Company X

advertisement

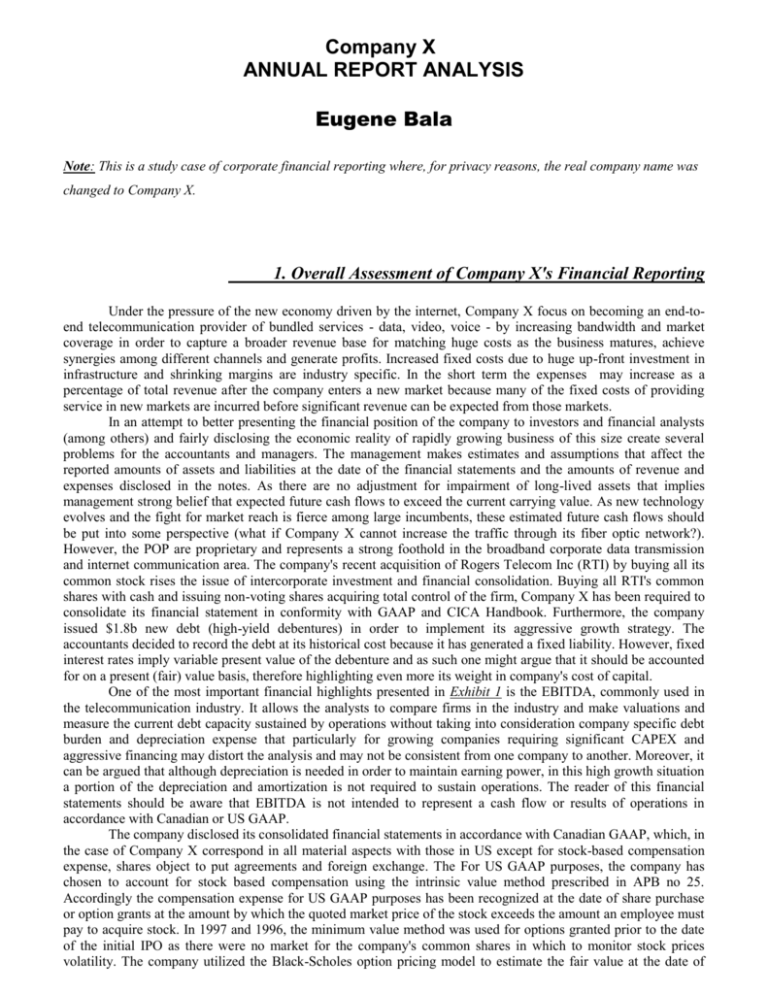

Company X ANNUAL REPORT ANALYSIS Eugene Bala Note: This is a study case of corporate financial reporting where, for privacy reasons, the real company name was changed to Company X. 1. Overall Assessment of Company X's Financial Reporting Under the pressure of the new economy driven by the internet, Company X focus on becoming an end-toend telecommunication provider of bundled services - data, video, voice - by increasing bandwidth and market coverage in order to capture a broader revenue base for matching huge costs as the business matures, achieve synergies among different channels and generate profits. Increased fixed costs due to huge up-front investment in infrastructure and shrinking margins are industry specific. In the short term the expenses may increase as a percentage of total revenue after the company enters a new market because many of the fixed costs of providing service in new markets are incurred before significant revenue can be expected from those markets. In an attempt to better presenting the financial position of the company to investors and financial analysts (among others) and fairly disclosing the economic reality of rapidly growing business of this size create several problems for the accountants and managers. The management makes estimates and assumptions that affect the reported amounts of assets and liabilities at the date of the financial statements and the amounts of revenue and expenses disclosed in the notes. As there are no adjustment for impairment of long-lived assets that implies management strong belief that expected future cash flows to exceed the current carrying value. As new technology evolves and the fight for market reach is fierce among large incumbents, these estimated future cash flows should be put into some perspective (what if Company X cannot increase the traffic through its fiber optic network?). However, the POP are proprietary and represents a strong foothold in the broadband corporate data transmission and internet communication area. The company's recent acquisition of Rogers Telecom Inc (RTI) by buying all its common stock rises the issue of intercorporate investment and financial consolidation. Buying all RTI's common shares with cash and issuing non-voting shares acquiring total control of the firm, Company X has been required to consolidate its financial statement in conformity with GAAP and CICA Handbook. Furthermore, the company issued $1.8b new debt (high-yield debentures) in order to implement its aggressive growth strategy. The accountants decided to record the debt at its historical cost because it has generated a fixed liability. However, fixed interest rates imply variable present value of the debenture and as such one might argue that it should be accounted for on a present (fair) value basis, therefore highlighting even more its weight in company's cost of capital. One of the most important financial highlights presented in Exhibit 1 is the EBITDA, commonly used in the telecommunication industry. It allows the analysts to compare firms in the industry and make valuations and measure the current debt capacity sustained by operations without taking into consideration company specific debt burden and depreciation expense that particularly for growing companies requiring significant CAPEX and aggressive financing may distort the analysis and may not be consistent from one company to another. Moreover, it can be argued that although depreciation is needed in order to maintain earning power, in this high growth situation a portion of the depreciation and amortization is not required to sustain operations. The reader of this financial statements should be aware that EBITDA is not intended to represent a cash flow or results of operations in accordance with Canadian or US GAAP. The company disclosed its consolidated financial statements in accordance with Canadian GAAP, which, in the case of Company X correspond in all material aspects with those in US except for stock-based compensation expense, shares object to put agreements and foreign exchange. The For US GAAP purposes, the company has chosen to account for stock based compensation using the intrinsic value method prescribed in APB no 25. Accordingly the compensation expense for US GAAP purposes has been recognized at the date of share purchase or option grants at the amount by which the quoted market price of the stock exceeds the amount an employee must pay to acquire stock. In 1997 and 1996, the minimum value method was used for options granted prior to the date of the initial IPO as there were no market for the company's common shares in which to monitor stock prices volatility. The company utilized the Black-Scholes option pricing model to estimate the fair value at the date of Eugene Bala Company X's Annual Report grant for options granted subsequent to the company's IPO (Exhibit 2). Had the company determined compensation costs based on the fair value at the date of grant for stock options under SFAS No 123, the loss attributable to common shareholders and basic loss per share would increased by $10m as indicated in Exhibit 3. The management used the most favorable method to reconcile the Canadian GAAP and the US GAAP. The company would have to take into consideration recent accounting pronouncement, SFAS no 133 regarding the "Accounting for Derivatives and Hedging Activities" and did not assessed the impact on its financial position as it will be required to implement it only for its fiscal year ended December 31, 2000. 2. Key Accounting Policies Tangible Capital Assets 31% total assets Property, plant and equipment increased eight fold from $116m to $870m in 1998, are recorded at cost and provisions for depreciation are using the straight-line method over the estimated useful lives of the assets (Exhibit 4). Under the cost method, the investment is initially recorded at cost which remains the carrying value until the investment is sold or a decline in value become evident. The acquisition of RTI has been accounted for using the purchase method. Under the purchase method, Company X acquired the assets, equities, service potential and obligations of RTI for $1.05b, $600m in cash and $450m in non-voting class B shares and the results of operations have been included from the date of acquisition - Exhibit 4. The value of net assets acquired being $355m plus a $32m non-compete agreement. Intangible Capital Assets 26% total assets The value of net assets acquired being $355m plus a $32m non-compete agreement the difference from the price has been accounted for and recorded as $666m goodwill - Exhibit 5. The goodwill should reflect the PV of future profits resulting above those that might normally be expected from investment in the tangible assets of the business. Through the acquisition of RCI the company substantially increased capacity and market share without incurring the normal start up and developmental costs. The goodwill is amortized on a straight-line basis over its estimated useful life of 25 years, in conformity with GAAP. However, it is questionable weather the above the normal benefits from acquisition will occur over such a long period of time. If amortized at a higher rate, the huge amount of goodwill would negatively impact the earnings per share (making the losses look even worse). The noncompete agreement has been recorded at its fair value determined by an independent valuator (although its name is not disclosed) and not by the management team, and is amortized -reasonably- on a straight-line basis over its estimated useful life of only 4 years. Cash and Short-term Deposits 32% total assets In conformity with GAAP the company regroups and discloses under this category its short-term investments in liquid lower risk securities. They have been recorded at cost approximating the fair market value. Under this method, based on the historical cost and the revenue realisation principal according to CICA handbook, any gain and losses on the investment is postponed until the security is sold. Because of their size huge losses may occur in an adverse market. However, the real use of cash is for capital assets investment - in alignment with the overall strategy - and for hedging purposes against interest rate and foreign exchange rate exposure. Long-term debt 70% total liabilities Company X took advantage of the red-hot capital markets in the high growth telecommunication sector, and successfully secured the financing required by its internal and external growth. It has issued and sold notes in four offerings during 1997 and 1998 with stated amounts of $1.8b. As the notes are not convertible there is no equity component attached to them and as such only the notional amount of proceeds has been recorded and amortized over the period to November 2002, respectively June and December 2003 - Exhibit 6. 3 3. Assessment of Company X's Financial Position and Performance Leveraged by huge amount of debt and without generating profits, the ROE rocket up to 111% in C$ and 93% in US$ compared to 24% TSE Telephone Utilities Index respectively 47% S7P Telephone Index. This figures make Company X a rare jewel and a strong buy. The Exhibit 7 shows some of the key financial highlights of incumbents in the buoyant telecommunication industry and puts some perspective in the last assessment. The company will probably continue its aggressive financial strategy - 75% debt and 25% equity - in order to take advantage of the favorable capital markets. However, the most profitable segment of the market is the transborder corridor between Canada and US. Therefore, a strategic US based investors is critical for sustaining furthermore a high growth rate and achieve its objective. Under this scenario the company might have to dilute its Corporate Financial Reporting 03/08/16 Page 1/5 Eugene Bala Company X's Annual Report ownership and issue more equity, a move that has been somehow restricted in the past : the company issued only .04% of its equity base in class A voting and 99% class B and C non-voting and warrants on the top. A strategic investor would require a significant portion of the voting common equity (although restricted to 33% foreign investment by the Telecommunication Act). High total shareholder return - as presented in the annual report - is due to an implied high P/E ratio is comparable with that of internet companies - with the difference that Company X is an infrastructure company that own huge assets -huge fiber optic network and related equipment - and generates revenues. The lower risk related to its capacity to deliver is counterbalanced, however, by the bankruptcy risk related to the current portion of LT debt is high - the interest coverage is negative as the EBIT is negative. Corporate Financial Reporting 03/08/16 Page 2/5 Eugene Bala Company X's Annual Report Exhibit 1 Underlying stock fair value (weighted-average) Risk free rate of return Volatility factor Estimated options life Vesting period Dividends Exhibit 2 14.50 0.06 0.35 5.00 3.00 - Income Statement Revenue Expenses Loss before the undernoted Other income Loss before income taxes Income taxes Loss for the year Canadian GAAP US GAAP pro-forma Deficit, beginning of the year Deficit, end of the year Loss/common share Canadian GAAP US GAAP pro forma 1998 76,238,000 190,092,000 (113,854,000) 91,322,000 (205,176,000) 7,625,000 (212,801,000) (213,398,000) (223,798,000) (39,410,000) (252,211,000) (6.04) (6.05) (6.35) Note: Pro forma values correspond to values obained from the Black-Scholes valuation Exhibit 3 Corporate Financial Reporting 03/08/16 Page 3/5 Eugene Bala Company X's Annual Report Life span Book Value 20 years 157,000,000 7 years 608,000,000 3-5 years 43,000,000 5-7 years 10,091,000 20 years 4,332,000 7 years 37,503,000 term of lease 9,058,000 Telecommunication networks Electronics and related equipment Computer hardware and software Furniture and office equipment Buinding Power equipment Leasehold improvement Exibit 4 Exhibit 5 12% senior notes (US $ 247.9 million) 10.75% senior discount notes (US $ 113.8million) 9.95% senior discount notes (US $630 million) 10.625% senior notes (US $225 million) $ 379m $ 174m $ 964m $ 344m Exhibit 6 Company Bell Canada MCI WorldCom Rogers Communications Metronet Corporate Financial Reporting EBITDA in millions D/E 4,714 7,445 210 (59) Exhibit 7 03/08/16 x 1.08 0.46 (0.80) 2.80 Interest coverage EBITDA base CAPEX 8.46 1,947 11.68 5,418 0.40 658 -0.46 400 Page 4/5