Steps for Intermediate Workshop Return 24

advertisement

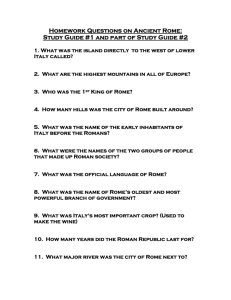

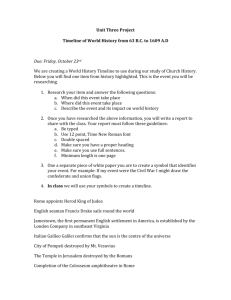

Intermediate Workshop Return 24 Title: Summary: Intermediate Workshop Return 24 In this lesson, you will learn the following: 1) Determine filing status; 2) Enter W-2 information; 3) Complete Form 2441, Credit for Child Care and Dependent Care Expenses; 4) Complete IRA worksheet; 5) Complete Form 8880, Credit for Qualified Retirement Savings Contributions; 6) Create the e-file. Average completion time: 35 minutes Steps for Intermediate Workshop Return 24 Log in to your user name. Use “TRAINING” if you plan to practice electronically filing these returns through the TaxWise Training Electronic Filing Center. Start a new return using 224-XX-XXXX. Use your company’s EFIN for “XX-XXXX” if you are in the Training user name. Otherwise, use a unique number agreed upon by your company. Charles Martin (birth date October 5, 1960) lives at 1320 Marion Parkway, Rome, GA 30165. Charles is an investigator for Rome Alarm Company. Charles’s wife, Mary, died July 16, 1999. He totally supports their son, Caleb (birth date August 4, 1996). On October 23 of last year, he deposited $1,800 in his IRA at Rome Bank and Trust. He made no nondeductible contributions to his IRA in previous years, and does not wish to withdraw any funds at this time. Charles pays Tiny Tots Day Care Center (EIN 12-8XXXXXX) to care for Caleb after school and during the summer. Charles paid $2,725 to the day care center located at 55 Main Street, Rome, GA 30165. He would like to electronically file this return and receive a paper check. Social Security Card Social Security Card CHARLES LEE MARTIN CALEB SAMUEL MARTIN 224-XX-XXXX 483-XX-XXXX 1 Intermediate Workshop Return 24 A Control number OMB No. 1545-0008 B Employer Identification Number 12-9XXXXXX C Employer’s name, address, and ZIP code Rome Alarm Company 8 West Lane Rome, GA 30165 D Employee’s social security number 224-XX-XXXX E Employee’s name, address, and ZIP code 1 Wages, tips, other compensation $ 29,880.00 3 Social security wages $ 29,880.00 5 Medicare wages and tips $ 29,880.00 7 Social security tips $ 9 Advance EIC payment $ 11 Nonqualified plans $ Charles L. Martin 1320 Marion Parkway Rome, GA 30165 13 15 State Employers State ID no. 16 State wages, tips, etc. GA 12-9XXXXXX $ 29,880.00 Form W-2 Wage and Tax Statement Statutory Employee 17 State income tax Pension Plan 2 Federal income tax withheld $ 2,753.00 4 Social security tax withheld $ 1,852.56 6 Medicare tax withheld $ 433.26 8 Allocated tips $ 10 Dependent care benefits $ 12a See instructions for box 12 Code $ 12b Code $ 12c Code $ 12d Code $ Third-party 14 Other Sick pay 18 Locality name 19 Local 20 Local Income wages, tips, tax etc. $ 1,471.26 $ $ Department of the Treasury – Internal Revenue Service Center 2