here

advertisement

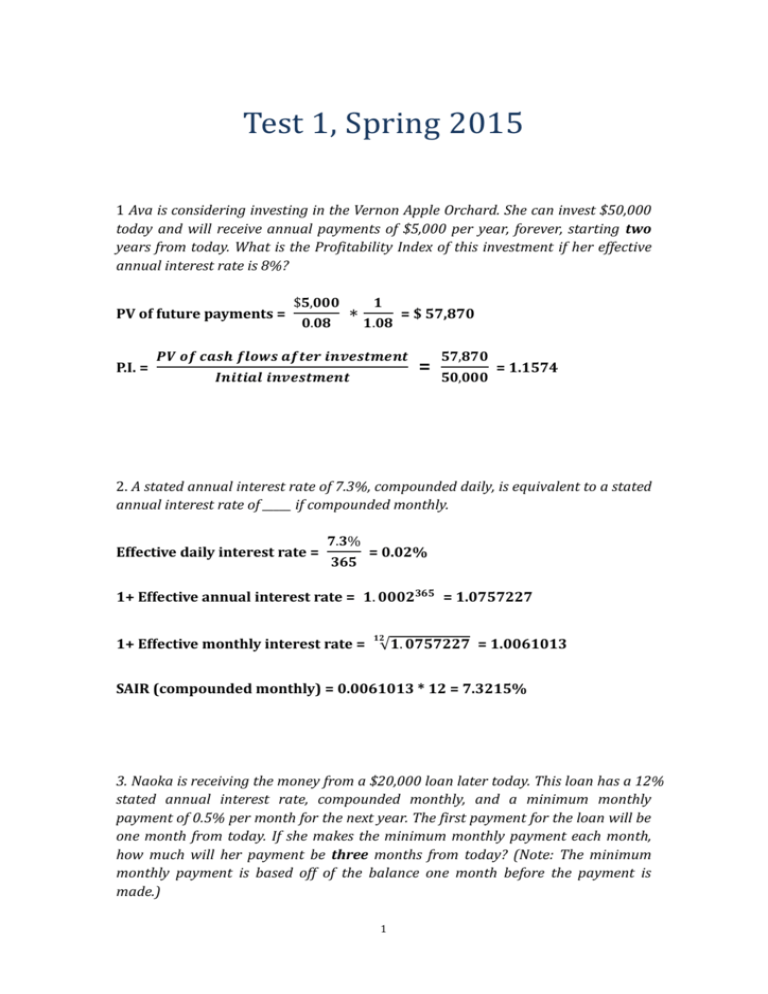

Test 1, Spring 2015 1 Ava is considering investing in the Vernon Apple Orchard. She can invest $50,000 today and will receive annual payments of $5,000 per year, forever, starting two years from today. What is the Profitability Index of this investment if her effective annual interest rate is 8%? PV of future payments = P.I. = $𝟓,𝟎𝟎𝟎 𝟎.𝟎𝟖 ∗ 𝟏 𝟏.𝟎𝟖 = $ 57,870 𝑷𝑽 𝒐𝒇 𝒄𝒂𝒔𝒉 𝒇𝒍𝒐𝒘𝒔 𝒂𝒇𝒕𝒆𝒓 𝒊𝒏𝒗𝒆𝒔𝒕𝒎𝒆𝒏𝒕 𝑰𝒏𝒊𝒕𝒊𝒂𝒍 𝒊𝒏𝒗𝒆𝒔𝒕𝒎𝒆𝒏𝒕 = 𝟓𝟕,𝟖𝟕𝟎 𝟓𝟎,𝟎𝟎𝟎 = 1.1574 2. A stated annual interest rate of 7.3%, compounded daily, is equivalent to a stated annual interest rate of _____ if compounded monthly. Effective daily interest rate = 𝟕.𝟑% 𝟑𝟔𝟓 = 0.02% 1+ Effective annual interest rate = 𝟏. 𝟎𝟎𝟎𝟐𝟑𝟔𝟓 = 1.0757227 𝟏𝟐 1+ Effective monthly interest rate = √𝟏. 𝟎𝟕𝟓𝟕𝟐𝟐𝟕 = 1.0061013 SAIR (compounded monthly) = 0.0061013 * 12 = 7.3215% 3. Naoka is receiving the money from a $20,000 loan later today. This loan has a 12% stated annual interest rate, compounded monthly, and a minimum monthly payment of 0.5% per month for the next year. The first payment for the loan will be one month from today. If she makes the minimum monthly payment each month, how much will her payment be three months from today? (Note: The minimum monthly payment is based off of the balance one month before the payment is made.) 1 First payment = $ 20,000 * 0.005 = $100 Interest = $20,000 * 0.01 = $200 Balance at the end of 1st month: $20,000 + $200 -$100 = $20,100 Second payment = $20,100 * 0.005 = $100.50 Interest = $20,100 * 0.01 = $201 Balance at the end of 2nd month: Third payment : $20,100 + $201 - $100.50 = $20,200.50 $20,200.50 * 0.005 = $101 4. Roderick is thinking about investing in the Sparkle Fun Hockey Stick Company. If he decides to invest $100,000 today, he will receive $5,000 every six months, starting six months from today. His effective annual discount rate is 12%. What is the annual internal rate of return for this investment? IRR is the rate such that NPV = 0 PV of payments = $100,000 = $𝟓,𝟎𝟎𝟎 𝟔−𝒎𝒐𝒏𝒕𝒉 𝑰𝑹𝑹 6-month IRR = 5% Annual IRR = 𝟏. 𝟎𝟓𝟐 − 𝟏 = 𝟏𝟎. 𝟐𝟓% 5. Natasha makes an initial deposit of $60,000 today into a bank account. Her stated annual interest rate is 6%, compounded monthly. If she makes no other deposits or withdrawals, how much will be in the account 71 months from today? Effective monthly interest rate = 𝟔% 𝟏𝟐 = 0.5% Future value of deposits: $60,000 * (𝟏. 𝟎𝟎𝟓)𝟕𝟏 = $85,495 2 FREE RESPONSE PORTION: 6. (5 points) Tyler buys a new house in Orlando, Florida. The amount loaned for the mortgage is $300,000. The loan will be paid off with 600 equal monthly payments, with payments starting six months from today. The effective annual interest rate is 14%. How much will each monthly payment be if each of the 600 payments is the same? 𝟏𝟐 Effective monthly rate: √𝟏. 𝟏𝟒 – 𝟏 = 1.0979% PV of annuity payment six months from today: 𝑪 𝟏 $300,000 * (𝟏. 𝟎𝟏𝟎𝟗𝟕𝟗)𝟓 = [1 ] 𝟎.𝟎𝟏𝟎𝟗𝟕𝟗 (𝟏.𝟎𝟏𝟎𝟗𝟕𝟗)𝟔𝟎𝟎 $ 316,834 = 90.954C C = $3,483.45 7. (8 points) Harold and Karen are about to get married and want to plan for their retirement. They want to withdraw $5,000,000 from an account 30 years from now and $10,000,000 from an account 40 years from now. They will make annual contributions to an account starting one year from today. The first contribution will be $X. Each subsequent contribution will be 3% bigger than the previous one. The final contribution to the account will be 25 years from today. Harold and Karen can earn 5% effective annual interest on any money saved. What is the smallest amount X can be in order for Harold and Karen to have enough money available for both withdrawals? PV_withdraws = $𝟓,𝟎𝟎𝟎,𝟎𝟎𝟎 (𝟏.𝟎𝟓)𝟑𝟎 + $𝟏𝟎,𝟎𝟎𝟎,𝟎𝟎𝟎 (𝟏.𝟎𝟓)𝟒𝟎 = $2,577,344 Growing Annuity: $2,577,344 = X [ 𝟏 𝟎.𝟎𝟓−𝟎.𝟎𝟑 $2,577,344 = 19.0851X - 𝟏 𝟎.𝟎𝟓−𝟎.𝟎𝟑 𝟏.𝟎𝟑 𝟐𝟓 ) ] 𝟏.𝟎𝟓 ( X = $135,045 3