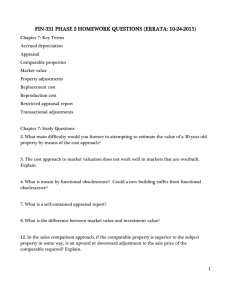

Final Exam Finance 264 Name______________

advertisement

Midterm II Spring 2003 Finance 264 Instructor: Petry Name______________ SSN_______________ Choose the best answer from the choices provided. Please verify that you have 13 pages with 35 questions. You have 1 hour and 20 minutes for the exam. Sign and turn in both your bubble sheet, and the test packet. Please put your full name, net-ID and Section (1 or 2) on the bubble sheet. Use common sense when rounding. If you calculate the answer to be 14.345%, and you have to decide between selecting “14.3%” and “None of the above”, select 14.3%, as your answer naturally rounds to an answer provided. GOOD LUCK! 1) ____An appraised value estimate can best be described as: A. An absolute value. B. A professional opinion of value. C. A purely scientific estimate of value. D. An informed guess. Answer: B Use the following information to answer the next four questions (#2-5). An investor plans to purchase a 10,000 square foot retail building. The market rent on the building is $12 per square foot per year. Rents are expected to increase by 3.5 percent per year. The market vacancy rate is expected to be 7 percent and expenses 44 percent of EGI. Both the vacancy rate and the operating expense ratio are expected to remain constant during the investment period of 3 years. The downpayment is $150,000 and the annual mortgage expense is estimated to be $50,000. 2) _____Determine the current value of the property using the direct capitalization approach, assuming the required rate of return is 12.25%. A. $546,840 B. $714,240 C. $1,275,429 D. $1,371,429 Answer: B 3) _____What is the Debt Coverage Ratio in this case? A. 1.25 B. 1.28 C. 1.31 D. 1.33 E. None of the above ANSWER: A 4) _____What is the Equity Dividend Rate in this case? A. 7.8% B. 8.0% 1 C. 8.3% D. 8.6% E. None of the above ANSWER: C 5) _____What is the Gross Income Multiplier assuming (for the purposes of this question only) that the property was purchased for $1,000,000. A. 7.43 B. 8.53 C. 8.69 D. 8.96 E. None of the above ANSWER: D Use the following information to answer question 6. The following data have been identified as recent comparable property sales. All are considered equally suited for estimating the value of subject property. No adjustments are necessary. ___Comparable_____Sale Price NOI______ __ A______________$1,000,000____$120,000____ ___B ____________ _$1,509,000____$166,000____ ___C______________$1,245,454____$124,545____ 6) _____What is the overall capitalization rate indicated by the market data? A. 9 percent B. 10 percent C. 11 percent D. 12 percent ANSWER: C 7) _____The final price from each appraisal approach is termed the: A. Final estimate of value. B. Indicated value. C. Final adjusted value estimate. D. Final adjusted sale price. E. Market Value ANSWER: B 8) _____For certain foreclosure procedures, time and money will be saved by lenders if the action occurs in a: A. Lien-theory state. B. Title-theory state. C. Deed-of-trust state. D. Power-of-sale state. ANSWER: B 2 9) ______Sometimes construction lenders grant loans without permanent loan commitments, these are termed: A. Forwarded commitments. B. Reverse commitments. C. Uncovered loans. D. Semi-permanent commitments. ANSWER: C 10) _____The clause the indicates that the lender obtains the right to all remaining payments on the loan should the borrower default is termed: A. An acceleration clause. B. A due-on-default clause. C. A late payment penalty clause. D. An escalation clause. ANSWER: A 11) _____A provision inserted in mortgages by lenders that requires borrowers to pay into separate accounts where the money will accumulate to pay annual insurance premiums and property taxes is known as: A. A sinking fund clause. B. An escrow clause. C. A power-of-sale clause. D. An additional payment clause. ANSWER: B 12) _____A comparable property sold eight months ago for $225,000. Assuming the adjustments below, what is the comparable property’s Final Adjusted Sales Price? Conditions of sale –$4,500; Location +3%; Physical characteristics –$14,000; Market conditions +3.5% A. $220,125 B. $221,064 C. $221,689 D. $222,345 E. None of the above ANSWER: B Use the following information to answer the next two questions (#13-14). In appraising a single-family home, you find a comparable property very similar to the subject property. One important difference, however, concerns the financing. The comparable property sold one month ago for $175,000 and was financed by the seller, who took back a 75%, 30 year mortgage, at 5% annual interest, amortized monthly. Current market financing terms are 75% LTV, on a 30 year mortgage at 7.5% interest, amortized monthly. The borrower has a discount rate of 7%. 13) _____What is the total market value to the borrower of the seller financing? 3 A. B. C. D. E. $10,723. $10,542. $5,382. $5,361. None of the above ANSWER: E 14) _____What adjustment should be made to the comparable’s price to account for the financing terms? A. $10,723. B. $10,542. C. $5,382. D. $5,361. E. None of the above ANSWER: C 15) _____The required monthly payment on a $90,000 interest-only loan at 9 percent for 30 years is: A. $675.00 B. $724.16 C. $730.02 D. $925.00 ANSWER: A 16) _____The largest providers of commercial construction loans are: A. Pension funds. B. Commercial banks. C. Mortgage bankers. D. Life insurance companies ANSWER: B 17) _____Commercial property financing for which the borrower is personally liable is termed: A. Recourse financing. B. Nonrecourse financing. C. Personal financing. D. Personal bonding. ANSWER: A 18) _____The most common instrument used to finance commercial property today is the: A. Fully-amortizing mortgage. B. Equity participation mortgage. C. Debt participation mortgage. D. Balloon mortgage. 4 ANSWER: D 19) _____A prepayment penalty, where the amount assessed depends on how far interest rates have declined since origination, is termed a: A. yield-maintenance agreement. B. Flexible penalty. C. Scheduled penalty. D. Stepped penalty agreement ANSWER: A 20) _____A_________________is an agreement by a lender to provide permanent financing for a project when a certain event occurs, normally the completion of the project (or a certain percentage of the project is preleased). A. Take-out commitment B. Closed-end loan C. Gap loan D. Mini-perm loan ANSWER: A 21) _____Calculate the size of the balloon payment on a $1 million loan at 9 percent, amortized monthly over 20 years. The loan matures in 7 years. A. $8,997 B. $244,230 C. $825,679 D. $936,405 ANSWER: C 5 22)_____ The subject property has three bedrooms, one bath, and is in excellent condition. A comparable sale has three bedrooms, 1.5 baths, and is in good condition. The comparable recently sold for $80,000. If each bedroom is worth $5,000; 0.5 baths equal $1,000; and the difference between good and excellent condition is $2,000; what is the indicated value of the subject? A. $77,000 B. $79,000 C. $81,000 D. $83,000 ANSWER: C 23)_____ In the sales comparison approach any value changes that have occurred to a comparable property since the date of the sale are reflected in an adjustment in: A. the conditions of sale adjustment. B. the market conditions adjustment. C. the physical characteristics adjustment. D. the time adjustment. ANSWER: B 24)_____ What is the monthly compound rate of increase for the following data? Date of Previous Sale 18 months ago A. 0.35% B. 0.36% C. 4.20% D. 6.49% ANSWER: A Price of Previous Sale $98,600 Price Today $105,000 Use the MRA output below to answer the following three questions (#25-27). Variable Number X1 X2 X3 X4 Multiple Regression Output Summary Beta Variable Name Coefficient Square Feet 55 Effective Age (years) -3,500 Lot Size (in acres) 22,000 Quality of Location (rank 1-4) 4,220 Std. Error 6.8 600 10,000 1,300 Dependent Variable = $ Price; Constant = 5,542 R Squared = .75; Standard Error = 400. 25)_____ Which variable appears to have the least explanatory power? A. X1 B. X2 C. X3 D. X4 ANSWER: C 6 26)_____ Calculate the estimated value of a property under appraisal which has 2,500 of living space, is 6 years old, is on a lot of one acre in size and ranks a 3 in Quality of Lot. A. 151,160 B. 156,702 C. 198,702 D. 191,650 ANSWER: B 27)_____ The 95 percent confidence interval would be the estimated value you obtained in the previous question +/- which quantity? A. 400 B. 800 C. 5542 D. 11084 ANSWER: B 7 Use the following regression output, to answer the next four questions (#28-31). SUMMARY OUTPUT Regression Statistics Multiple R 0.812261646 R Square 0.659768982 Adjusted R Square 0.574711227 Standard Error 78.71942284 Observations 76 ANOVA df SS 720996.3091 371804.8519 1092801.161 MS 48066.42061 6196.747532 Coefficients Standard Error 247.5015051 48.35956151 -11.81779478 26.17325375 42.55334147 31.56007248 -27.76864869 24.36703784 -40.39287208 59.55135981 12.26700514 32.32744303 -30.36837246 19.16230309 50.17409958 22.25488232 55.81866928 19.98511126 9.362724851 15.30905912 0.579595068 0.142794865 -15.61506647 2.290978788 -8.751254161 35.93596744 53.96300809 24.56231297 93.5864007 28.01625395 67.21121076 34.76215351 t Stat 5.117943533 -0.451521805 1.348328382 -1.139598866 -0.67828631 0.37946104 -1.584797626 2.254521001 2.793012685 0.611580684 4.058934962 -6.81589308 -0.243523544 2.196983979 3.340432338 1.933459351 Regression Residual Total Intercept DSHWSHER? TENISCRT? SAUNA? YRLYLEAS? XTRAUTIL? POORNBHD? UTLITIES? FURNISHED? BTHPERBD BDRMSIZE LOCATION Efficiency Two-bedroom Three-bedroom Four-bedroom 15 60 75 F Significance F 7.756717595 3.05665E-09 P-value 3.4293E-06 0.65324141 0.182620831 0.258982586 0.500197879 0.705685259 0.118269338 0.027826375 0.006997403 0.543125661 0.00014479 5.15075E-09 0.808430556 0.031894838 0.001442863 0.057901679 Lower 95% Upper 95% 150.768011 344.235 -64.17208025 40.53649 -20.57618227 105.6829 -76.50996559 20.97267 -159.5132887 78.72754 -52.39748774 76.9315 -68.69867315 7.961928 5.657721393 94.69048 15.84250773 95.79483 -21.25994282 39.98539 0.293962904 0.865227 -20.19770486 -11.03243 -80.63386821 63.13136 4.831082911 103.0949 37.54556714 149.6272 -2.323426601 136.7458 SUMMARY OUTPUT Regression Statistics Multiple R 0.789264546 R Square 0.622938524 Adjusted R Square 0.584123372 Standard Error 77.84347216 Observations 76 ANOVA df Regression Residual Total Intercept UTLITIES? FURNISHED? BDRMSIZE LOCATION Two-bedroom Three-bedroom Four-bedroom SS 680747.9423 412053.2187 1092801.161 MS 97249.70605 6059.606157 Coefficients Standard Error 252.1954071 43.23934726 56.45595797 21.02406625 49.90898205 19.25040169 0.555426241 0.13288203 -15.06578651 2.10271903 48.52249129 22.91764982 97.32532623 26.47179786 75.49979813 30.9709308 t Stat 5.832544269 2.685301564 2.592620292 4.179844657 -7.164907102 2.117254241 3.676566538 2.437763289 7 68 75 8 F Significance F 16.0488493 2.91336E-12 P-value 1.66394E-07 0.009096502 0.011650674 8.52626E-05 7.15283E-10 0.037898693 0.0004678 0.017397986 Lower 95% Upper 95% 165.9126838 338.4781 14.50311168 98.4088 11.4954262 88.32254 0.290264436 0.820588 -19.26169454 -10.86988 2.791060038 94.25392 44.50170717 150.1489 13.69830437 137.3013 28) _____You are interested in which model is the most appropriate to use, the full model, or the reduced model. The F-statistic for the Partial F-test used to make this assessment is: A. .81188 B. 1.2317 C. 7.7567 D. 16.0489 E. Impossible to determine ANSWER: A 29) _____The correct conclusion of this test based on the results above would be: A. Reject H0, and conclude it was okay to delete the variables B. Reject H0, and conclude you should not have deleted the variables C. Do Not Reject H0, and conclude it was okay to delete the variables D. Do Not Reject H0, and conclude you should not have deleted the variables E. Accept that you don’t remember this stuff and guess the answer ANSWER: C 30) _____Using the most appropriate model from above, calculate the expected monthly rent for a 1-bedroom apartment, which has a dishwasher (DSHWSHER), is furnished (FURNISHED?), has 1 bathroom per bedroom (BTHPERBD), is located 8 miles from downtown (LOCATION), with a 250 square foot bedroom (BDRMSIZE). A. $320.43 B. $320.84 C. $68.23 D. $73.34 E. None of the above ANSWER: A 31) _____Assume that the answer you came up with as your expected rent for a particular apartment was $550 per month. The 95% confidence interval for rent would be: A. [472.16, 627.84] B. [471.28, 628.72] C. [394.32, 705.68] D. [392.56, 707.44] E. None of the above ANSWER: C 32) _____The final price for each comparable property reached after all adjustments have been made is termed: A. Final estimate of value. B. Indicated value. 9 C. Final adjusted value estimate. D. Final adjusted sale price. E. Market Value ANSWER: D Use the following information to answer the next two questions (#33-34). A comparable property sold eight months ago for $150,000. Assuming the adjustments below should be made: Non-realty items +$3,000; Location -4%; Physical characteristics +$4,000; Market conditions +4.5% Conditions of sale +$3,000 33) _____ What is the comparable property’s Market Adjusted Normal Sale Price? A. $150,000 B. $160,490 C. $163,885 D. $147,000 E. None of the above ANSWER: E 34) _____ What is the comparable property’s Final Adjusted Sale Price? A. $150,000 B. $160,490 C. $163,885 D. $147,000 E. None of the above ANSWER: B Use the following information to answer the next question (#35). In appraising a single-family home, you find a comparable property very similar to the subject property. One important difference, however, concerns the financing. The comparable property sold one month ago for $375,000 and was financed by the seller, who took back a 80%, 30 year mortgage, at 9% annual interest, amortized monthly. Current market financing terms are 80% LTV, on a 30 year mortgage at 6% interest, amortized monthly. Use the borrower has a discount rate of 8%. 35) _____What adjustment should be made to the comparable’s price to account for the financing terms? A. Add $30,342. B. Subtract $30,342. C. Add $15,171 D. Subtract $15,171 ANSWER: C 10 Fin 264, Exam II, Formula Sheet Reconstructed Operating Statement Potential Gross Income (PGI) - Vacancy & Collection Losses (VC) = Effective Gross Income (EGI) - Fixed Operating Expenses - Variable Operating Expenses = Net Operating Income (NOI) After Tax Cash Flows Net operating income (NOI) = = Interest expense (INT) Principal amortization (PA) Before-tax cash flow (BTCF) Tax liability (TAX) After-tax cash flow (ATCF) = x = Taxable Liability from Operations Net Operating Income (NOI) Depreciation (DEP) Interest expense (INT) Amortized financing costs (AFC) Taxable income (TI) Tax rate (TR) Tax liability (TAX) 11 Calculating Cash Flow from Sale = = = Gross Sales Price (GSP) Selling Expenses (SE) Net Sale Proceeds (NSP) Remaining Mortgage Balance (RMB) Before-Tax Equity Reversion (BTER) Taxes Due on Sale (TDS) After-Tax Equity Reversion (ATER) Calculating Taxes Due on Sale = = Net Sales Proceeds Adjusted Basis (AB) Total Taxable Gain (TG) Depreciation Recapture (DR) Capital Gain (CG) + = Capital Gain Tax Liability (CGTAX) Depreciation Recapture Tax (DRTAX) Taxes Due on Sale (TDS) + = Depreciation Calculations Acquisition Price (AP=OCB) Acquisition Costs (AC) Land Value (LV) Depreciable Cost Basis (DCB) + + = = Acquisition Price Acquisition Costs Capital Improvements Undepreciated Cost Basis Depreciation Expenses Adjusted Basis 12 (AP) (AC) (CI) (UCB) (DE) (AB) Calculating Calculating Cas Calculating Tax Reject H 0 if ( SSR f SSR r ) / k d F ( k ) d , ( n k 1) f MSE f Sequence of Adjustments Transaction Price Conditions of Sale Financing terms Normal Sale Price Market Conditions Market Adjusted Normal Sale Price Location Physical Characteristics Legal Characteristics Use Nonrealty items Final Adjusted Sale Price 13