Introduction to Accounting Syllabus

advertisement

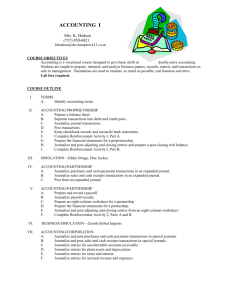

Accounting I Syllabus Instructor’s name and contact information: Mrs. Kerry Lockwood Room 600 klockwood@mtpleasant.edzone.net 989 775-2200 ext. 20600 General Purpose of the course: The course is designed to give students a thorough background in the basic accounting procedures used to operate a business. The accounting procedures presented will also serve as a sound background for employment in office jobs and preparation for studying business courses in college. Students will become acquainted with the principles of double entry bookkeeping including the preparation of financial statements for sole proprietorship, partnership and corporate businesses. The objective of this class is to prepare students for jobs requiring a basic knowledge of business records and to introduce the fundamentals of accounting for students who wish to go into advanced work in this field. There is also a personal use objective that can be attained from this class. This class is intended to be a hands-on learning experience. It requires the student to read the text, listen to a limited amount of lecture, and a great deal of “doing” accounting work in class. Most students will have little homework if class time is spent productively. Students with gain the technical and procedural skills required in accounting departments of today's businesses. The student will not only be trained in basic accounting principles but will also become proficient in automated systems and advanced applications which require greater analysis and decision making. Students will work through an accounting cycle for a proprietorship, partnership, and merchandising businesses. Accounting September, 2012 1 Course Outcomes: The students will be able to: Trimester 1: Marking Period 1: Chapter 1: Define the accounting process Describe the role of accountants Explain accounting concepts and principles Discuss the concept of the accounting equation Use the accounting equation to analyze basic transactions in terms of increases and decreases Reporting financial information on a balance sheet Chapter 2: Determine how transactions change owner’s equity in an accounting equation Reporting a changed accounting equation on a balance sheet Chapter 3: Analyze transactions using T-accounts and using debits and credits Use debits and credits to record increase and decreases in accounts Chapter 4: Record journal entries in a 5-column journal Define accounting terms related to journalizing transactions Prove and rule a five-column journal and prove cash Marking Period 2: Chapter 5: Prepare a chart of accounts and opening accounts Post separate amounts from a journal to a general ledger Post column totals from a journal to a general ledger Make correcting entries Chapter 6: Reconcile a bank statement and record bank service charges, dishonored checks, and petty cash transactions Reinforcement 1A Trimester 2: Marking Period 3: Accounting September, 2012 2 Chapter 7: Describe and prepare the work sheet Plan and adjust entries on a work sheet Extend financial statement information on a work sheet Find and correct errors on a work sheet Chapter 8: Describe the content and purpose of the three basic financial statements and how they are related Prepare financial statements directly from the work sheet with a net income and a net loss Team Project Two (Financial Statements) Rico Sanchez, Disc Jockey Simulation Marking Period 4: Chapter 9: Journalize and post adjusting entries Journalize and post closing entries and prepare a post-closing trial balance Reinforcement 1B Chapter 10: Describe the nature of merchandising business Describe and be able to journalize purchases of merchandise for cash Describe and be able to journalize purchases of merchandise on account and buying of supplies Describe and be able to journalize cash payments and other transactions Chapter 11: Journalizing sales (compute sales tax) and cash receipts Describe the concept of subsidiary ledgers Journalize and post using accounts payable subsidiary ledgers Journalize and post using accounts receivable subsidiary ledgers Trimester 3: Marking Period 5: Chapter 12: Prepare payroll records Preparing payroll time cards Calculating employee total earnings Determining payroll tax withholding Preparing payroll checks Chapter 13: Record, and journalize the payroll for a merchandising business Record employer payroll taxes Accounting September, 2012 3 Chapter 14: Reporting, and paying withholding and payroll taxes Prepare a worksheet for a merchandising business Analyzing and adjusting the Merchandise Inventory account Analyzing and adjusting the Supplies account Analyzing and adjusting the Prepaid Insurance account Chapter 15: Prepare a multiple-step income statement for a merchandising business Analyzing component percentages of income statements showing net income and net loss Prepare a distribution of net income and owner’s equity statements Prepare a classified balance sheet Marking Period 6: Chapter 16: Prepare adjusting and closing entries for a merchandising business Prepare a post-closing trial balance for a merchandising business Unique Global Imports Update résumé Affective Objectives: The students will: Develop business-like attitudes and work habits Demonstrate the ability to follow oral and written directions Be responsible for regular attendance and punctuality Be responsible for personal supplies needed in class and careful use of school materials Accounting September, 2012 4 Evaluation/Assessments and Grading Procedures: BMMT GRADING SYSTEM Each marking period’s grade is based on the following: 1. Tasks/Assignments 2. Practice Tests 3. Assessments Materials Supplied: Once you lose these you pay for them 1. Textbook 2. Online working papers code 3. Practice Sets Accounting September, 2012 5 25% 35% 40% Textbook: Software: Software: Software: South-Western Century 21 Accounting. Multicolumn Journal--10th Editon Automated Accounting 8.1 Intuit QuickBooks 2012 Aplia.com Online Working Papers LEADERSHIP OPPORTUNITIES: Students have the opportunity to participate in the Regional Business Professionals of America Competition. Students also have the opportunity to become the Chief Financial Officer of Miles for Miracles EXPLORE FUTURE CAREER OPPORTUNITIES Career Cruising-offers many tools to help you plan your future. You can explore careers, get information on colleges and technical training, write a resume, take a self-assessment, work on your EDP, etc.www.careercruising.com. O*Net OnLine – is a great tool for career exploration and job analysis! It has detailed descriptions of careers including salary ranges and projected job growth. - www.onetonline.org Michigan Works - The Michigan Works! system is open to everyone for information gathering, local and state labor market information, and self-serve career information. The system helps employers find the skilled workers they need, and helps job seekers find good jobs that provide economic self-sufficiency. www.camwc.org Mt. Pleasant Area Technical Center – Link to Accounting career information page http://www.mpatc.com/programs/accounting_description.asp Mock Interview-Students have the opportunity to attend the Mock Interview day at Central Michigan University. They will interview and be critiqued by a person in the field. They will have their resume and cover letter critiqued as well. There are break-out sessions available for the students related to career development. EARN COLLEGE CREDIT Completion of the Accounting/Finance program prepares students for entry level jobs and possible college credit. Students may apply for articulation credit with the following colleges and universities. The maximum number of articulated college credits available as of 2011-2012 is listed. Baker College – Up to 4 credits – www.baker.edu Davenport University – Up to 6 credits - www.davenport.edu Delta College – Up to 4 credits - www.delta.edu Ferris State University – Up to 3 credits – www.ferris.edu Mid Michigan Community College – Up to 4 credits – www.midmich.edu Montcalm Community College – Up to 7 credits – www.montcalm.edu Accounting September, 2012 6