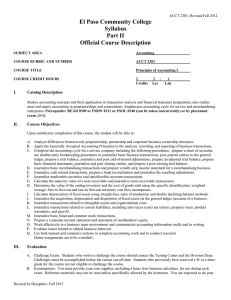

ACCOUNTING II

advertisement

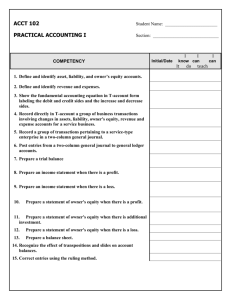

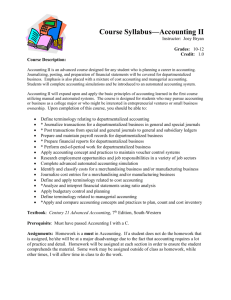

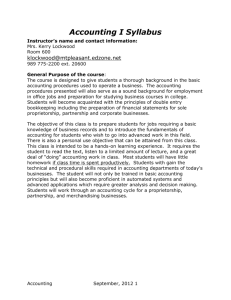

ACCOUNTING II SYLLABUS INSTRUCTOR: Christina Smith TELEPHONE: 352-221-5034 Accounting is…the planning, recording, analyzing, and interpreting of financial information for a business. COURSE DESCRIPTION The Beginning Accounting II program is a necessary follow-up to Beginning Accounting I. This course allows you to go beyond the level of using accounting on a personal level. In Beginning Accounting II you will work on procedures for a partnership and continue into the beginning work for a corporation. The class will help you to have a proficiency level of accounting that could be applied in the business world. This course covers the basic accounting cycle for service and merchandising businesses. Topics include the analysis of business transactions, recording transactions in a variety of journals, and the preparation of financial reports. Students begin this second semester course with the basic accounting cycle and proceed to more complex activities. COURSE OBJECTIVE Emphasis in this course will be on learning and using bookkeeping basics. Areas of emphasis will include internal control, voucher system, accounts, and financial information. The following list of course goals will be addressed in the course. These goals are directly related to the performance objectives. GOALS FOR FIRST SEMESTER 1. 2. 3. 4. 5. 6. 7. 8. display effective work habits name accounting process functions compare three business entity types identify financial information users define generally accepted accounting principles identify accounting major areas record business transaction financial effects use accounting equation GOALS FOR SECOND SEMESTER 9. Analyze business transactions 10. prepare income statement 11. prepare statement of owner’s equity 12. prepare balance sheet 13. analyze financial statements’ relationship 14. use T accounts 15. apply debit/credit entry rule 16. develop/set up simple chart of accounts 17. journalize transactions 18. post journal entries 19. correct journal/ledger errors 20. prepare trial balance 21. use ten-column worksheet 22. enter adjustments 23. complete worksheet 24. journalize/post adjusting entries 25. journalize/post closing entries 26. prepare post closing trial balance 27. journalize/post credit sales 28. set up accounts receivable subsidiary ledger 29. post to accounts receivable subsidiary ledger 30. journalize/post sales returns and allowances 31. compute trade discounts 32. journalize/post freight in/out 33. journalize/post purchases journal 34. set up accounts payable subsidiary ledger 35. post to accounts payable subsidiary ledger 36. journalize/post purchases returns and allowances 37. compute/record sales tax returns 38. prepare state sales tax returns STUDENT OBJECTIVES 1. Students will develop a general understanding of the accounting world. 2. Students will develop skills needed to be successful in a business setting. 3. Students will become more comfortable with basic accounting skills and the expectations for entry level positions. 4. Students will examine the ethical situations faced by accountants today. 5. Students will better understand the basic role of bookkeeping in business today. TEXTBOOK Century 21 Accounting-Advanced Course, Southwestern Publishing Textbook and Working Papers Ch. 1-17 MATERIALS *The following materials will be needed each day in class: 1. Pencil and Eraser 2. Accounting Text 3. Accounting Workbook 4. Calculator (does not need to be scientific—just for basic math) 5. Student workbook (provided by teacher) COURSE STRUCTURE Week 1 & 2 Week 3 & 4 Week 5 Week 6 Week 7 & 8 Week 9 Posting to General and Subsidiary Ledgers Preparing Payroll Account Work Sheet for a Merchandising Business Financial Statements for a Partnership Recording Adjusting and Closing Entries for a Partnership Accounting Cycle for a Partnership: End-of-Fiscal-Period Work Week 10-18 Resource Management - Financial Systems GRADING PROCEDURE Grades will be computed each nine weeks as follows: Graded Assignments: 25% Daily Work 25% Tests and Quizzes: 50% Total 100% Grading Scales is as follows: A 90-100 B 80-89 C 70-79 D 60-69 F 59 and below Assignments: Following directions, neatness, correct work, creativity, and meeting due dates will significantly contribute to your grade. Make-up: All make-up work must be turned in within three days following an absence. Work will not be accepted after three days unless you clear it with me. Attendance and Tardies: Attendance in this class is essential to your learning and benefiting from it. Therefore, attendance and tardy policies will be strict and strictly enforced! You must be seated and working when the tardy bell rings. No missed work as a result of a tardy will be permitted to be made up. Citizenship: Respect for your teacher, other students, and classroom property is requested at ALL TIMES!!! YOUR RESPONSIBLILITIES IN THE CLASSROOM Be seated at your assigned seat before the bell rings with workbook. Not being in your seat when the bell rings will result in a tardy for that day. While in discussion, wait your turn to speak. Loud talking and obscene language will NOT be tolerated. Work together and contribute your own ideas. It is very important that you participate to make this class work. Understand that you are responsible for each other’s learning as well as your own. If you have questions, raise your hand or you may come to my desk for help. Absolutely no food or drinks, including gum in the computer lab. Passes are always necessary to leave the classroom. Do not ask for a pass the first ten minutes or last ten minutes of class. Do not interrupt lecture to ask for a restroom pass unless it is an emergency. No hats, cell phones, i-pods, cameras, etc. abide by school rules. You are responsible for your desk and the area around it. Please keep your area clean at all times. At the end of class--return your books and folders, and pick up any paper around your work area. Remain in your seat until the bell rings—no lining up at the door!!! SMILES ARE ALWAYS WELCOME