Income & Expenditure Account Guide

advertisement

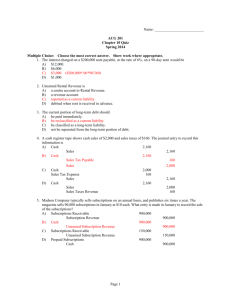

INCOME AND EXPENDITURE ACCOUNT(with answers) P.1 A conventional trading and profit and loss account is not an appropriate form in which to present the final accounts of a non-trading entity. Clubs, institutions, societies, professional bodies and similar concerns not formed with the intention of profit making will usually prepare an income and expenditure account. Occasionally it may be called a revenue account. Differences between ‘A Receipts and Payment Account’ and ‘An Income and Expenditure Account’ Receipts and Payment Account 1. a summary of cash transactions and the resultant cash or bank balance Income and Expenditure Account 1. a balance representing the surplus or deficit of income over expenditure for the period under review 2. contains only part of the income or expenditure for the period, i.e., the part actually received or paid. It may also contain receipts and payments belonging to preceding or succeeding periods. 2. contains all income and revenue expenditure attributable to the period of the account, whether received or paid or not. 3. contains both capital and revenue items if received or paid. 3. contains revenue items only. 4. virtually a summarised statement of cash book 4. virtually a Trading and Profit and Loss Account. There are a few points in particular that should be noted when attempting an income and expenditure question in an examination. 1. In large clubs it is usual to prepare special Trading Accounts to show the results of bar trading, sale of refreshments and similar operations. 2. The capital account is sometimes described as an Accumulated Fund. A surplus of income over expenditure for the period is added to this fund, and a deficit is deducted. 3. Depreciation of fixed assets may or may not be required. If depreciation is required there will be some indication of this, though it may be implicit rather than explicit. 4. If receipts are described as ‘bar receipts’ or ‘dance receipts’ or other ‘special effort receipts’, careful scrutiny is recommended to see if expenses are similarly identified. If is quite probable that the examiner is looking for a separate ‘bar account’ or ‘dance account’, the profit and loss on which should be transferred to the main income and expenditure account. Marks will be list if the individual items are simply listed in the income and expenditure account. In the case of a bar account, stocks at the beginning and the end of the year should of course be included, as should items such as barman’s wages. P.2 5. A payment for life membership should not be treated as income solely in the year in which the member paid the money. It should be credited to a Life Membership Account, and transfers should be made to the credit of the income and expenditure account of an appropriate amount annually. 6. Entrance fees paid on application for membership should not be treated as income solely in the year in which the member is admitted. It should be credited to Entrance Fees Account and transfers should be made from that account to the income and expenditure account of an appropriate amount annually. Accounting treatments for subscriptions e.g 1. The club has 10 members at present and the annual subscription for each member is $100 each. Case 1 – all members duly paid their subscriptions. I&E a/c Subscription $1 000 | Bank (10x$100) $1 000 Case 2 – only 9 members paid their subscriptions. I & E a/c In arrear b/d Subscription 1 000 | Bank (9x$100) | In arrear c/d 1 000 | | 100 900 100 1 000 Journal entries for year end adjustments: Dr. Subscription in arrear Cr. Subscription 100 100 To record the unpaid subscription for one member. Case 3 – all members duly paid their subscriptions and one of them also paid for the next year. Subscription I & E a/c 1 000 | Bank (11x$100) In advance c/d 100 | 1 100 | | In advance b/d Journal entries for year end adjustments: Dr. Subscription Cr. Subscription in advance 100 100 To record the subscription paid in advance for one member. 1 100 1 100 100 P.3 e.g 2. The cash receipts for members’ subscription amounted to $4 388 for the year ended 30 September 1998. The following valuations are also available: As at 30 September Subscriptions in arrears Subscriptions in advance 1997 $150 75 1998 $ 90 35 You are required to prepare the subscription account for the year ended 30 September 1998. Subscription account In arrear b/d I&E a/c (b.f.) In advance 150 | In 4 368 c/d advance b/d 75 | Bank 35 | In 4 553 4 388 arrear c/d 90 | 4 553 e.g 3. The subscriptions received from members for the year ended 31 December 1998 are shown as follows: Subscriptions received for: 1997 55 1998 1 236 1999 40 Subscriptions owing by members amounted to $65 on 31 December 1997, and $66 on 31 December 1998. Subscriptions owing for more than one year would be treated as uncollectible. You are required to prepare the subscription account for the year ended 31 December 1998. Subscription In arrear b/d I & E a/c (b.f.) In advance c/d 65 1 302 | In advance b/d 0 | Bank – 1997 55 | - 1998 1 236 | - 1999 ___44 1 335 | Bad debts 44 | In ______ | _____ 1 411 | 1 411 arrear 10 c/d 66 P.4 Illustration One (Amended from 1998 Section A Question 3) The treasurer of the Leisure Club has prepared the following receipts and payments account for the year ended 31 December 1997: Receipts and payments account $ $ Balance b/d 15 330 Bar purchases 61 250 Subscriptions 49 000 Bar wages 7 420 Bank interest 92 Administration expenses 42 270 Bar sales 97 500 Insurance 6 250 Balance c/d 44 732 161 922 161 922 Additional information: (i) The following balances were extracted from the club’s books at 31 December 1996: $ Accrued bar wages 455 Bar debtors 1 000 Club premises 300 000 Creditors for bar supplies 8 190 Bar stock 9 425 Prepaid insurance 600 Subscriptions in arrears 2 405 Subscriptions in advance 1 120 (ii) Depreciation is to be charged on the cost of club premises at 5% per annum. (iii) Bar stock at 31 December 1997, amounted on $9 620. (iv) Accrued bar wages, prepaid insurance, bar debtors and creditors for bar supplies amounted to $390, $400, $1 200 and $7 215 respectively at 31 December 1997. (v) Subscriptions in advance and in arrears amounted to $2 600 and $1 360 respectively at 31 December 1997. You are required to prepare for the Leisure Club: a) A statement showing the accumulated funds of the club as at 1 January 1997, and b) A bar trading account for the year ended 31 December 1997, and c) An income and expenditure account for the year ended 31 December 1997, d) A balance sheet as at 31 December 1997. Answers: a) A statement showing the accumulated funds of the club as at 1 January 1997: Assets: Club premises $ $ 300 000 Bar debtors 1 000 Bar stock 9 425 Prepaid insurance 600 Subscriptions in arrears 2 405 Cash and Bank 15 330 328 760 Liabilities: Accrued bar wages 455 Creditors for bar supplies 8 190 Subscriptions in advance 1 120 Balance of the accumulated funds as at1.1.1997 9 765 318 995 P.5 b) Leisure Club Bar trading account for the year ended 31 December 1997 Opening stock 9 425 Purchases (W2) 60 275 Sales (W1) 97 700 69 700 Less: closing stock 9 620 Cost of goods sold 60 080 Gross profit c/d 37 620 ______ 97 700 97 700 Bar wages (W3) Net profit 7 355 Gross profit b/d 37 620 30 265 ______ 37 620 37 620 Workings: 1. Bar debtors 1997 1997 Jan 1 Balance b/d Dec 31 Total sales (b.f.) 1 000 Dec 31 Cash / Bank 97 500 97 700 31 Balance c/d 1 200 98 700 98 700 2. Bar creditors 1997 1997 Dec 31 Cash / Bank Dec 31 Balance c/d 61 250 Jan 1 Balance b/d 7 215 Dec 31 Total purchases (b.f.) 68 465 8 190 60 275 68 465 3. Bar wages 1997 1997 Dec 31 Cash / Bank 7 420 Dec 31 Accrued c/d 390 Jan 1 Accrued b/d 455 Dec 31 Bar trading (b.f.) 7 355 7 810 7 810 c) Leisure Club Income and expenditure account for the year ended 31 December 1997 Expenditure Administration expenses Insurance (W5) Income 42 270 6 450 Depreciation 15 000 Surplus of income over expenditure 13 112 76 832 Subscription (W4) 46 475 Bar profit 30 265 Bank interest received 92 ______ 76 832 P.6 Workings : 4. Subscription 1997 1997 Jan 1 In arrear b/d 2 405 Dec 31 I&E a/c (b.f.) 46 475 Dec 31 Bank / Cash 49 000 2 600 31 In arrear c/d 1 360 31 In advance c/d Jan 1 In advance b/d 1 120 51 480 51 480 5. Insurance 1997 1997 Jan 1 Prepaid b/d 600 Dec 31 Cash / Bank 6 250 Dec 31 I&E a/c (b.f.) 6 450 31 Prepaid b/d 400 6 850 6 850 d) Leisure Club Balance Sheet as at 31 December 1997 Fixed assets Accumulated funds Club premises 300 000 Accumulated depreciation 15 000 At 1 January 1997 318 995 Add: Surplus for the year 13 112 285 000 Current assets 332 107 Current liabilities Bar stock 9 620 Bar creditors Bar debtors 1 200 Accruals Prepaid insurance Subscription in arrear Cash and Bank 400 Subscription in advance 7 215 390 2 600 10 205 1 360 44 732 57 312 _______ 342 312 342 312 P.7 Illustration Two (Amended from 1987 Section A Question 4) The Treasurer of the International Club submitted the following receipts and payments account to club members covering the year to 31 December 1986: Receipts Bank b/f Subscriptions received: For current year In advance For previous years Bar takings Sale of equipment Bank c/f Receipts and Payments Account $ Payments 62 500 Printing and stationery Bar purchases 232 000 New equipment bought 8 000 Wages for bar staff 10 000 Sundry expenses 318 600 35 000 51 600 717 700 $ 110 000 132 000 150 000 215 000 110 700 _______ 717 700 Additional information: (i) The following balances were extracted from the club’s books: At 31.12.86 At 31.12.85 Bar stock $ 36 000 $ 28 000 Bar debtors 4 100 5 200 Bar creditors 3 200 6 300 Stationery stock 800 600 Sundry expenses accrued 700 200 (ii) (iii) (iv) (v) The discounts allowed, discounts received and bad debts during the year were $1 000, $2 000 and $3 000 respectively. On 1 January 1986 the club’s only equipment was sold. The net book value of the equipment was $20 000. Depreciation on the new equipment was estimated at $30 000. The subscription in advance at 31 December 1985 was $900 and all the subscriptions for the previous years were collected. The subscription in arrears on 31 December 1986 amounted to $3 000. You are required to prepare for the Leisure Club: a) A statement showing the accumulated funds of the club as at 31 December 1985, and b) A bar trading account for the year ended 31 December 1986, and c) An income and expenditure account for the year ended 31 December 1986, d) A balance sheet as at 31 December 1986. Answers: a) A statement showing the accumulated funds of the club as at 31 December 1985: Assets: Equipment $ Bar debtors $ 20 000 5 200 Bar stock 28 000 Stationery stock 600 Subscriptions in arrears 10 000 Cash 62 500 126 300 Liabilities: Bar creditors 6 300 Sundry expenses accrued 200 Subscriptions in advance 900 Balance of the accumulated funds as at 31.12.1985 7 400 118 900 P.8 b) International Club Bar trading account for the year ended 31 December 1986 Opening stock Purchases (W2) 28 000 Sales (W1) 321 500 130 900 158 900 Less: closing stock 36 000 Cost of goods sold 122 900 Gross profit c/d 198 600 _______ 321 500 321 500 Bar wages 215 000 Gross profit b/d _______ Net loss 215 000 198 600 16 400 215 000 Workings: 1. Bar debtors 1986 1986 Jan 1 Balance b/d Dec 31 Total sales (b.f.) 5 200 321 500 Dec 31 Bank 318 600 31 Discounts allowed 1 000 31 Bad debts 3 000 31 Balance c/d 4 100 326 700 326 700 2. Bar creditors 1986 1986 Dec 31 Bank 132 000 Jan 1 Balance b/d 31 Discounts received 2 000 31 Balance c/d 3 200 Dec 31 Total purchases (b.f) 137 200 6 300 130 900 137 200 c) International Club Income and expenditure account for the year ended 31 December 1986 Expenditure Loss from bar Income 16 400 Subscription (W3) 235 900 Printing and stationery (W4) 109 800 Discounts received 2 000 Sundry expenses (W5) 111 200 Profit on disposal of equipment 15 000 Deficit of expenditure over income 18 500 Discounts allowed 1 000 Bad debts 3 000 Depreciation 30 000 _______ 271 400 271 400 P.9 Workings : 3. Subscription 1986 1986 Jan 1 In arrear b/d 10 000 Jan 1 In advance b/d Dec 31 I&E a/c (b.f.) 235 900 Dec 31 Bank - current - in advance - previous 31 In advance c/d 8 000 900 232 000 8 000 10 000 250 000 31 In arrear c/d 3 000 253 900 253 900 4. Printing and stationery 1986 1986 Jan 1 Stock b/d 600 Dec 31 Bank 110 000 Dec 31 I&E a/c (b.f.) 109 800 31 Stock b/d 800 110 600 110 600 5. Sundry expenses 1986 1986 Dec 31 Bank 110 700 Dec 31 Accrued c/d 700 Jan 1 Accrued b/d 200 Dec 31 I&E a/c (b.f.) 111 200 111 400 111 400 d) International Club Balance Sheet as at 31 December 1986 Fixed assets Accumulated funds Equipment 150 000 Accumulated depreciation 30 000 At 1 January 1986 118 900 Less:Deficit for the year 18 500 120 000 Current assets Bar stock Bar debtors Stationary stock Subscription in arrear 100 400 Current liabilities 36 000 Bar creditors 4 100 Accruals 800 3 000 Subscription in advance 43 900 163 900 Bank overdraft 3 200 700 8 000 51 600 63 500 163 900 P.10 Exercise One The following is a summary of the receipts and payments of the Victory Club during the year ended 30 September 1998: Victory Club Receipts and Payments Account For the year ended 30 September 1998 ---------------------------------------------------------------------------------------------------------------------Cash and Bank balances b/d $1 247 Rent $1 524 Sales of annual dinner tickets 990 Purchase of office equipment 870 Members’ subscriptions 4 388 Donations to charities 287 Life membership 200 Meeting expenses 559 Donations 150 Expenses of annual dinner 1 213 Heating and lighting 446 Stationery and printing 320 Cash and Bank balances c/d 1 756 6 975 6 975 The following valuations are also available: As at 30 September 1997 Subscriptions in arrears $150 Subscriptions in advance 75 Stocks of stationery 67 Meeting expenses prepaid 150 Heating and lighting accrued 110 1998 $ 90 35 83 0 83 On 1 October 1997 the Victory Club owned office equipment costing $2 500 which had been depreciated by $500. The policy of the club is to depreciate office equipment at 10% per annum using the straight line method applied on a full year basis. The club did not sell any office equipment during the year ended 30 September 1998. Life membership was introduced for the first time in the current year. The payment for each member amounted to $100 and it would be spread over 5 years. You are required to prepare an Income and Expenditure Account for the Victory Club for the year ended 30 September 1998 and a Balance Sheet as at that date Victory Club Income and Expenditure Account For the year ended 30 September 1998 Income: Life membership Subscriptions Donations Expenditure: Rent Donations to charities Meeting expenses Expenses over ticket sales of annual dinner Heating and lighting Stationery and printing Depreciation Surplus of income over expenditure P.11 Victory Club Balance Sheet as at 30 September 1998 Fixed assets: Office equipment Less: Accumulated depreciation Current assets: Stock of stationery Subscriptions in arrear Cash and bank Less: Current liabilities Subscription in advance Accruals Accumulated fund: Beginning balance Add: Surplus Ending balance Life membership account ________ Workings: 1. Subscription In arrear b/d | In advance b/d I & E a/c | Bank In advance c/d | In arrear c/d | 2. Meeting expenses Prepaid b/d | I & E a/c Bank/Cash | | 3. Bank-expenses Annual dinner | Bank-sales of tickets | Excess of expenses | over sales revenue | P.12 4. Bank Heating and Lighting | Accrual b/d Accrual c/d | I & E a/c | 5. Stock b/d Stationery and printing | I & E a/c Bank/Cash | Stock c/d | 6. Accumulated Fund as at beginning of year: Assets: Cash and bank Subscriptions in arrear Stock of stationery Meeting expenses prepaid Office equipment Liabilities: Subscriptions in advance Heating and lighting accrued $ P.13 Exercise Two Long Lane Football Club Receipts and Payments Account For the year ended 31 December 1998 --------------------------------------------------------------------------------------------------------------------------Bank Balance 1.1.1998 $ 524 Payment for bar supplies $ 3 962 Subscriptions received for: Wages: 1997 55 Groundsman and assistant 939 1998 1 236 Barman 624 1999 40 Bar expenses 234 Bar sales 5 628 Repairs to stands 119 Donations received 120 Ground upkeep 229 Secretary's expenses 138 Transport costs 305 _____ Bank Balance 31.12.1998 1 053 7 603 7 603 1. Assets and liabilities at the beginning and end of the year: 31.12.1997 31.12.1998 Stocks in the bar - at cost $ 496 $ 558 Owing for bar supplies 294 340 Bar expenses owing 25 36 Transport costs owing 65 2. The land and football stands were valued at 31 December 1997 at: Land at cost of $4 000 Football stands at cost of $5 000 less accumulated depreciation of $3 000 The stands are to be depreciated by 10% per annum on reducing balance method. 3. The equipment at 31 December 1997 was valued at cost of $1 000 less depreciation to date of $500, and is to be depreciated at 25 per cent per annum on straight line method. 4. Four-fifths of the bar expenses were actually spent on the improvement of the equipment on 1 January 1998. 5. It was found repairs to stands included $100 cost of additions to stands. 6. Subscriptions owing by members amounted to $65 on 31 December 1997, and $66 on 31 December 1998. Subscriptions owing for more than one year would be treated as uncollectible. You are required to prepare a Bar Trading Account, an Income and Expenditure Account for the year ended 31 December 1998 and a Balance Sheet as at that date. Long Lane Football Club Bar Trading Account for the year ended 31 December 1998 Bar sales Beginning stock Add: purchases Less: ending stock Cost of goods sold Gross profit Bar wages Bar expenses Net profit from bar P.14 Income and Expenditure Account for the year ended 31 December 1998 Income Subscriptions Profit from the bar Donations received Expenditure Wages Repairs to stands Ground upkeep Secretary's expenses Transport costs Depreciation - Stands - Equipment Bad debts Surplus of income over expenditure Balance Sheet as at 31 December 1998 Fixed assets: Cost Depreciation Net book value Land Stand ________ Current assets: Stock of bar supplies Subscriptions in arrear Cash at bank Less: Current liabilities Bar creditors Bar expenses owing Transport costs owing Subscription in advance Accumulated fund: Beginning balance Add: Surplus Ending balance _________ ________ P.15 Workings: 1. Bar creditors | | | 2. Bar expenses | | | 3. Subscription | In advance b/d In arrear b/d I & E a/c In advance c/d | Bank - 1997 | - 1998 | - 1999 | Bad debts | In arrear c/d | 4. Transport costs | | | 5. Accumulated Fund as at beginning of year: Assets: Land Stands Equipment Stock in bar Bank Subscriptions in arrear Liabilities: Bar creditors Bar expenses owing $