Chapter 8

advertisement

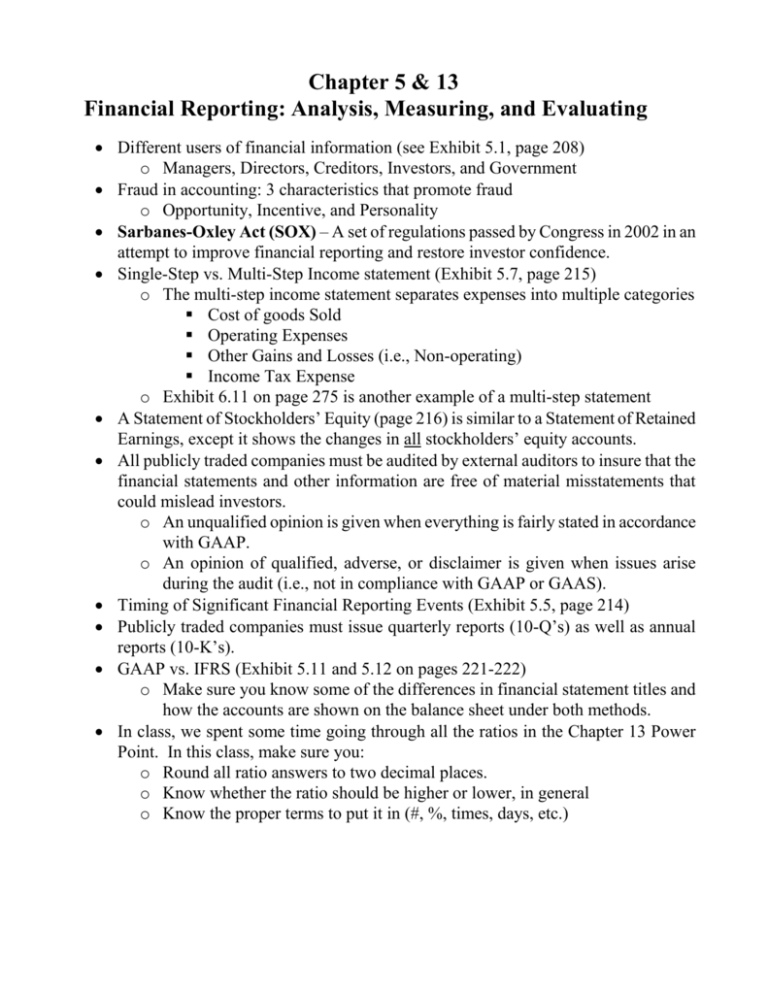

Chapter 5 & 13 Financial Reporting: Analysis, Measuring, and Evaluating Different users of financial information (see Exhibit 5.1, page 208) o Managers, Directors, Creditors, Investors, and Government Fraud in accounting: 3 characteristics that promote fraud o Opportunity, Incentive, and Personality Sarbanes-Oxley Act (SOX) – A set of regulations passed by Congress in 2002 in an attempt to improve financial reporting and restore investor confidence. Single-Step vs. Multi-Step Income statement (Exhibit 5.7, page 215) o The multi-step income statement separates expenses into multiple categories Cost of goods Sold Operating Expenses Other Gains and Losses (i.e., Non-operating) Income Tax Expense o Exhibit 6.11 on page 275 is another example of a multi-step statement A Statement of Stockholders’ Equity (page 216) is similar to a Statement of Retained Earnings, except it shows the changes in all stockholders’ equity accounts. All publicly traded companies must be audited by external auditors to insure that the financial statements and other information are free of material misstatements that could mislead investors. o An unqualified opinion is given when everything is fairly stated in accordance with GAAP. o An opinion of qualified, adverse, or disclaimer is given when issues arise during the audit (i.e., not in compliance with GAAP or GAAS). Timing of Significant Financial Reporting Events (Exhibit 5.5, page 214) Publicly traded companies must issue quarterly reports (10-Q’s) as well as annual reports (10-K’s). GAAP vs. IFRS (Exhibit 5.11 and 5.12 on pages 221-222) o Make sure you know some of the differences in financial statement titles and how the accounts are shown on the balance sheet under both methods. In class, we spent some time going through all the ratios in the Chapter 13 Power Point. In this class, make sure you: o Round all ratio answers to two decimal places. o Know whether the ratio should be higher or lower, in general o Know the proper terms to put it in (#, %, times, days, etc.)