Contents - Department of Accounting and Information Systems ACIS

advertisement

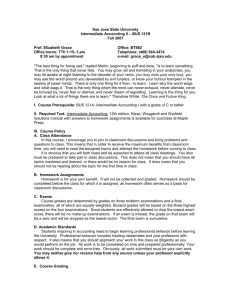

PAMPLIN COLLEGE OF BUSINESS DEPARTMENT OF ACCOUNTING & INFORMATION SYSTEMS ACIS, 3116- INTERMEDIATE FINANCIAL ACCOUNTING II FALL 2012 Instructor: Office: Class Times Dr. John Brozovsky Pamplin Hall, 3011 CRN 80135: Monday, Wednesday and Friday, 1:25-2:15 Derring 3081 CRN 88714: Monday, Wednesday and Friday, 12:20-1:10 Pam 2003 Office Hours: Monday, Wednesday and Friday 11:00-12:15 and by appointment Email: jbrozovs@vt.edu Phone: 540-231-5971 *************************************************** Course Description The purpose of this course is to continue the in-depth analysis of basic concepts of external financial reporting that you began in ACIS 3115. We will address how readers of financial statements use information on a variety of events to make business decisions. With this understanding in mind, you will then learn about the application of generally accepted accounting principles to account for and report the results of various business transactions. Prerequisites ACIS 3115. Required Text/ Software Spiceland, Sepe, and Nelson, 2012. Intermediate Accounting, seventh edition, chapters 13 – 21. McGraw-Hill Irwin. Access to McGraw-Hill Connect. Access to FASB standards As of September 15, 2009 FASB is now published under the Codification. The web site is: http://asc.fasb.org/. Virginia Tech has an access code that will be given in class. Incorporating International Financial Reporting Standards (IFRS) into Intermediate Accounting (VT publication –Blackboard) IFRS and US GAAP: similarities and differences (PwC Publication, 2012) Financial calculator (my preference is the TI BAII plus). Please note, for exams a simple financial calculator is required. Complex function and communication devices (for example, smartphones) are not allowed on exams. The use of such device will be considered cheating and will result in disciplinary actions. Paper Gleim CPA review manuals are available in the library on two hour reserve basis under my name. OBJECTIVES ACIS 3116 extends earlier in-depth analyses of basic concepts of external financial reporting. Included in the course are the following specific objectives: Improving your understanding of how economic actions are translated into accounting information. Improving your understanding of why particular accounting policies are selected. Improving your understanding of accounting and reporting for particular events using generally accepted accounting principles. Improving your understanding of the effects of accounting concepts and standards on the financial accounting and reporting process. Recognizing the objectives and limitations of financial accounting and the means by which the objectives are met. Recognizing the ethical implications of selecting the most appropriate accounting methods. Identify and understand differences between International Financial Reporting Standards and US GAAP. STUDENTS WITH SPECIAL NEEDS OR CIRCUMSTANCES: Any student with special needs or circumstances should feel free to meet with me during office hours. INTERNET FACILITIES: In this course, I make use of the internet and computing facilities available through the Accounting Department and the Virginia Tech campus. For this class, you will be using the World Wide Web and/or e-mail. All course material (catalog description, syllabus, and schedule) are available on Scholar. Supplemental information will be posted to Scholar. One method of communication to be used in this class is e-mail. Your official Virginia Tech email address will be used for communication with the class. HONOR SYSTEM: The honor code will be strictly enforced in this course. All assignments submitted shall be considered graded work, unless otherwise noted. All aspects of your coursework are covered by the honor system. Any suspected violations of the honor code will be promptly reported to appropriate authorities. Honesty in your academic work will develop into professional integrity in your chosen profession. The faculty and students of Virginia Tech will not tolerate any form of academic dishonesty. GRADES: Exam 1 100 Exam 2 100 Final Exam Quizzes HW Assignments IFRS Case Semester Project Class Participation Total 150 50 50 20 40 10 520 Retain all of your assignments that are returned to you throughout the term. If there are any discrepancies between my gradebook and what you believe your grade to be, these papers will be necessary as backup for your position (this does not necessarily mean I will award the points). Any paper/ exam brought back for regrading is eligible to be regraded in its entirety. Regrading may raise or lower your grade. Grades will be based on a 90/80/70/60 percent point split with the top 2% points in each category being the + grade and the bottom 2% points being a – grade. I will look at the possibility of curving at the end of the semester but will not curve any individual assignment or exam. EXAMINATIONS: This course includes two midterm examinations and a comprehensive final examination. Note that the midterms are scheduled in the evening. Please see to ensuring that this night is free for you. These examinations will be primarily in problem format and tend to be quite difficult. Some short written and multiple choice questions will also be included. These multiple choice questions tend to be CPA exam type questions. The purpose of each examination is to test the amount you have learned, and should not reflect anyone else's input but yours. You may not refer to any source during these examinations, including books, notes, or neighbors. Note that the bulk of your grade is from the exams. QUIZZES: There will be a chapter quiz on each chapter the first day it shows up on the syllabus. They will be short essay questions. You will be allowed one page (8 ½ by 11 one side) of notes for the quiz. HOMEWORK: It is critical that you spend the time it takes working through problems in order to understand accounting. Homework will be picked up EVERY day on the day it is assigned on the syllabus. It is almost impossible to learn accounting without putting the pencil to the paper. Since these will generally be done prior to our coverage in class they will be marked as done/partially done/not done. More limited homework assignments also have been posted to Connect and due dates are on the schedule. All Connect HW assignments are due by 10pm (solutions are released at that time) on the due date. Because ample time is provided for this, late submissions are not accepted. These are typically algorithmic problems so they can be used to confirm your understanding of each problem essentially after the fact. These will be graded on correctness. For the homework grade I will use the higher of the two above assessments (chapter by chapter). If you wish to pass this class both need to be done. You need to work through the problems as best you can to give you a familiarity prior to our going over them (which tends to make it look easy) in order for you to remember anything past the next few days. You also need to confirm your understanding by working through something afterwards. IFRS CASE: The IFRS case is at the back of ‘Incorporating International Financial Reporting Standards (IFRS) into Intermediate Accounting’ which is up on Scholar. PROJECT: This last summer FASB passed a new revenue recognition standard. This has significantly changed the accounting for revenue (something all businesses have and need to account for). Write an article 2000-2500 words that will bring a professional in the field (well versed in the old methods) up to steam on the new standard for an industry of your choice (for example: farming, movie making, mining, or software). Use the style in the Journal of Accountancy (however you should also provide me with a bibliography of all the resources you used these should be cited in the text at the appropriate locations (author year)—this is not part of the word count). CLASS PARTICIPATION: I provide 10 points for evaluating students based upon class participation. This requires your active participation. While it is important that you can respond to direct queries it is also important for you to initiate the conversation (add a point, ask a question etc.). SCHEDULE: I will try and stick to the schedule as closely as possible. However, if more time is needed on certain topics, the class schedule will have to change. Day Date M Aug 25 W Aug 27 F Aug 29 M Sept 1 W Sept 3 CHAPTER - TOPIC Introduction and Orientation, start chapter 13 (all assignments include any appendixes) Current Liabilities and Contingencies (Chapter 13) Current Liabilities and Contingencies (Chapter 13) Current Liabilities and Contingencies (Chapter 13) Current Liabilities and Contingencies (Chapter 13) CHAPTER QUESTIONS BE: 1,2,3,4,6,7,9,11,12,14,17 E: 2,3,4,9,10,13,15,19,24,27 P:1,2,4,6 P:7,9,13 Chapter 13 HW due F Long-Term Liabilities (Chapter Sept 5 14) BE: 2,5,7,8,9,11,12,14 M Long-Term Liabilities (Chapter Sept 8 14) E:1,3,5,11,19,21,22,28,30 W Long-Term Liabilities (Chapter Sept 10 14) P:7,8,21, Case 14-2 F M W F Sept 12 Sept 15 Sept 17 Sept 19 Long-Term Liabilities (Chapter 14) Leases (15) Leases (15) Leases (15) P:15,16,17,24 Chapter 14 HW due BE:1,4,8,11,13 E: 2,3,7,16,18,19,23 E:26,27, P:3, 9, M Sept 22 Leases (15) W Sept 24 Leases (15) F Sept 26 Review for exam M Sept 29 Pre exam Q & A M Sept 29 Exam 1: chapters 13,14 and 15 Accounting Changes and Error Oct 1 Corrections (Chapter 20) W F F M W F F M W M W Oct 3 Last day to drop without penalty Accounting Changes and Error Oct 3 Corrections (Chapter 20) Accounting for Income Taxes Oct 6 (Chapter 16) Accounting for Income Taxes Oct 8 (Chapter 16) Oct 10 FALL BREAK – NO CLASSES Accounting for Income Taxes Oct 13 (Chapter 16) Accounting for Pensions and Other Postretirement Benefits Oct 15 (Chapter 17) Accounting for Pensions and Other Postretirement Benefits Oct 17 (Chapter 17) Accounting for Pensions and Other Postretirement Benefits Oct 20 (Chapter 17) Accounting for Pensions and Other Postretirement Benefits Oct 22 (Chapter 17) P:14,16,18 P:19,20, Case 15-3 Chapter 15 HW Due 6:00 – 9:00 pm. E:1,11,14,22 P: 5,11,15/ Chapter 20 HW Due BE: 2,3,6,9,11,13 E:2,10,13,16,20,25 P:1,4,7,9,12, Chapter 16 HW Due Case 17-1 Project Due BE: 1,5,8,9,10,13 E:2,5,6,11,13,15,19,27 P:2,8,10,11 Hand out IFRS Case5 M Accounting for Pensions and Other Postretirement Benefits Oct 24 (Chapter 17) Accounting for Pensions and Other Postretirement Benefits Oct 27 (Chapter 17) W Oct 29 Shareholder’s Equity (Chapter 18) BE:3,6,9,12,14, E:1 F M Oct 31 Shareholder’s Equity (Chapter 18) Nov 3 Shareholder’s Equity (Chapter 18) W W Nov 5 Shareholder’s Equity (Chapter 18) Share-Based Compensation and Nov 7 EPS (Chapter 19) Share-Based Compensation and Nov 10 EPS (Chapter 19) Share-Based Compensation and Nov 12 EPS (Chapter 19) E:4,6,7,12,14,17,19 P:1,2,6 P:8,12, Case 18-2 Chapter 18 HW Due F Share-Based Compensation and Nov 14 EPS (Chapter 19) M Tues W F M W F Nov 17 Nov 18 Nov 19 Nov 21 Nov 24 Nov 26 Nov 28 F F M P:16,17 Chapter 17 HW Due P:18,20 BE:1,2,4,7,10,12 E:2,5,7,10,14,20,23 P:2,6,8 P:10,12,17 Review for exam Chapter 19 HW Due EXAM 2: 16, 17, 18, 19 and 20 6:00 – 9:00 pm. No Class No Class THANKSGIVING BREAK THANKSGIVING BREAK THANKSGIVING BREAK The Statement of Cash Flows BE:3,4,5,9,10,11 M Dec 1 (Chapter 21) IFRS Case due The Statement of Cash Flows W Dec 3 (Chapter 21) E:2,4,7,9,14,15,20,23,27 The Statement of Cash Flows F Dec 5 (Chapter 21) P: 2,4,6,11 The Statement of Cash Flows P:14,15,16 M Dec 8 (Chapter 21) Chapter 21 HW Due Review for Final exam W Dec 10 (comprehensive) Final Exam Friday December 12, 7:45 – 9:45am. For the 12:20 class Final Exam Wednesday December 17, 7:45 – 9:45am. For the 1:25 class