ACC 100 Practical Accounting Procedures

advertisement

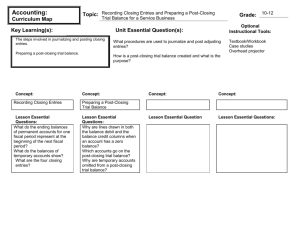

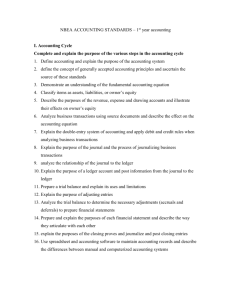

COCONINO COMMUNITY COLLEGE COURSE OUTLINE Prepared by: Stephen L. West, MBA Text revision: Kathy Wigal-Emmons Text revision: Paul Holbrook Revised: Nik Zatezalo and Paul Holbrook Date: March 2, 1993 Date: Spring 1999 Date: August 3, 2001 Date: April 28, 2011 A. Identification: 1. Subject Area: Accounting 2. Course Number: ACC 100 3. Course Title: PRACTICAL ACCOUNTING PROCEDURES 4. Credit Hours: 5 5. Catalog Description: Practical accounting offers a step-by-step approach to the study of accounting. This includes accounting for service, merchandising, and small business operations. The course includes the financial statements, basic accounting cycle, special journals, procedures for controlling cash and payroll accounting. Computerized accounting systems and procedures for small businesses are stressed. Five lecture. B. Course Goals: To provide the students with the comprehensive skills necessary to prepare them for understanding the basic accounting concepts and practices needed to focuses on professional standards found in the accounting profession emphasizing the small business environment. Skill sets include problem-solving, communication, reasoning, and reporting of accounting information. Both manual and computer applications are utilized. C. Course Outcomes: The student will: 1. Analyze accounting transactions and the accounting equation 2. Use the double entry accounting framework 3. Perform journalizing, posting to the ledger, adjusting and closing entries 4. Prepare a trial balance, adjusted trial balance, and a post-closing trial balance 5. Prepare all financial statements 6. Account for cash and prepare payroll accounting documents 7. Prepare financial statements and year-end accounting documents. D. Assessment: 1. Homework and classroom questions on instructor assigned readings 2. Departmental exam questions and/or project(s) E. Course Content Will include: 1. 2. 3. 4. 5. Accounting cycle for a business: analyzing transactions, journalizing, posting to the ledger, preparing unadjusted trial balance, making adjustments, preparing adjusted trial balance, preparing the financial statements, closing all temporary accounts, preparing a post-closing trial balance Accounting procedures for service, merchandising, and other small businesses Accounting for cash, petty cash fund, and general payroll accounting Accounting for sales, cash receipts, purchases and cash payments. Worksheets will be utilized for accounting for merchandising business, and preparing financial statements and year-end closing Accounting procedures for processing accounts receivable, notes and interest receivables, accounts and notes payables, inventory management Revisions: Format/consistency change May 11, 1994/NLB format change Fall 1996/ann textbook change, 10/17/96.amk