9 Journalizing Purchases and Cash Payments. 13 10 Journalizing Sales and Cash Receipts. 14 Reinforcement Activity 2--Part A 15 11 Posting to General and Subsidiary Ledgers. 16 12 Preparing Payroll Records. 17 13 Payroll Accounting, Taxes, and Reports. 18 19 20 21 Reinforcement Activity 2--Part B. 14 Work Sheet for a Merchandising Business. 15 Financial Statements for a Corporation. 16 Recording Adjusting and Closing Entries for a Corporation 22 23 1.03.01 1.03.02 1.04.02 1.04.03 1.04.06 1.04.07 1.03.01 1.03.03 1.04.05 1.05.02 1.05.03 1.05.05 1.05.06 1.05.07 1.13.01 1.13.02 1.09.01 1.09.02 1.10.03 1.10.05 1.10.06 1.10.07 1.09.01 1.09.02 1.11.02 1.11.03 1.11.05 1.11.06 1.11.07 1.04.041. 04.081.0 5.041.05. 101.10.0 1.11.08 1.10.04 1.07.01 1.07.02 1.07.03 1.07.06 1.07.07 1.13.01 1.10.08 1.11.04 1.11.10 1.12.01 1.12.02 1.12.03 1.07.04 1.07.05 2.01.02 1.01.08 1.01.01 1.01.17 1.01.18 1.01.15 1.01.02 1.01.09 1.01.10 1.13.01 1.05.08 1.01.12 1.07.08 1.13.02 1.01.16 1.01.13 1.01.14 1.01.11 2.01.01 2.01.04 1.13.02 Reinforcement Activity 2--Part B Simulation 2 UNIT 3: ACCOUNTING CYCLE FOR A MERCHANDISING BUSINESS ORGANIZED AS A CORPORATION--ADJUSTMENTS AND VALUATION. 24 17 Accounting for Uncollectible Accounts Receivable. 1.05.09 1.05.11 1.11.09 1.11.11 25 18 Accounting for Plant Assets and Depreciation. 1.06.01 1.06.02 Washington County Finance Pathway Page 3 1.06.03 1.06.04 1.06.05 1.13.01 1.13.02 1.13.02 Simulation #3 UNIT 4: ADDITIONAL ACCOUNTING PROCEDURES 1.13.02 1.08.01 1.08.02 1.08.03 1.08.04 26 19 Accounting for Inventory. 27 28 29 30 &31 32 20 21 22 Accounting for Notes and Interest. Accounting for Accrued Revenue and Expenses End-of-Fiscal-Period Work for a Corporation. 33 23 Accounting for Partnerships 34 24 Recording International and Internet Sales Reinforcement Activity 3. Washington County Finance Pathway Page 4