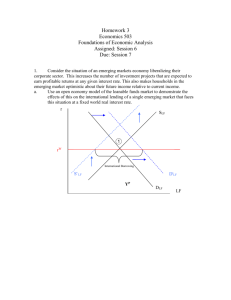

equilibrium bonds

advertisement

AP Economics: Monetary Policy Review FRQs May 6, 2015 Monetary Policy FRQs 1) The United States is experiencing a high rate of unemployment. a) Identify one fiscal policy action that Congress might initiate to decrease the unemployment rate. Decrease taxes or increase transfer payments or increase spending b) Assume that the policy you identified in part a) reduced unemployment, but the economy is still operating below full employment. Using a correctly labeled aggregate demand – aggregate supply graph, show and explain how the action you identified would affect each of the following: i) output ii) price level Correct labels; downward sloping AD; upward sloping SRAS; vertical LRAS to the right of short-run equilibrium; fiscal action shifted AD to the right, increasing equilibrium output (reducing unemployment) and increasing equilibrium price level; new equilibrium still to the left of LRAS curve. c) Explain how the policy you identified in part a) would affect short-term interest rates. Decreased taxes or Increased spending both increase budget deficit, increases demand for loanable funds, increases real interest rates. Or All three fiscal policies increase output, increasing demand for money (DM), increasing nominal interest rates. d) Given that the economy is still below full employment, identify the open market policy the Federal Reserve could implement to increase the money supply. Buying securities e) Using correctly labeled graphs, show and explain how the increase in money supply will affect each of the following in the short-run: i) short-term interest rates ii) output iii) price level i)Correct labels, money market graph with downward sloping DM and vertical MS; MS shift to right; decreases nominal interest rates ii) and iii) Correct labels, AD/AS graph with downward sloping AD and upward sloping SRAS and vertical LRAS curves; LRAS curve to the right of short-run equilibrium; AD to shift to the right (increase); causes increase both output an price levels. Explanation: Decrease in interest rates causes increase in I (or C), causing increase in AD 2) The Federal Reserve buys $5,000 in bonds from Clark Consulting Services, which then deposits the money in a checking account at First Generation Bank. a) As a result of the Federal Reserve’s action, what is the change in the money supply if the required reserve ratio is 100%. $5,000 b) If the required reserve ratio is reduced to 10%, calculate the following: i) the maximum amount this bank could lend from this deposit $4,500 (1-.10) * $5,000 ii) the maximum increase in the total money supply from the Federal Reserve’s purchase of bonds $50,000 (1/.10) * $5,000 c) If banks keep some of the deposit as excess reserves, how will this influence the change in the money supply that was determined in part b) ii) ? Explain. It will reduce the total change in MS. If banks do not use all of their reserves to create new loans, it will reduce the maximum multipier. d) If the public decides to hold some money in the form of currency rather than in demand deposits, how will this influence the change in the money supply that was determined in part b) ii) ? Explain. It will reduce the total change in MS. The money held as currency is not a bank reserve so cannot be loaned out and create new MS. 3) A stranger arrives from outside a given economic system with $1,000 of acceptable currency that has never been in the system before. The nation’s banking system is governed by a central bank that has set a reserve requirement of 10 percent. a) Assume the stranger deposits the $1,000 in a local bank. Explain the impact of this deposit on each of the following: i) the change in the dollar value of the local bank’s reserves Increase by $1,000 ii) the maximum possible change in the dollar value of the local bank’s loans Increase by $900 (1 - .10) * $1,000 iii) the maximum possible change in the dollar value of the total money supply $10,000 (1/.10) * $1,000 b) State two factors in the real world that might cause this change in the money supply to be less than the maximum possible change. Bank may not loan out all of its excess reserves or borrowers may not redeposit all of their loans in the banking system or loan demand may be less than bank excess reserves 4) A drop in credit card fees causes people to use credit cards more often for transactions and demand less money. a) Using a correctly labeled graph of the money market, show how the nominal interest rate will be affected. Correct labels; downward sloping DM and vertical MS; DM shifts to left; nominal interest rate decreases b) Given the interest rate change in part (a), what will happen to bond prices in the short run? Bond prices rise c) Given the interest rate change in part (a), what will happen to the price level in the short run? Explain. Increases. Decrease in interest rates causes increase in I (or C), causing increase in AD, causing increase in price level d) Identify an open-market operation the Federal Reserve could use to keep the nominal interest rate constant at the level that existed before the drop in credit card fees. Explain. Sell securities. By selling securities to banks, excess reserves are removed, reducing MS, which causes nominal interest rates to increase.