Homework 3

advertisement

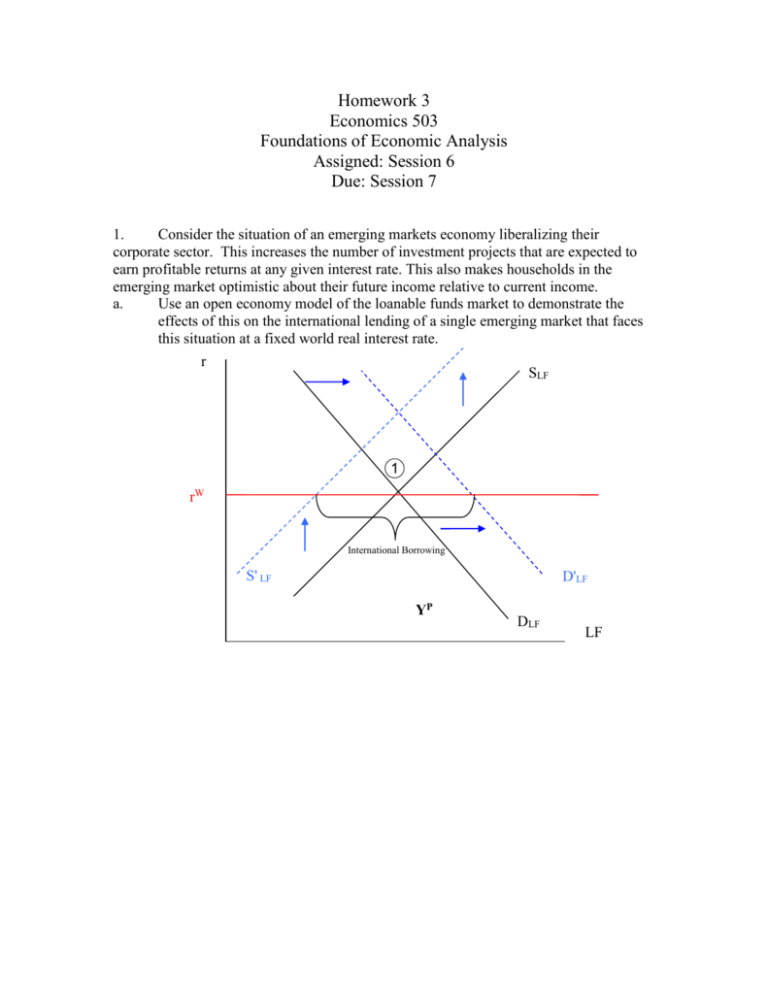

Homework 3 Economics 503 Foundations of Economic Analysis Assigned: Session 6 Due: Session 7 1. Consider the situation of an emerging markets economy liberalizing their corporate sector. This increases the number of investment projects that are expected to earn profitable returns at any given interest rate. This also makes households in the emerging market optimistic about their future income relative to current income. a. Use an open economy model of the loanable funds market to demonstrate the effects of this on the international lending of a single emerging market that faces this situation at a fixed world real interest rate. r SLF 1 rW International Borrowing S' LF D'LF YP DLF LF b. Assume this is a world wide trend, so that it happens simultaneously around the world. Draw a graph of the global loanable funds market to demonstrate the impact on equilibrium world real interest rates. r SLFW 2 rWW 1 rW S' LFW D'LFW YP c. DLFW LFW Draw a graph of a single developed economy that does not experience any improvement in future income or profitability of investment projects. Use an open economy loanable funds model of this situation to demonstrate the impact of the change in world interest rates from 1.b. on international lending in the developed economy. r SLF International Lending rWW 1 rW YP 2. DLFW LFW Construct an AS-AD model of the economy. Begin by assuming the economy is in a long-run level of equilibrium with the aggregate supply curve crossing the aggregate demand curve at the level of potential output. For simplicity, also assume potential output is constant. Use the model to describe how each of the events will change the macroeconomic equilibrium in the short-run. Suppose that policymakers allow the self correction mechanism to bring GDP back to the long-run equilibrium. Use the model to describe how each of the events will change the economy in the long-run. Illustrate with diagrams. a. An increase in the level of GDP of a leading trading partner. P SRAS lt st SRAS' o AD' YP b. AD Y The household and corporate sector becomes pessimistic about the future. P YP SRAS AD' SRAS' o st lt AD Y 3. In December 2010, The People’s Bank of China increased their reserve requirement. Assume this increases the demand for reserves. a. Draw a graph of the interbank market when a central bank increases the reserve requirement while maintaining a fixed supply of reserves. Demonstrate the impact of this increase in reserve requirements on interbank interest rates. The increase in the reserve ratio will increase the demand for reserves at any level of deposits. The equilibrium interest rate will rise. iIBOR DBR SBR DBR' 2 i** i* 1 Reserves b. If the central bank wants to prevent the change in reserve requirements from impacting the interest rate, they must engage in open market operations. In another graph, demonstrate the type of open market operation they must engage in to keep an increase in reserve requirements from impacting the interest rate. iIBOR DBR SBR DBR' SBR' Open Market Purchase to increase supply of reserves to meet demand 3 i* 1 Reserves