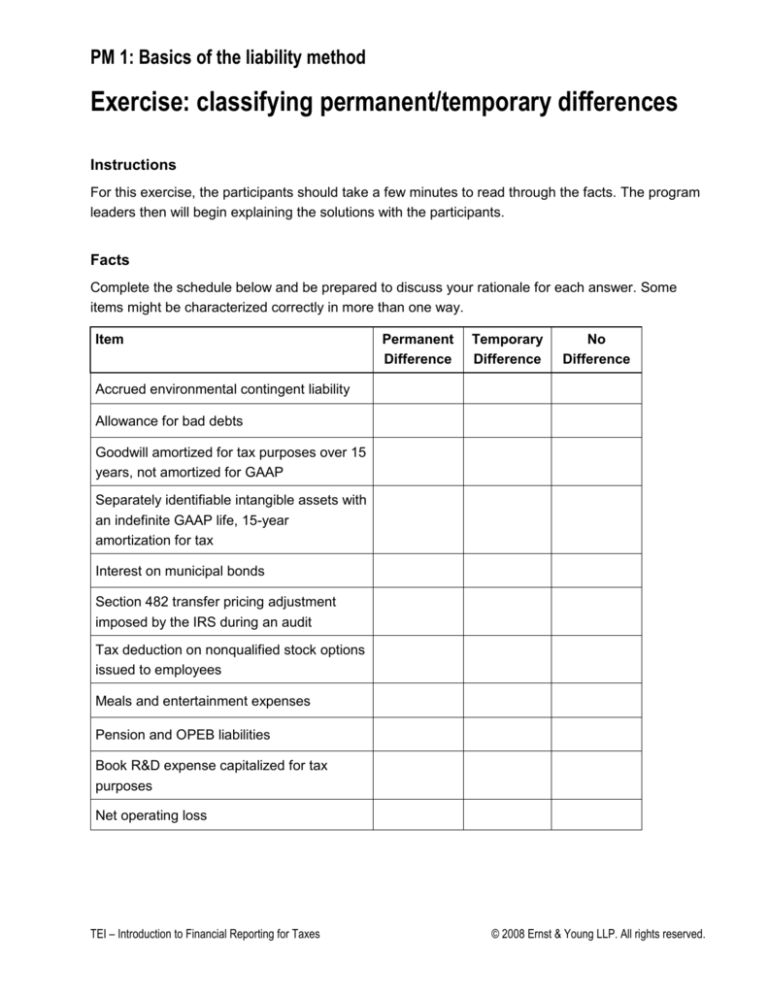

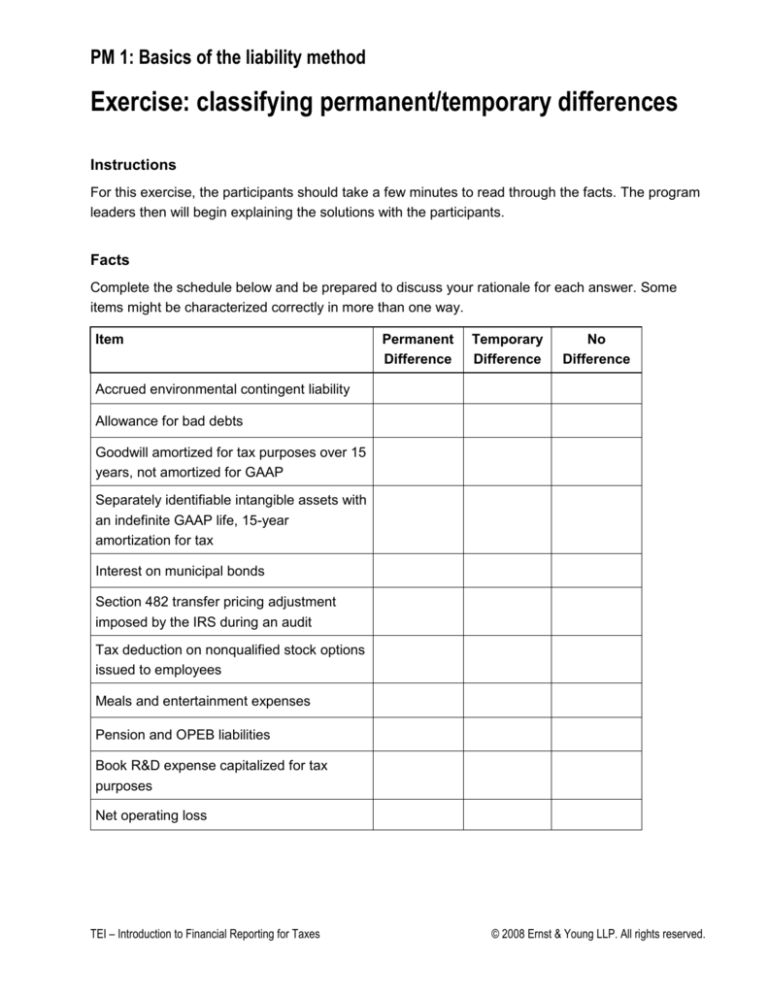

PM 1: Basics of the liability method

Exercise: classifying permanent/temporary differences

Instructions

For this exercise, the participants should take a few minutes to read through the facts. The program

leaders then will begin explaining the solutions with the participants.

Facts

Complete the schedule below and be prepared to discuss your rationale for each answer. Some

items might be characterized correctly in more than one way.

Item

Permanent

Difference

Temporary

Difference

No

Difference

Accrued environmental contingent liability

Allowance for bad debts

Goodwill amortized for tax purposes over 15

years, not amortized for GAAP

Separately identifiable intangible assets with

an indefinite GAAP life, 15-year

amortization for tax

Interest on municipal bonds

Section 482 transfer pricing adjustment

imposed by the IRS during an audit

Tax deduction on nonqualified stock options

issued to employees

Meals and entertainment expenses

Pension and OPEB liabilities

Book R&D expense capitalized for tax

purposes

Net operating loss

TEI – Introduction to Financial Reporting for Taxes

© 2008 Ernst & Young LLP. All rights reserved.