ITEM

advertisement

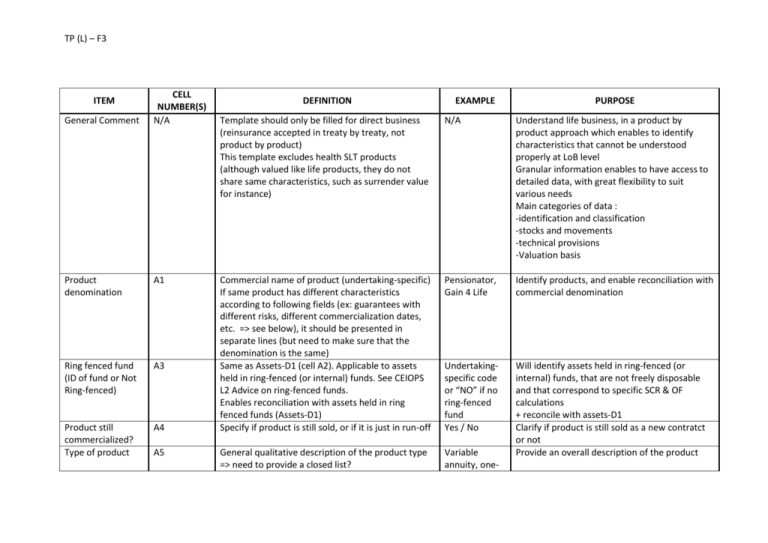

TP (L) – F3 ITEM General Comment CELL NUMBER(S) N/A Product denomination A1 Ring fenced fund (ID of fund or Not Ring-fenced) A3 Product still commercialized? Type of product A4 A5 DEFINITION EXAMPLE PURPOSE Template should only be filled for direct business (reinsurance accepted in treaty by treaty, not product by product) This template excludes health SLT products (although valued like life products, they do not share same characteristics, such as surrender value for instance) N/A Understand life business, in a product by product approach which enables to identify characteristics that cannot be understood properly at LoB level Granular information enables to have access to detailed data, with great flexibility to suit various needs Main categories of data : -identification and classification -stocks and movements -technical provisions -Valuation basis Commercial name of product (undertaking-specific) If same product has different characteristics according to following fields (ex: guarantees with different risks, different commercialization dates, etc. => see below), it should be presented in separate lines (but need to make sure that the denomination is the same) Same as Assets-D1 (cell A2). Applicable to assets held in ring-fenced (or internal) funds. See CEIOPS L2 Advice on ring-fenced funds. Enables reconciliation with assets held in ring fenced funds (Assets-D1) Specify if product is still sold, or if it is just in run-off Pensionator, Gain 4 Life Identify products, and enable reconciliation with commercial denomination Undertakingspecific code or “NO” if no ring-fenced fund Yes / No General qualitative description of the product type => need to provide a closed list? Variable annuity, one- Will identify assets held in ring-fenced (or internal) funds, that are not freely disposable and that correspond to specific SCR & OF calculations + reconcile with assets-D1 Clarify if product is still sold as a new contratct or not Provide an overall description of the product TP (L) – F3 ITEM CELL NUMBER(S) Product classification ID A6 Type of premium A7 Currency A8 DEFINITION Harmonized code (consistent with CEIOPS L2 advice on Segmentation): 1/ 1st letter = major LoB (with-profit (P), unit-linked (U), other life (O) or reinsurance accepted (R)) 2/ 2nd letter = main risk (used for LoB segmentation) => death (D), survival (S), disability/morbidity (I), savings contracts (E); “other” include products that have different main risk drivers 3/ 3rd letter = type of contact => single life (S), joint life (J), collective (C), other (O) Possible list of choices : -regular premium (R): premiums that policyholder has to pay at pre-determined dates and amounts in order to have the full effect of its guarantee -single premium paid under a pre-determined schedule (S) without pre-determined amounts, and with additional guarantee according to amount paid - single premium without any pre-determined schedule (NS) with additional guarantee according to amount paid -single premium (NF) without possibility to pay an additional premium in the future -other (O) : any other case Currency used to pay benefits If more than one currency is used to pay benefits, they should be indicated EXAMPLE year death cover, etc. PEC (collective saving contracts with profits) PURPOSE Describe main characteristics of products, and enable reconciliation with TP-E1 R/S/NS/NF/O Enables to identify the type of future cash inflows that can be expected from this product, and the impact on guarantees EUR, GBP, SEK, USD (ISO 4217 Code) EUR/GBP/DKK e.g. if three are used Necessary to assess currency risk, and also discount rate (different for each currency), which are related to currency of benefits paid (not currency of premiums) TP (L) – F3 ITEM Number of insured persons at the end of the year CELL NUMBER(S) A9 DEFINITION Insured persons are the persons which represent the insurance risk, i.e. : - not the policyholder, for instance with collective contracts with many insured persons (e.g. employees) for a given policyholder (e.g. employer) - not the beneficiary, for instance with contracts covering death risk where the beneficiary (e.g. children) receive money in case the insured person (e.g. parent) dies EXAMPLE PURPOSE Necessary to compare to new insured persons or exits, and also eg to mortality rates Open issue: treatment of savings contracts? Number of new insured persons during year Amount of premiums written during the year Amount of surrenders Total amount of claims paid during year Technical provisions Incl. cost of options and guarantees Incl. Best Estimate for discretionary benefits A10 New insured persons during year (this is for all new contracts) Assess origins of movements in the number of insured persons (in number) A15 Premium written on all policies (new or existing) Possible reconciliation with Result Analysis templates Claims paid due to surrender (full or partial) by policyholders Claims paid during year Possible reconciliation with Result Analysis templates Assess movements in contracts (in amount), and compare with evolution of TP (along with claims) Assess assumptions used (surrender rate) A18 A20 A21 A21a A22 Reconciliation of total with BS-C1 and TP-F1 (along with cell A6, which enables classification by LoB) Valuation within Technical Provisions of embedded options and guarantees This should be calculated only when applicable, i.e. where benefits are calculated product by product (not the case in all markets) Assess amount of claims paid during year (comparison with premiums, TP, surrenders, etc.) Assess importance of each product in terms of technical provisions Assess impact of options and guarantees within TP Assess impact of discretionary benefits within TP TP (L) – F3 ITEM CELL NUMBER(S) DEFINITION EXAMPLE PURPOSE Incl. best estimate of future premiums Incl. Best Estimate for future expenses Value of benefit (lump sum assured) A23 Same definition of FDB as in TP-F1 Same definition of FP as in TP-F1 Reconciliation with TP-F1 (line BD) A23a Valuation of BE for future expenses Compare to actual expenses and assess the adequacy of TPs A24 Identify type of benefits, and amounts with maximum possible benefit to be paid Value of benefit (annual amount of annuities) A25 Surrender value A26 Amount of lump sums to be paid in case of occurrence of all events triggering lump sums (death, disability, etc.), i.e. sum of all benefits defined in the product over all policies included in the row; In order to be comparable with technical provisions, figure should include amounts related to future premiums included in BE calculation; If product has both lump sum and annuity guarantees, they should be unbundled, with each being probability-weighted in case policyholder has an option between both Total amount of annuities (during year and in future – should be discounted for future) to be paid in case of occurrence of all events triggering annuities (death, disability, etc.); Inclusion of future premiums (see above) In case of contract with both lump sum and annuity guarantees, see above Same definition as TP-F1 Reconciliation of total with TP-F1 (total of line I) Paid-up value A27 Paid-up value, as mentioned in art. 185 (3) (f) of the directive, net of taxes Assess impact of future premiums within TP Identify type of benefits, and amounts (maximum possible benefit), because different risks (longevity and interest rate risk in case of annuity) Compare Technical Provisions to surrender value due under contractual options (guarantee to policyholders) Compare Technical Provisions to paid-up value due under contractual options (guarantee to TP (L) – F3 ITEM CELL NUMBER(S) Annualized technical rate (over average duration of guarantee) A30 Return rate based on a given index A32 Actual rate of return (during current year) A33 Different table used for pricing and BE ? (Y/N) A35 Table used for BE A34 DEFINITION EXAMPLE Technical rate is rate used for pricing (i.e. guaranteed rate, independent of return on assets); ex : 100 of premium today at 4,5% technical rate during 6 years will lead to guaranteed amount of 100*1,045^6 in 6 years => different from return rate (might be higher than technical rate, depending on performance of assets) and from calculation of discount rate used for BE Technical rate is not based on an index Here, technical rate is annualized over average duration of guarantee Indicate if return rate is based on a given index and, if yes, which index 3 % during 1st year and 0 % during 2nd and 3rd year will lead to annualized technical rate of around 1 % over 3 years Rate of return actually provided to policyholder (may be higher than guaranteed rate, for instance if good performance over last year or if use of discretionary benefits reserves) Specify whether table (mortality, disability or other) used for pricing is different from that of BE (see below) 4% Yes / No Assess differences between BE and pricing Mortality or disability or other table used for valuation of BE : either commonly agreed name, or formula if composition of tables, or name of undertaking-specific table (if possible with description) Have a separate line for each table used, if different tables are used for different generations of same TH 00-02, UK 2005 mortality table for smokers, 80 % of table XY Assess valuation assumptions NO; inflation; 50% DAX & 50% CAC 40 PURPOSE policyholders) Assess extend of guarantee granted to policyholder, and risk related to error in pricing + compare with discount rate curve used for BE calculation Assess return rate (on top of technical rate) which is not related to investment performance of undertaking, and can lead to gaps between actual performance and guaranteed rate Know performance of products over current year, and compare with guaranteed rates TP (L) – F3 ITEM CELL NUMBER(S) Surrender rate used for BE Discount rate: used of illiquidity premium? A35a Use of financial instrument for replication? (Y/N) A41 A36 DEFINITION guarantee Surrender rate used for valuation of BE Specify iliquidity premium used for discount rate of TP : 50 % / 75 % / 100 % (according to latest discussions) Possible reconciliation with TP-F1 (line G) State whether the product is considered replicable by a financial instrument (i.e. hedgeable => TP calculated as a whole) : closed question (Yes/No) EXAMPLE PURPOSE Rate (3 % per year) or curve 50 % / 75 % / 100 % Assess assumptions on surrender (compare to actual amount of surrenders in A18) Assess whether TP is calculated using different method of discounting from risk-free rate, with use of liquidity premium (related to ability to cash in the policy or not) Know whether product is replicated => supervisors will then be able to require ad hoc data on the financial instrument used and their market quotation (need for a “deep, liquid and transparent market”) Yes/No