Draft 06/30/2004

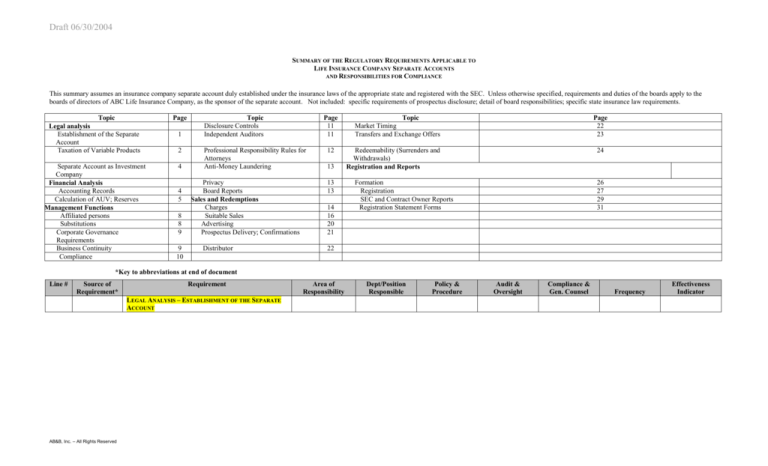

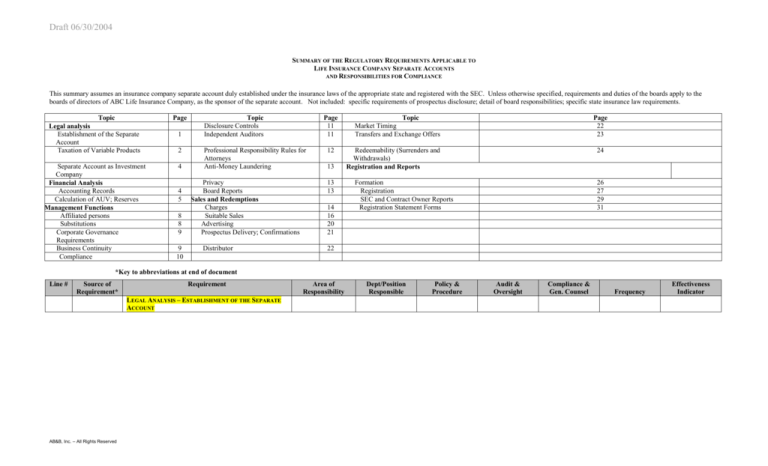

SUMMARY OF THE REGULATORY REQUIREMENTS APPLICABLE TO

LIFE INSURANCE COMPANY SEPARATE ACCOUNTS

AND RESPONSIBILITIES FOR COMPLIANCE

This summary assumes an insurance company separate account duly established under the insurance laws of the appropriate state and registered with the SEC. Unless otherwise specified, requirements and duties of the boards apply to the

boards of directors of ABC Life Insurance Company, as the sponsor of the separate account. Not included: specific requirements of prospectus disclosure; detail of board responsibilities; specific state insurance law requirements.

Topic

Legal analysis

Establishment of the Separate

Account

Taxation of Variable Products

Page

Separate Account as Investment

Company

Financial Analysis

Accounting Records

Calculation of AUV; Reserves

Management Functions

Affiliated persons

Substitutions

Corporate Governance

Requirements

Business Continuity

Compliance

4

1

2

4

5

8

8

9

9

10

Topic

Disclosure Controls

Independent Auditors

Page

11

11

Professional Responsibility Rules for

Attorneys

Anti-Money Laundering

Privacy

Board Reports

Sales and Redemptions

Charges

Suitable Sales

Advertising

Prospectus Delivery; Confirmations

Distributor

12

13

13

13

14

16

20

21

Topic

Market Timing

Transfers and Exchange Offers

Page

22

23

Redeemability (Surrenders and

Withdrawals)

Registration and Reports

24

Formation

Registration

SEC and Contract Owner Reports

Registration Statement Forms

26

27

29

31

22

*Key to abbreviations at end of document

Line #

Source of

Requirement*

Requirement

LEGAL ANALYSIS – ESTABLISHMENT OF THE SEPARATE

ACCOUNT

AB&B, Inc. – All Rights Reserved

Area of

Responsibility

Dept/Position

Responsible

Policy &

Procedure

Audit &

Oversight

Compliance &

Gen. Counsel

Frequency

Effectiveness

Indicator

Page 2

Line #

1

Source of

Requirement*

State insurance

law

Requirement

Each insurance company establishes its separate accounts

in accordance with the laws of its state of domicile. State

insurance law prohibits each insurance company from

charging the separate account with the liabilities of its

general business. Each insurance company credits or

charges income, gains and losses, realized or unrealized,

from assets allocated to each separate accounts against

that separate account without regard to the income, gains

or losses of the insurance company.;

The insurance company owns the amounts allocated to the

separate account. Variable contract owners neither hold

legal title to, nor have any beneficial ownership interests

in, the assets of the separate account. However, separate

account laws provide that the portion of the assets of the

separate account equal to the reserves and other liabilities

with respect to the variable contract issued through the

account will not be charged with liabilities arising out of

any other business the insurance company conducts. To

that extent, assets of separate accounts are segregated

from other assets of the insurance company that are

subject to the claims of creditors.

2

#193839 v02

Code

§72

LEGAL ANALYSIS – TAXATION OF VARIABLE PRODUCTS

Variable annuities are taxed under §72 of the Code.

Generally, any owner who is a natural person is not taxed

on increases in the value of the contract until a

distribution occurs. Distributions taken during the

accumulation period are taxed first as taxable income to

the extent that there are any previously untaxed earnings

accumulated in the contract, and as tax-free recovery of

basis only after any and all such earnings have been

included in income. When periodic annuity payments

begin, the aggregate annuity payments each year generally

are treated in part as taxable income and in part as a taxfree recovery of basis. To be eligible for treatment as an

annuity contract under federal tax law, a contract must

provide that its value will be distributed in accordance

with a prescribed timetable on the death of the owner.

These rules prevent the indefinite deferral of the taxation

of earnings accumulated in annuity contracts.

Area of

Responsibility

Dept/Position

Responsible

Policy &

Procedure

Audit &

Oversight

Compliance &

Gen. Counsel

Frequency

Effectiveness

Indicator

Page 3

Line #

3

Source of

Requirement*

Code

§7702

Code

§7702A

4

#193839 v02

Code

§817(h)

Requirement

Variable life insurance policies are taxed under §7702 of

the Code. This section is designed to ensure that a policy

provides an appropriate level of life insurance protection.

To qualify as a life insurance contract under §7702, a

contract must be treated as a life insurance contract under

applicable state insurance law and must satisfy either of

two limits on the investment emphasis of the contract: the

“cash value accumulation test” or the “guideline premium

limitation” and the “cash value corridor.” If a contract

satisfies the §7702 requirements, increases in the

contract’s cash value are not subject to current taxation

and its death benefits are tax-free to the recipient.

Distributions from life insurance contracts prior to the

death of the insured generally are treated as tax-free

recovery of basis until all of the “investment in the

contract” has been distributed. However, life insurance

contracts classified as a “modified endowment contracts”

under §7702A are treated in the same manner as deferred

annuity contracts.

Section 817(h) of the Code provides that separate account

investments underlying a variable life insurance or

annuity contact must be “adequately diversified” in

accordance with Treasury Department regulations.

Typically, these diversification requirements are met

through the investments made at the level of the mutual

fund underlying the separate account. To be eligible for

this treatment, the mutual fund generally must be

unavailable for investment except through the purchase of

a variable product. Treasury Regulations prescribe several

alternative tests for adequate diversification.

Area of

Responsibility

Dept/Position

Responsible

Policy &

Procedure

Audit &

Oversight

Compliance &

Gen. Counsel

Frequency

Effectiveness

Indicator

Page 4

Line #

5

6

Source of

Requirement*

IRS Position

1933; 1940;

Prudential Ins.

Co. v. SEC.

326 F.2d 383

(3d Cir.), cert,

denied, 377

U.S. 953

(1964)

Requirement

Investor Control. The IRS has taken the position that

owners of variable products may be considered the

owners of the assets of the separate account supporting

their contracts for federal tax purposes if they exercise

investment control over those assets. In that event,

income and gains from the separate account assets are

includible in the variable contract owner’s income. In

particular, the IRS has taken the position that if the assets

underlying a variable contract are publicly available, the

owner will be deemed to have sufficient control. The IRS

also has indicated in the past that a large number of

investment choices may provide sufficient control to the

contact owner, although more recently, the IRS does not

appear to be concerned with the number of investment

options.

LEGAL ANALYSIS – SEPARATE ACCOUNT AS AN

INVESTMENT COMPANY

While state insurance law treats a separate account as an

accounting mechanism, federal securities law treats most

separate accounts as investment companies that issue

variable contracts. As the depositor, the 1933 Act treats

the insurance company as a co-issuer or guarantor of the

contracts issued through the separate account. Both the

separate account and the insurance company must sign the

1933 Act registration statement for variable contracts and

the financial statements for each must be included in the

registration statement.

There are three exclusions from the 1940 Act definition of

an investment company that could apply to a separate

account:

§3(c)(11) – Separate accounts supporting

variable contracts issued in connection with

qualified plans;

§3(c)(1) – Private placement separate accounts

where there are no more than 100 beneficial

owners of variable contracts and there is no

public offering; and

§3(c)(7) – Private placement separate accounts

where variable contract owners are all

“qualified persons” and there is no public

offering.

#193839 v02

Area of

Responsibility

Dept/Position

Responsible

Policy &

Procedure

Audit &

Oversight

Compliance &

Gen. Counsel

Frequency

Effectiveness

Indicator

Page 5

Line #

Source of

Requirement*

7

1940

§31

Rules 31a-1;

31a-2

8

1940

§34(a)

9

1940

Rule 22c-1

10

1940

Rule 22c-1

#193839 v02

Requirement

FINANCIAL ANALYSIS – ACCOUNTING RECORDS

Each Separate account must maintain and keep current the

following accounts, books and documents relating to its

business that constitute the record forming the basis for

financial statements that the separate account files with

the SEC :

Journals that contain itemized daily records of

contract owner transactions related to the

separate accounts (permanently, 2 years eap);

Ledgers reflecting the various accounts

maintained by reflect the separate account’s

financial status (permanently, 2 years eap);

Monthly trial balances of the ledgers (6 years, 2

years eap);

Records of the portfolio investment transactions

(6 years, 2 years eap);

Records of who has authority to authorize the

purchase and sale of the underlying fund shares

(6 years, 2 years eap); and

Copies and evidence of filings made with the

SEC (most permanently, 2 years eap).

It is unlawful to destroy, mutilate or alter any book or

record required to be maintained by § 31 or 32

FINANCIAL ANALYSIS – CALCULATION OF AUV;

RESERVES

AUV must be calculated at least once each day.

Typically, net asset values are computed at the close of

regular trading (usually 4:00 p.m. Easter Time) on each

day the New York Stock Exchange is open for business.

Unit values for variable contracts are linked to the net

asset values of the underlying fund shares held by each

subaccount of the separate account. Accordingly, the

pricing process must occur at both the underlying fund

and at the variable contract levels.

Sales and redemptions must be effected at the current net

asset value next computed after receipt of an order. The

insurance company processes purchase payments,

premium payments, transfers, withdrawals, surrenders and

death benefits using the AUV next computed after receipt

of a transaction request or other triggering event.

Area of

Responsibility

Dept/Position

Responsible

Policy &

Procedure

Audit &

Oversight

Compliance &

Gen. Counsel

Frequency

Effectiveness

Indicator

Page 6

Line #

11

Source of

Requirement*

NAL

New York Life

Insurance

Company

(pub. avail.

5/7/1971)

12

1940

Rule 22c-1

13

1940

Rules 6e2(b)(12);

6e-3(T)(b)(12)

14

1940

Rule 22c-1

#193839 v02

Requirement

SEC confirms method of pricing AUVs and shares of

underlying funds serving as investment options under the

variable contracts, as of the same record date even though,

because computer processing of information regarding

purchase payments and requests for redemption could not

be completed by the insurer until after close of business of

the New York Stock Exchange, the insurer could not

transmit orders to buy or sell shares to the underlying fund

until the next business day after the record date.

Two day / five day rule: For new variable annuities,

once an insurance company receives a completed

application and an initial purchase payment, it must

process the purchase payment and issue the contract

within two business days. If an insurance company

receives an initial purchase payment and an incomplete

application, it has five business days to obtain enough

information to complete the application (and then must

apply the purchase payment within two business days).

The insurance company can hold the purchase payment

for more than five days only if the applicant specifically

consents. Otherwise, the insurance company must return

the purchase payment.

For variable life insurance policies, Rules 6e-2 and 6e3(T) provide an exemption from Rule 22c-1 to allow the

insurance company to comply with established

administrative procedures with respect to issuance,

transfers and redemptions. For example, this permits the

insurance company to underwrite the life insurance

policy. These established administrative procedures are

disclosed as an exhibit to the registration statement.

An investment company may appoint an agent to accept

orders. The board should consider whether the agent’s

internal controls are reasonably designed to prevent orders

received after the fund’s pricing cut off from being

aggregated with orders received before the cut off.

Area of

Responsibility

Dept/Position

Responsible

Policy &

Procedure

Audit &

Oversight

Compliance &

Gen. Counsel

Frequency

Effectiveness

Indicator

Page 7

Line #

15

16

#193839 v02

Source of

Requirement*

1940

Rue 22c-1

1940

Rule 22c-1

Requirement

AUVs must be computed at least once daily (and may be

calculated more often) on each day that the New York

Stock Exchange is open for trading. However, the AUV

need not be computed on: (i) any day on which no

purchase payments or orders for transfers, withdrawals,

surrenders or other transactions are received; (ii)

customary national business holidays listed in the contract

prospectus; or (iii) days on which the SEC has declared an

emergency. Rule 22c-1 also requires the insurance

company to set a time (or times) as of which it will

perform the computation and disclose this time in the

prospectus.

Emergencies: If it is impossible to price, a separate

account may subsequently calculate the price for that day

and retroactively apply it to sales and redemptions

received in the mail or otherwise on that day. Orders

must be segregated based on date of receipt. If orders

cannot be segregated, then all orders must get the next

price calculated after operations resume. Purchase and

redemption orders must be processed on the same basis.

Area of

Responsibility

Dept/Position

Responsible

Policy &

Procedure

Audit &

Oversight

Compliance &

Gen. Counsel

Frequency

Effectiveness

Indicator

Page 8

Line #

17

Source of

Requirement*

State insurance

law;

TR 1.4086(d)(4);

ICL

(10/23/1992)

18

State insurance

law

19

1940

§17

1940

§17(a)

20

21

1940

§17(c)

22

1940

§17(d)

#193839 v02

Requirement

Free Look Periods: Contract owners have the right to

review and return their contracts for a refund within a

specified time period. Depending on the applicable state

law and federal law (that applies to IRAs), the insurance

company generally must refund either the current cash

value (without deducting surrender charges) or the full

amount of the purchase payment or premium. In those

cases where the insurance company must refund the

purchase payment, the insurance company assumes the

investment risk. To protect against this risk, the insurance

company can require the contract owner to allocate the

cash value to a money market fund during the free look

period, provided this is disclosed in the contract Under

this circumstance, the amount refunded must be the

greater of purchase payments or payments (without

deduction of sales charges) plus any amount deducted

from the payment prior to its allocation to the separate

account, if the contract is canceled during the free look

period. Also, on either the 15th or 10th day after the

contact is issued (depending upon whether the contract is

mailed to the contract owner or delivered by a agent), the

cash value must be reallocated to the investment options

selected by the purchaser in the application.

Free Look Periods for Variable Life Insurance: Policy

owners have the right to review and return their policies

for a full refund of all premiums paid within the time

period specified under state insurance law.

MANAGEMENT FUNCTIONS –AFFILIATED PERSONS

In order to assure compliance with §17, procedures should

be in place to identify affiliated persons.

Affiliated transactions. An affiliate (acting as principal)

may not buy property from or sell property to an

investment company. An investment company may not

loan money or other property to an affiliate.

Section 17(a) does not apply to transactions in

merchandise in the ordinary course of business with

affiliates.

An affiliate (acting as principal) may not effect a

transaction with an investment company if the investment

company is a joint participant with the affiliate.

Area of

Responsibility

Dept/Position

Responsible

Policy &

Procedure

Audit &

Oversight

Compliance &

Gen. Counsel

Frequency

Effectiveness

Indicator

Page 9

Line #

23

Source of

Requirement*

1940

Rule 17d-1

24

1940

§17

25

1940

§26(c)

Requirement

An affiliate, or an affiliate of an affiliate, may not effect a

transaction in connection with a joint enterprise or other

joint arrangement in which an investment company is a

participant without prior SEC approval. A joint enterprise

generally requires an element of combination or profit

motive.

Procedures should be in place to review, on a periodic

basis, compliance with exemptive rules and orders that

permit affiliated transactions.

MANAGEMENT FUNCTIONS – SUBSTITUTIONS

The insurance company must apply to the SEC for

approval before substituting shares of one underlying fund

held by a separate account for shares of another

underlying fund. Variable contracts usually permit the

insurance company to make such substitutions without

contract owner approval. In those cases where they do not,

the insurance company must obtain the consent of all

contract owners since the contract cannot be amended

unless the insurance company has reserved the right to do

so.

In evaluating substitution transactions, the SEC looks at a

number of factors, including similarity of investment

objectives, the relative expenses, the relevant historical

performance of the funds involved, and the insurance

company’s interest (if any) in the substitution. In some

cases, the insurance company must cap expenses of the

new fund for a number of years, obtain contract owner

approval of the substitution, and/or make representations

regarding the level of direct and indirect benefits it is

receiving from the new fund for a prescribed time period.

#193839 v02

Area of

Responsibility

Dept/Position

Responsible

Policy &

Procedure

Audit &

Oversight

Compliance &

Gen. Counsel

Frequency

Effectiveness

Indicator

Page 10

Line #

26

27

#193839 v02

Source of

Requirement*

NAL

AEL (pub.

avail.

4/30/2002)

1940

§12(d)(1)(A)

and (E);

Rules 6e-2; 6e3(T)

Requirement

The SEC staff does not distinguish between “reactive”

substitutions (resulting from circumstances beyond the

control of the insurance company) and “proactive”

substitutions (resulting from the insurance company’s

initiative). However, the SEC has issued a no-action letter

permitting an insurance company to allocate monies it

received upon liquidation of an unaffiliated underlying

fund to a subaccount investing in an affiliated money

market fund (with a 12b-1 fee) without obtaining a §26

order. The insurance company must give contract owners

advance notice of the pending liquidation. Contract

owners who have money in the underlying fund to be

liquidated must be advised to transfer such money to other

investment options available under the contract and must

be notified multiple times that the insurance company will

allocate monies it receives upon liquidation of the

underlying fund to the subaccount investing in the money

market fund.

MANAGEMENT FUNCTIONS –CORPORATE GOVERNANCE

REQUIREMENTS

The corporate governance requirements of the 1940 Act

are applicable to any registered management investment

company, including funds underlying variable contracts.

They mandate that the board of directors and contract

owners approve certain matters such as investment

advisory contracts, elect the board members and ratify the

appointment of the independent public accountants.

Whenever an underlying fund solicits proxies or holds a

shareholder meeting, the insurance company must “pass

through” proxies to the variable contract owners and

solicit instructions on how to vote. The insurance

company then votes shares for which it has not received

instructions in the same proportion as the votes for which

it received instructions. The insurance company also will

vote the shares for which it has voting rights in the same

proportion as the votes for which it received instructions.

MANAGEMENT FUNCTIONS – BUSINESS CONTINUITY

Area of

Responsibility

Dept/Position

Responsible

Policy &

Procedure

Audit &

Oversight

Compliance &

Gen. Counsel

Frequency

Effectiveness

Indicator

Page 11

Line #

28

Source of

Requirement*

NASD

Rule 3510

(NTM 04-37)

Rule 3520

(NTM 04-37)

Requirement

Business continuity plans. All NASD members

(including distributors of investment companies) must

create and maintain a written business continuity plan.

Each plan must identify procedures relating to an

emergency or significant business disruption that are

“reasonably designed to enable the NASD member to

meet its existing obligations to customers.” Each plan

must be tailored to suit the member’s size and needs, but

Rule 3510 requires that each plan address at least 10

categories, including back-up and recovery of hard copy

(i.e. paper) and electronic data, and alternate physical

location of employees. Importantly, broker-dealers will

be allowed to rely on another entity for the identified

categories or any "mission critical system," but the plan

must address the broker-dealer's relationship with any

such entity. In addition, Rule 3510 requires a brokerdealer to disclose to its customers how its business

continuity plan addresses the possibility of a future

significant business disruption, and how the member plans

to respond to events of varying scope. The business

continuity plan must be made available promptly upon

request to the NASD staff. Rule 3510 has an effective

date of August 11, 2004 for clearing firms, and September

10, 2004 for introducing firms.

Rule 3520, which requires members to designate two

emergency contact persons and provide such information

to the NASD, has an effective date of June 14, 2004 for

all member firms.

MANAGEMENT FUNCTIONS - COMPLIANCE

#193839 v02

Area of

Responsibility

Dept/Position

Responsible

Policy &

Procedure

Audit &

Oversight

Compliance &

Gen. Counsel

Frequency

Effectiveness

Indicator

Page 12

Line #

29

Source of

Requirement*

1940

Rule 38a-1

Requirement

Effective on or before October 5, 2004, a separate account

and the funds underlying variable contracts must

establish, maintain and periodically review procedures

reasonably designed to prevent violations of the federal

securities laws, to detect violations that have occurred

and to promptly correct any violations that have

occurred, and to appoint a chief compliance officer to be

responsible for administering the policies and procedures.

The separate account’s principal underwriter or depositor

must approve the policies and procedures and the chief

compliance officer and must receive annual reports from

the chief compliance officer. (At a minimum the

following should be addressed: pricing and processing of

units and mutual fund shares; identification of affiliated

persons; market timing; the accuracy of disclosures made

to contract owners and regulators; the accurate creation of

required records; processes for valuing assets and

assessing fees; safeguards for the privacy protection of

contract owner records and information; business

continuity plans; and processing of new account

applications, purchase and premium payments and

exchanges). Compliance procedures must provide for the

oversight of compliance by service providers (i.e. the

principal underwriter, insurance company depositor,

administrator or transfer agent) through which the

separate account conducts its activities.

Each insurance company depositor’s board of directors

(including a majority of disinterested directors) must

approve the investment company’s written policies and

procedures and those of its service providers.

Procedures must be reviewed at least annually by the chief

compliance officer, but not necessarily by the board.

Recordkeeping: copies of policies and procedures for 5

years (eap)

Copies of materials provided to board of the depositor and

written reports for 5 years, 2 years in eap

Records documenting annual review for 5 years, 2 years

in eap

MANAGEMENT FUNCTIONS –DISCLOSURE CONTROLS

#193839 v02

Area of

Responsibility

Dept/Position

Responsible

Policy &

Procedure

Audit &

Oversight

Compliance &

Gen. Counsel

Frequency

Effectiveness

Indicator

Page 13

Line #

30

Source of

Requirement*

1940

Rule 30a-3

31

1934

§10A(g)

32

1934

§10A(j)

33

1934

§10A(l)

34

Regulation

S-X

Rule

2-01(c)(8)

1934

Rules 13b-2(b)

and 13b-2(c)

35

36

#193839 v02

Regulation

S-X

Rule 2-06

Requirement

The principal executive officer and principal financial

officer are not required to make certain certifications

regarding the establishment, maintenance and periodic

evaluation of internal controls with respect to separate

accounts. Nevertheless, the SEC strongly emphasizes the

importance for all investment companies to have

disclosure controls and procedures designed to ensure

that information required to be disclosed is recorded,

processed, summarized and reported within the time

periods specified in SEC rules and forms and is

appropriately communicated to management.

MANAGEMENT FUNCTIONS –INDEPENDENT AUDITORS

Prohibition on Non-audit Services. Auditors generally

are prohibited from providing the specified types of nonaudit services to audit clients.

Audit Partner Rotation Requirement. All audit

partners must rotate off the engagement after specified

periods and maintain a required “cooling off” period.

Auditor Employment Prohibition. Members of the

audit team are prohibited from serving in certain

capacities for a period of one year after employment with

the registrant (or the sponsoring insurance company).

Restriction on Auditor Compensation. Audit partners

are prohibited from receiving compensation for selling

non-audit services.

Officers, directors and persons acting under their direction

are prohibited from improperly influencing the auditor of

a issuer’s financial statements, when the officer, director

or person acting under his or her direction know or should

have known that the action, if successful (but regardless

of whether the action is in fact successful), could result in

rendering the issuer’s financial statements materially

misleading.

Record Relevant to Audits. The accounting firms must

retain certain records relevant to separate account

financial statement audits and reviews (but not audits and

reviews of the insurance company financials) for seven

years. Records to be retained include an accounting firm's

workpapers and certain other documents that contain

conclusions, opinions, analyses, or financial data related

to the audit or review.

Area of

Responsibility

Dept/Position

Responsible

Policy &

Procedure

Audit &

Oversight

Compliance &

Gen. Counsel

Frequency

Effectiveness

Indicator

Page 14

Line #

37

Source of

Requirement*

1934

§13(b)(2)

38

17 CFR Part

205

39

Treasury

BSA, FinCen

67 Fed. Reg.

21117

40

1940

Rule 0-11

(must comply

by 10/1/2003)

41

Reg. S-P

#193839 v02

Requirement

Assessment of Accounting Support Fees. A separate

account with an average monthly market capitalization (or

net asset value) for the past calendar year of more than

$250 million appears to be subject to the requirement that

provides funding for the Public Company Accounting

Oversight Board. Although the funding rules would not

apply directly to the sponsoring insurance company, the

insurance company would pay the fee.

MANAGEMENT FUNCTIONS –PROFESSIONAL

RESPONSIBILITY RULES FOR ATTORNEYS

In-house or outside counsel retained by the insurance

company and providing advice concerning federal

securities disclosure and regulatory matters related to

separate accounts must report to the company’s chief legal

officer, or, if necessary, to the audit committee or board of

directors, evidence of material violations of the securities

laws or breach of fiduciary duty or similar violations by a

client company or its agent.

MANAGEMENT FUNCTIONS –ANTI-MONEY LAUNDERING

An open-end fund must adopt anti-money laundering

procedures. The fund must establish and implement

policies to prevent money laundering or financing terrorist

activities; provide for independent testing for compliance

by an independent party; designate a person responsible

for the program; provide ongoing training for employees.

The board must approve the plan in writing.

Every mutual fund must establish, document and maintain

a written Customer Identification Program (CIP). The

CIP must include risk-based procedures for verifying the

identity of any customer who opens an account. The

procedures must enable the fund to form a reasonable

belief that it knows the identity of the customer. Required

information includes name, date of birth, address,

identification number.

MANAGEMENT FUNCTIONS – PRIVACY

Financial institutions must have privacy policies. Nonpublic personal information may not be provided to an

unaffiliated third party unless customers are provided with

an initial and annual privacy notice providing the option

to withhold consent. The initial notice must be given

when the relationship is established. The annual notice

must be given once in each 12-month period.

Area of

Responsibility

Dept/Position

Responsible

Policy &

Procedure

Audit &

Oversight

Compliance &

Gen. Counsel

Frequency

Effectiveness

Indicator

Page 15

Line #

42

43

#193839 v02

Source of

Requirement*

Reg. S-P

1940

Rule 6e-3(T);

Participation

Agreements

Requirement

Financial institutions must implement measures designed

to ensure the security and confidentiality of nonpublic

personal information, to protect the information against

any anticipated threats or hazards, and to protect against

unauthorized access to, or use of, the information that

could result in substantial harm or inconvenience to any

customer.

MANAGEMENT FUNCTIONS – BOARD REPORTS

When contract owners of both variable annuities and

variable life insurance policies invest in the same

underlying funds, the insurance companies issuing those

policies, , will submit to the board of the underlying fund

at least annually such reports, materials, or data as the

board reasonably may request so that the directors or

trustees of the board may make a determination regarding

whether there is a material irreconcilable conflict between

the variable annuity and variable life insurance contract

owners. Such reports, materials, and data will be

submitted more frequently if deemed appropriate by the

board.

SALES AND REDEMPTIONS – CHARGES

Area of

Responsibility

Dept/Position

Responsible

Policy &

Procedure

Audit &

Oversight

Compliance &

Gen. Counsel

Frequency

Effectiveness

Indicator

Page 16

Line #

44

#193839 v02

Source of

Requirement*

1940

§26(f);

legislative

history

Requirement

The “Reasonableness Standard:” Aggregate fees and

charges under a variable contract must be reasonable in

relation to the services rendered, the expenses expected to

be incurred and the risks assumed by the insurance

company sponsoring the contract.

Services rendered include contract features and

other services. Contract features include all

services the insurance company provides under

the contract such as transfer and withdrawal

services, death benefit options and payout

options. Other services include asset allocation

services, automatic rebalancing, automated

telephone services and accommodation of

qualified plans.

Expenses expected to be incurred generally

include external expenses, internal expenses and

contract benefits. External expenses include

any expenses the insurance company pays to

outside persons such as legal and actuarial

expenses, commissions, marketing expenses and

registration fees. Internal expenses relate to the

expense of internal company functions such as

personnel (for marketing and customer service)

and systems development. Contract benefit

expenses include the payment of benefits under

the contracts such as death benefits, lifetime

annuity or settlement benefits or cash surrender

or withdrawal values.

Risks assumed generally include mortality

risks, expense risks and other risks. Mortality

risks are the risk the insurance company

assumes from the projected lives of contract

owners, which can affect the timing of death

benefits and/or lifetime payouts. Insurance

companies are also subject to the risk that

assumptions make I the pricing of contracts will

prove inaccurate. Expense risks refer to the

discrepancies in projected and actual expenses

expected to be incurred in connection with the

contracts. Other risks assumed by the insurance

company might include risks associated with

mistakes, product failures or innovation.

Area of

Responsibility

Dept/Position

Responsible

Policy &

Procedure

Audit &

Oversight

Compliance &

Gen. Counsel

Frequency

Effectiveness

Indicator

Page 17

Line #

45

46

#193839 v02

Source of

Requirement*

SEC Report on

ICAA

1940

Rule 6c-8(b)

Requirement

The SEC has stated that it will not adopt rules governing

permissible charges unless it is demonstrated that there

have been abusive pricing practices. For this reason, there

is little guidance as to what constitutes “reasonable”

charges. However, SEC staff recommendations, which

appear in the SEC Report on the ICAA legislation,

suggest the use of a reasonableness test for overall

charges. The Report stated that a reasonableness test

would contemplate a facts and circumstances analysis.

The Report identified several relevant facts and

circumstances:

Profit. The SEC Report acknowledges that a

reasonable profit is allowable. The proposed

reasonableness test should approximate the

standard for regulating mutual fund sales

charges in §22(b) of the 1940 Act which allows

for “reasonable compensation” for sales

personnel, broker-dealers and underwriters, and

for “reasonable sales loads” to investors.

Industry Practice. The SEC Report also

expresses the Staff’s view that whether the

aggregate charges and fees are “within the range

of industry practice” would be a factor

supporting reasonableness.

Innovation. The SEC Report states that a

reasonableness test would give the insurance

industry the business flexibility to develop and

market variable contracts effectively.

In spite of the reasonableness standard, it appears that

surrender or withdrawal charges under variable annuities

continue to be subject to an overall limit of 9% of

purchase payments.

Area of

Responsibility

Dept/Position

Responsible

Policy &

Procedure

Audit &

Oversight

Compliance &

Gen. Counsel

Frequency

Effectiveness

Indicator

Page 18

Line #

47

Source of

Requirement*

1940

§26(f)

48

1933

§11

49

SEC Staff

Position

50

NASD

Rule 2310

#193839 v02

Requirement

The Reasonableness Representation. The insurance

company sponsoring the contract must expressly represent

in the contract’s registration statement that the fees and

charges deducted under the contract meet the

“Reasonableness Standard.” This reasonableness

representation must be made in all registration statements

and post-effective amendments. Since this representation

is consistently “renewed,” the insurance company has a

continuing obligation to maintain reasonable fees and

charges, even in connection with contracts that are no

longer being offered.

Directors’ Responsibility and Due Diligence. Directors

of a company issuing securities may be held personally

liable for material misstatements or omissions in a

registration statement. The insurance company

sponsoring variable contracts should document in writing

the basis for its reasonableness representation and

periodically update that written document, as necessary.

Certain members of the SEC staff have expressed the

view that underlying fund fees and expenses should be

taken into account when determining whether aggregate

contract charges are reasonable. The SEC staff also has

expressed the view that expenses of affiliated underlying

funds may be subject to greater scrutiny because of the

opportunity they provide for ‘double dipping” by the

insurance company.

SALES AND REDEMPTIONS – SUITABLE SALES

NASD Rule 2310 requires that member companies and

their registered representatives, prior to the execution of a

recommended transaction, make reasonable efforts to

obtain information concerning a customer’s financial and

tax status, investment objectives, and such other

information used or considered to be reasonable in

making recommendations to the customer.

Area of

Responsibility

Dept/Position

Responsible

Policy &

Procedure

Audit &

Oversight

Compliance &

Gen. Counsel

Frequency

Effectiveness

Indicator

Page 19

Line #

51

52

Source of

Requirement*

NASD

Rule 3010

NASD

NTM 99-35

Requirement

NASD Rule 3010 requires member companies, to adopt

and implement a supervisory system that is tailored

specifically to a member’s business. Supervisory systems

must address the activities of all of the member’s

registered representatives and associated persons and may

include components such as automated exception reports

and surveillance programs that monitor unusual activity.

Members must adopt written supervisory procedures that

document the supervisory system and that are reasonably

designed to achieve compliance with all applicable

securities laws and regulations and NASD rules.

NASD Regulation has developed the guidelines that

represent a compilation of industry practices in the

supervision of the sale of variable annuities. The

guidelines do not mandate any specific procedure. Rather,

they are designed to assist members in developing

appropriate procedures relating to variable annuity sales

practices.

These guidelines relate to:

Customer Information: When recommending a variable

annuity, the registered representative should make

reasonable efforts to obtain comprehensive customer

information, discuss all relevant facts with the customer,

and seek to ensure the application is complete and

accurate. The registered representative and registered

principal should review the customer’s investment

objectives, risk tolerance and other information to

determine the suitability of the sale.

Product Information: The registered representative

should have a thorough knowledge of the product

specifications, give a current contract prospectus to the

customer and use only approved sales material.

Liquidity And Earnings Accrual: The registered

representative should recommend a variable annuity only

if the customer has a long-term investment objective and

screen a customer whose age may make a long-term

investment inappropriate. The registered principal should

carefully review any variable annuity investment that

exceeds a stated percentage of the customer’s net worth.

#193839 v02

Area of

Responsibility

Dept/Position

Responsible

Policy &

Procedure

Audit &

Oversight

Compliance &

Gen. Counsel

Frequency

Effectiveness

Indicator

Page 20

Line #

Source of

Requirement*

Requirement

Investment In Tax Qualified Accounts: The registered

representative should disclose that the tax deferral

provided by the annuity is unnecessary in a tax-qualified

account. The suitability analysis must take into account a

variable annuity’s surrender charges when the taxqualified account is subject to minimum distribution

requirements.

53

NASD

NTM 00-44

Variable Annuity Replacements: An exchange or

replacement analysis document should be completed for

all variable annuity replacements and should include an

explanation of the benefits of replacing one contract for

another. The registered representative and registered

principal should determine that replacing the existing

contract is suitable for the customer. Compliance systems

should monitor and identify those registered

representatives whose clients have a particularly high rate

of variable annuity replacements.

NASD Regulation has developed guidelines that represent

a collection of industry practices regarding the supervision

of the sale of variable life insurance. Although these are

only guidelines, members are encouraged to refer to them

in developing their own policies and procedures relating

to variable life insurance sales practices.

These guidelines relate to:

Customer Information: When recommending a variable

life insurance policy, registered representatives should

make reasonable efforts to obtain comprehensive

customer information. A registered principal should

review and verify that the recommendation of both the

policy and the subaccount allocation is consistent with the

customer’s investment objectives and risk tolerance.

Review Of Customer Information: The member

company should consider whether the customer desires

and needs life insurance and whether the customer can

afford the premiums likely needed to keep the policy in

force.

Product Information: The registered representatives

#193839 v02

Area of

Responsibility

Dept/Position

Responsible

Policy &

Procedure

Audit &

Oversight

Compliance &

Gen. Counsel

Frequency

Effectiveness

Indicator

Page 21

Line #

Source of

Requirement*

Requirement

should be thoroughly familiar with the features and costs

associated with each recommended variable life insurance

policy and give a current policy prospectus to the

customer. A member company may wish to provide

customers with member-approved product information

brochures, in addition to any required disclosure

documents, that explain the features and principal risks

associated with variable life insurance.

Variable Life Insurance Replacements: A member

company should adopt procedures for the review of

replacement recommendations to ensure that they are

suitable. An exchange or replacement analysis document

should be completed for each replacement. In addition,

each replacement question on the application should be

answered. A member company should provide registered

representatives and registered principals with appropriate

procedures on replacements. The member company may

create a compliance system that tracks replacement

activity by each registered representative and flags

unacknowledged replacement activity.

Life Insurance Financing: A member company should

not recommend that a customer finance a variable life

insurance policy from the value of another life insurance

policy or annuity, such as through the use of loans or cash

values, unless the transaction is otherwise suitable for the

customer. When financing is recommended, a registered

representative should disclose to the policy owner the

potential consequences to both the existing and new

policy.

Advertising And Sales Literature: A member company

must have supervisory procedures in place to ensure

compliance with the rule’s filing requirements. A member

company also must ensure that all advertisements and

sales literature regarding variable life insurance are

approved in writing by a registered principal and prior to

use with the public.

Supervisory Systems And Procedures: A member

company may wish to design its own supervisory system

to monitor variable life insurance sales activities based

#193839 v02

Area of

Responsibility

Dept/Position

Responsible

Policy &

Procedure

Audit &

Oversight

Compliance &

Gen. Counsel

Frequency

Effectiveness

Indicator

Page 22

Line #

Source of

Requirement*

Requirement

upon the its organization and structure.

#193839 v02

Area of

Responsibility

Dept/Position

Responsible

Policy &

Procedure

Audit &

Oversight

Compliance &

Gen. Counsel

Frequency

Effectiveness

Indicator

Page 23

Line #

Source of

Requirement*

NASD

Proposed Rule

Requirement

The NASD has proposed for comment specific

requirements for deferred variable annuity sales. In

general, the new rule would codify and make mandatory

best-practice guidelines that NASD had previously issued.

The key requirements of the rule proposal include:

Suitability: In recommending a deferred variable annuity

transaction, a registered representative would be required

to determine that:

The customer has been informed of the unique

features of the variable annuity;

The customer has a long-term investment

objective, and

The deferred variable annuity as a whole, and its

underlying subaccounts, are suitable for the

customer, particularly with regard to risk and

liquidity.

The registered representative would be required to

document these determinations.

Disclosure and Prospectus Delivery: The firm or its

representative would be required to provide the customer

with a current prospectus and a separate, brief, “plain

English” risk disclosure document highlighting the main

features of the particular variable annuity transaction.

Principal Review: Before a registered representative

could effect any transaction in a deferred variable annuity,

a registered principal would be required to review and

approve the transaction.

Supervisory Procedures: The rule proposal would

require registered firms to establish and maintain specific,

written supervisory procedures reasonably designed to

achieve compliance with the rule’s standards.

Training: Registered firms would be required to develop

and document specific training policies or programs

designed to ensure that registered representatives and

registered principals comply with the rule’s requirements

and that they understand the unique features of deferred

variable annuities.

#193839 v02

Area of

Responsibility

Dept/Position

Responsible

Policy &

Procedure

Audit &

Oversight

Compliance &

Gen. Counsel

Frequency

Effectiveness

Indicator

Page 24

Line #

54

Source of

Requirement*

1933

Rule 482

4/88 letter

from the SEC

to the ICI

55

1933

Rule 135A

56

1940

Rule 34b-1

Requirement

SALES AND REDEMPTIONS – ADVERTISING

An advertisement under Rule 482 (an omitting

prospectus or a performance ad) is no longer limited to

information the substance of which is found in the

prospectus. The ad must advise an investor to consider the

investment objectives, risks, and charges and expenses of

the investment company carefully before investing;

explain that the prospectus contains this and other

information about the investment company; identify a

source from which an investor may obtain a prospectus;

state that the prospectus should be read carefully before

investing. If performance is included, it must include 1, 5

and 10-year average annual total returns. The ad must

include a legend that past performance is no guarantee of

future results; investment return and principal value will

fluctuate so that shares, when redeemed, may be worth

more or less than their original cost; that current

performance may be lower or higher than the performance

data quoted. The legend must also identify either a tollfree telephone number or a website where an investor may

obtain performance data current to the most recent monthend. The maximum sales charge must be disclosed.

Legends must be in a type size at least as large as and in a

different style from the major portion of the ad.

Rule 482 applies to automated phone systems.

Generic advertising is not considered an offer for sale.

Generic ads cannot mention an investment company by

name.

Sales literature. Sales literature must be accompanied or

preceded by a prospectus. Sales literature can include any

information that is not misleading. If performance is

included, it must include 1,5 and 10 year average annual

total return as well as the disclosures required under Rule

482.

Rule 34b-1 does not apply to performance included in

annual or semiannual reports to shareholders, provided

that the performance information covers only the period

of the report.

#193839 v02

Area of

Responsibility

Dept/Position

Responsible

Policy &

Procedure

Audit &

Oversight

Compliance &

Gen. Counsel

Frequency

Effectiveness

Indicator

Page 25

Line #

57

58

Source of

Requirement*

10/93 letter

from the SEC

to the NASD

1940

Rule 31a-1

59

NASD

Rule 2210

60

1933

§5(b)(2);

#193839 v02

Requirement

Testimonials in fund advertisements raise serious antifraud concerns.

The following books and records must be maintained:

Advertisements, pamphlets, form letters or other

sales literature addressed to or intended for

prospective investors (6 years, 2 eap)

Under NASD Rule 2210, a member company must file

with NASD Regulation’s Advertising/Investment

Companies Regulation Department all variable life

insurance advertisements and sales literature within 10

days of first use or publication. Members are also required

to file the format for hypothetical illustrations used in the

promotion of variable life insurance policies, since these

formats qualify as sales literature. Members must have

supervisory procedures in place to ensure compliance with

the rule’s filing requirements. Members also must ensure

that all advertisements and sales literature regarding

variable life insurance are approved in writing by a

registered principal and prior to use with the public.

SALES AND REDEMPTIONS – PROSPECTUS DELIVERY;

CONFIRMATIONS

Prospectus delivery. A current prospectus must

accompany or precede any purchase of securities. This

includes the prospectus for the variable contract and the

prospectuses for the underlying funds in which the

separate account invests. The statement of additional

information must be available upon request.

Area of

Responsibility

Dept/Position

Responsible

Policy &

Procedure

Audit &

Oversight

Compliance &

Gen. Counsel

Frequency

Effectiveness

Indicator

Page 26

Line #

61

Source of

Requirement*

1934

Rule 10b-10

62

NASD

Rule 2830 (l)

63

OCC

Interagency

Statement

64

1934

§11(d)

#193839 v02

Requirement

A confirmation must be sent to the client at or before the

completion of the transaction. The confirm must include

date and time, identity, price and number of units or

principal amount, whether the broker-dealer is acting as

agent or principal; if as agent, the amount of

compensation received in connection with the transaction;

and the source and amount of any other compensation

Confirmations may be sent quarterly, instead of

immediately, for systematic purchases or redemptions if

sent within 5 days after the end of each quarterly period.

Quarterly confirms must include purchases, redemptions

and distributions; transactions in the account; total

number of units at the end of the period; compensation to

the broker-dealer.

SALES AND REDEMPTIONS – DISTRIBUTOR

Cash/non-cash compensation. Special compensation

arrangements must be disclosed in the prospectus (if not

uniformly paid to all broker-dealers). Special short-term

compensation arrangements to all broker-dealers must be

described generically in the prospectus or a prospectus

supplement.

An investment company sold by a depository institution

must include disclosure that the investment company is

not a bank deposit, is not insured by the FDIC, is not

endorsed by any bank, is not guaranteed

Broker-dealers may not extend credit (margin) to finance

the purchase of investment company shares if the brokerdealer is the fund’s distributor or has a dealer agreement

to sell investment company shares

SALES AND REDEMPTIONS - MARKET TIMING

Area of

Responsibility

Dept/Position

Responsible

Policy &

Procedure

Audit &

Oversight

Compliance &

Gen. Counsel

Frequency

Effectiveness

Indicator

Page 27

Line #

65

Source of

Requirement*

1933, 1940

Forms N-4 and

N-6

Requirement

The SEC has adopted final amendments to Forms N-4 and

N-6 under the 1933 Act and 1940 Act to require separate

accounts and underlying funds to disclose in their

prospectuses information about the risks of, and policies

and procedures with respect to, the frequent purchase and

redemption of separate account units and fund shares.

The implementation date for the new rule is December 5,

2004. Any new product or post-effective amendment

filed after the implementation date must comply with the

new rule

66

1940

§11

67

1940

Rule 11a-2

#193839 v02

Prospectuses are required to include disclosure on the

following:

The risks that frequent transfers may present for

investors;

Whether or not policies and procedures have

been adopted with respect to frequent transfers;

If such policies and procedures have not been

adopted, a statement of the “specific basis” why

not;

A description with “specificity” of policies and

procedures for deterring frequent transfers; and

A description of any special arrangement for

permitting certain parties to engage in frequent

transfers (specifics of such arrangements will

go in the statement of additional information).

SALES AND REDEMPTIONS – TRANSFERS AND EXCHANGE

OFFERS

Transfers among the investment options underlying a

variable contract and offers to exchange one variable for

another are both regulated by §11 of the 1940 Act.

Transfers: Contract owners generally are permitted to

transfer cash values among the investment options

underlying their contracts.

Area of

Responsibility

Dept/Position

Responsible

Policy &

Procedure

Audit &

Oversight

Compliance &

Gen. Counsel

Frequency

Effectiveness

Indicator

Page 28

Line #

68

69

#193839 v02

Source of

Requirement*

1940

§11;

NAL

Alexander

Hamilton

Funds (pub.

avail.

7/20/1994)

1940

§11(c)

EO

SEC REL. IC25460

(3/12/2002)

Requirement

Exchange offers: §11 applies only to exchange offers of

variable contracts issued by the same insurer or affiliated

insurers. It does not cover exchange offers involving

variable contracts issued by unaffiliated insurance

companies, except in certain circumstances, such as where

unaffiliated insurance companies have agreed, formally or

informally, to offer a waiver of sales load or some other

incentive for and exchange from one to the other. §11

does not cover exchanges of fixed contracts for variable

contracts, or variable contracts for fixed contracts. §11

generally requires that those transactions coming within

its scope be effected based on relative net asset values.

In the case of separate accounts registered as unit

investment trusts, it prohibits any such transactions (even

at net asset value) unless prior approval has been obtained

from the SEC. ABC Life has received exemptive relief

permitting it to make an offer of exchange of certain older

variable annuity contracts for the Best Ever Variable

Annuity.

Area of

Responsibility

Dept/Position

Responsible

Policy &

Procedure

Audit &

Oversight

Compliance &

Gen. Counsel

Frequency

Effectiveness

Indicator

Page 29

Line #

70

Source of

Requirement*

1940

Rule 11a-2

71

1940

§11;

SEC Letter to

NAVA, IMSA

and ACLI

(6/19/2001)

72

NASD

NTM 99-35

#193839 v02

Requirement

The SEC permits certain transfers and exchange offers of

variable contracts issued by the same or affiliated

insurance companies that otherwise would be prohibited.

Specifically, transfers are permitted if they are at relative

net asset values and the only charge deducted at the time

of the transfer is an administrative charge to cover the

associated processing costs. Rule 11a-2 does not permit

sales charges to be deducted in connection with exchange

offers of one variable life insurance contract for another.

Permitted exchange offers of variable annuity contracts

under the Rule, however, must satisfy certain conditions

related to the sales loads imposed on the exchanged and

acquired contracts. For example, no deferred sales load

may be deducted from the exchanged contract at the time

of the exchange, and any deferred sales load applicable to

amounts applied from the exchanged to the acquired

variable annuity contract must be calculated based on the

issue date and relevant purchase payment dates of the

exchanged variable annuity contract so that the contract

owner is given credit for the time amounts were invested

in the exchanges variable annuity contract. Moreover, the

acquired variable annuity contract nay not assess a sales

load on any app0reication attributable to the purchase

payments made under the exchanged variable annuity

contract, and no sales load may exceed 9% of the sum of

the purchase payments made for the acquired and

exchanged contracts.

The Retail Exception. §11 does not cover “retail”

transactions that simply result from a recommendation by

a registered representative at point of sale or the contract

owner’s request to exchange one specific variable contract

for another. The SEC staff issued a letter setting forth a

number of factors it believes are relevant to determining

whether the retail exception is available, including facts

relating to communications to existing contract owners

and brokers about new contracts, the insurance company’s

intent to promote exchanges, and the compensation paid

to brokers.

Procedures must be in place to monitor for excessive

switching between variable contracts.

SALES AND REDEMPTIONS – REDEEMABILITY

(SURRENDERS AND WITHDRAWALS)

Area of

Responsibility

Dept/Position

Responsible

Policy &

Procedure

Audit &

Oversight

Compliance &

Gen. Counsel

Frequency

Effectiveness

Indicator

Page 30

Line #

73

74

Source of

Requirement*

1940

§22(e)

1940

§22(e);

SEC Staff

Position

EOs

SEC REL.

Nos. IC 24257

(1/19/2000);

IC - 26354

(2/20/2004)

1940

Rule 6c-7

NAL

#193839 v02

Requirement

Because a variable contract is a redeemable security under

the 1940 Act, any payment by the insurance company is

considered a redemption under the 1940 Act. These

payments include surrenders, withdrawals, loans, annuity

payouts and death benefits. The insurance company

cannot suspend the right of redemption and must pay

redemption proceeds within seven days. This seven day

period includes weekends and holidays, but does not

include other periods during which the New York Stock

Exchange is closed or trading on the New York Stock

Exchange is restricted, any period during which an

emergency exists as defined by SEC rules, ad any other

periods as the SEC by order may permit.

Redeemability requirements for variable annuities:

During the accumulation phase of a variable annuity

contract, a redemption request must be honored, and

generally must be processed on a daily basis at the net

asset value next computed after receipt of the order. The

SEC staff interprets this to mean that the contract can be

surrendered at any time, and that partial withdrawals also

can be taken at any time without any restrictions except

for reasonable minimum amount requirements. The SEC

permits CDSCs and certain administrative charges to be

assessed in connection with surrenders and partial

withdrawals.

Insurance companies must obtain exemptive relief to

deduct any other charges on surrenders and partial

withdrawals, such as insurance charges or any bonus

credit recapture. ABC Life has received exemptive relief

from the SEC allowing it to recapture bonus credits under

certain variable annuity products under the following

conditions: (i) any credits applied if the owner returns the

contract for a refund during the free look period; (ii)

credits applied within twelve months preceding the date of

death that results in a lump sum death benefit; (iii) credits

applied within twelve months preceding a request for a

surrender due to the following contingent event where no

CDSC is incurred: owner or annuitant’s confinement to a

nursing home, terminal illness, disability or

unemployment; and (iv) credits applied within twelve

months preceding the owner’s settlement of the Amended

Contract under an annuity payout plan.

Area of

Responsibility

Dept/Position

Responsible

Policy &

Procedure

Audit &

Oversight

Compliance &

Gen. Counsel

Frequency

Effectiveness

Indicator

Page 31

Line #

Source of

Requirement*

ACLI (pub.

avail.

11/28/1988)

1940

Rules 22e-1;

27c-1; SEC

Staff Position

Requirement

Exceptions:

A variable annuity contract can restrict or prohibit

redemptions as necessary to comply with the Texas

Optional Retirement Program as long as disclosure

regarding the restrictions is made in the registration

statement.

A variable annuity contract issued in connection with an

IRC §403(b) plan may restrict redemptions.

75

SEC Staff

Position; 1992

Industry

Comment

Letter; NAL

Mass. Mut.

(pub. avail.

6/16/1986)

76

1940

Rules 6e2(b)(12) and

6e-3(T)(b)(12)

#193839 v02

During the payout phase of a variable annuity contract,

redemptions may be suspended, but only with respect to

variable annuity contracts under which payments are

being made based on life contingencies. For variable

annuity contracts making payouts that are not based on

any life contingency (i.e. for a period certain like Plan E),

the SEC staff has taken the position that contract owners

must be able to redeem without restriction (other than

reasonable minimum amount requirements).

Death benefit payments under variable annuities:

There is no exception to the redeemability rules for death

benefit payments under variable annuity contracts. The

SEC staff has taken the position that a contract’s cash

value must remain invested in the separate account until

the death benefit is determined (as provided for in the

contract) and be paid to the beneficiary within seven days.

In the case of multiple beneficiaries, the contract’s cash

value must remain invested in the separate account and

paid out to each beneficiary individually as payout

instructions are received.

Redeemability requirements for variable life insurance

policies: Rules 6e-2 and 6e-3(T) of the 1940 Act provide

exemptions from the redeemability provisions to the

extent necessary to comply with established

administrative procedures of the life insurance company

for redemption of the contracts, subject to a “reasonable,

fair and no discriminatory” standard. Among other

things, this allows the insurance company to process load

applications and death benefit claims for variable life

insurance policies in the same time frames that they use

Area of

Responsibility

Dept/Position

Responsible

Policy &

Procedure

Audit &

Oversight

Compliance &

Gen. Counsel

Frequency

Effectiveness

Indicator

Page 32

Line #

Source of

Requirement*

77

NAL

78

NAL

79

1940

§7(a)

1940

§8(a)

1940

§8(b);

1933

§5

80

81

82

1940

§14(a)(1);

Rule 14a-2

83

1933

Rule 430

#193839 v02

Requirement

for traditional life insurance policies. This, for example,

permits death benefits to be computed as of the dated of

the insured’s death (i.e. before proof of death is received)

and the cash value to be moved to the insurance

company’s general account until the benefits are paid.

Automatic redemption of small accounts is permitted if

the terms are disclosed in the prospectus, shareholders

receive adequate notice, the minimum amount is

reasonable.

Telephone redemptions must be discussed in the

prospectus or SAI, including whether the privilege is

available automatically, and that the fund will use

reasonable procedures to confirm that instructions are

authentic.

REGISTRATION AND REPORTS - FORMATION

An investment company may not offer or sell securities

unless it has been registered.

An investment company must register the company with

the SEC by filing a notice on Form N-8A.

An investment company must register its securities with

the SEC by means of a registration statement that meets

the requirements of Form N-4 (variable annuities), N-6

(variable life insurance), S-1 / S-2 (market value adjusted

annuities or accounts).

Generally, an investment company must have a net worth

of at least $100,000 before offering shares to the public.

However, Rule 14a-2 provides an exemption from the

$100,000 initial net worth requirement in §14(a), provided

the sponsoring insurance company has: (i) a combined

capital and surplus, if a stock company, or (ii) an

unassigned surplus, if a mutual company, of not less than

$1,000,000 as set forth in the balance sheet of such

insurance company. This exemption also applies to an

underlying fund that has a qualifying insurance company

as its promoter.

Information may be provided to prospective investors

during the waiting period before an investment company

goes effective if the preliminary prospectus includes red

herring language. The SEC staff takes the position that

discussions about a new product in speeches, interviews

or press conferences that are then reprinted, excerpted or

used in articles or broadcasts before the effective date of a

Area of

Responsibility

Dept/Position

Responsible

Policy &

Procedure

Audit &

Oversight

Compliance &

Gen. Counsel

Frequency

Effectiveness

Indicator

Page 33

Line #

Source of

Requirement*

84

1933

§11;

§12(a)(2)

85

1933

§17(a);

1934

Rule 10b-5

86

1933

§11

#193839 v02

Requirement

registration statement may be “gun jumping”. The staff

may decline to declare the investment company effective

and impose a “cooling off” period and require

recirculation of any preliminary prospectus.

REGISTRATION AND REPORTS - REGISTRATION

The 1933 Act imposes liability with respect to any

material misstatement or omission. These liability

provisions have the effect of requiring a registration

statement or prospectus to contain whatever information

may be necessary or appropriate to avoid liability for a

material misstatement or omission. This obligation

applies for so long as the registration statement and

prospectus is being used, ad therefore means that the

insurance company must amend or supplement (sticker)

its disclosure materials whenever necessary to ensure that

they remain accurate and complete in all material respects.

Insurance companies are strictly liable for material

misstatements or omissions and available remedies

include rescission of the transaction.

The anti-fraud provisions of the 1933 Act and the 1934

Act also have the effect of requiring a prospectus to

contain whatever information may be necessary or

appropriate to avoid liability for a material misstatement

or omission. Damages for violations of these provisions

can include rescission as well as other possible measures

of losses.

An insurance company’s directors can avoid liability

under §11 of the 1933 Act only if they can show they

conducted appropriate "due diligence" to determine that

the registration statement contained no material

misstatement or omission. The level of diligence required

to meet the "due diligence" standard as to any statement

depends on a number of factors. The due diligence

performed by an insurance company's board of directors

should focus on the separate account, its operations, and

the terms of the variable contract. The principal purpose

of the due diligence is to ensure that the registration

statement adequately describes the contract and how the

contract will be administered. Because of the technical

nature of variable contracts, it has been posited that

directors and officers should be able to rely heavily on

representations as to the accuracy and completeness of the

Area of

Responsibility

Dept/Position

Responsible

Policy &

Procedure