investment plan - Home | OMBD

advertisement

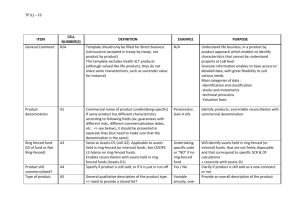

INVESTMENT PLAN Retail Mass Market Broker Distribution February 2014 Creating Wealth for your Dreams INVESTMENT PLAN The Investment Plan is designed to provide an affordable vehicle for long-term savings to provide a tax-free cash lump sum, in the event of the earliest of the policyholder’s death/disability or the attainment of the end of the selected term. Min. Premium: R115.00 (R155.00 recommended) Max. Premium (guide): R1 000.00 Investment Portfolio: Smoothed Bonus Min Term: 10 years API: The Automatic Premium Increase (API) is effective each year on the 1st July (provided the policy is in force for at least 6 months). The client can switch off the API in any given year, if the client is unable to pay the increased premium for that particular year. The premium escalation will automatically revert back for the policy in the following year. Maturity value /death or disablement Withdrawal Option after 5-year interval Withdrawal Option first 5 years Monthly Premiums Savings Savings term (min. 10yrs) 1 F2014 SAVINGS BENEFIT RANGE Maturity lump sum (where no tax is due) SINGLE PREMIUM INVESTMENT PLAN The Single Premium Investment Plan is designed to offer lump-sum investors access to an investment vehicle for long-term capital growth. The plan provides a tax-free cash lump sum, in the event of the earliest of the policyholder’s death, disablement or the attainment of the end of the selected term. Minimum Investment: R2 000 Maximum Premium: R100 000 Maximum Term: to age 75 Investment Portfolio: Smoothed Bonus Min Term: 5 Years Withdrawal Option after 5-year interval Lump Sum investment Maturity value Capital Growth Savings term (min. 5yrs) Death/Disability Benefit 2 F2014 SAVINGS BENEFIT RANGE Maturity lump sum PRODUCT FEATURES AND BENEFITS Surrenders: The Plan has a surrender value available immediately Paid-ups: The Plan has a paid-up value available Withdrawals: One part-withdrawal will be available within the first 5 years of the policy term, and then at 5-yearly intervals thereafter. The period between any part-withdrawals must also be at least 5 years Benefit Payable: On reaching policy maturity or on the policyholder's earlier death or disablement Premium Holiday Benefit: The Premium Holiday allows for up to six premiums to be skipped, during the term of the policy. This benefit is available again to the client, on payment of the skipped premiums Disability: On disablement of the policyholder prior to the end of the investment term, the policyholder may either continue with premium payments or the plan may be made paid-up 3 F2014 SAVINGS BENEFIT RANGE 24 HOUR FAMILY SUPPORT SERVICES Access to the following Family Support Services* from independent service providers: Health support*: Telephone access to health advisers for assistance with health queries Trauma, assault and HIV treatment*: Assistance and treatment following assault (e.g. rape, hijacking, child abuse), accidental exposure to HIV or other kinds of trauma Emergency medical response*: Advice, emergency treatment and transportation to an appropriate medical facility Legal support*: Free telephone advice and assistance on legal matters, help with legal documents Important note: *Family Support Services - Certain terms and conditions apply to the facilitation of this access. For a copy of these, call 0860 00 1919. Old Mutual facilitates access to independent Family Support Service providers. Such access is not offered as a benefit under your insurance policy and may be varied or cancelled at any time. The service providers provide services directly to you on terms agreed between you and the service providers. Old Mutual does not accept any liability arising from the services rendered by the service providers. 4 F2014 SAVINGS BENEFIT RANGE THANK YOU Old Mutual is a Licensed Financial Service Provider