File - AP Economics

advertisement

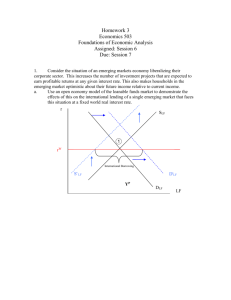

I. Roles of Money A. Medium of exchange – an asset that individuals use to trade for goods and services B. Store of Value - a way of holding purchasing power over time C. Unit of account – measure individuals use to set prices and make economic calculations http://www.brainpop.com/socialstudies/economics/money/ II. Definition of Money A. M1 1. currency 2. checkable deposits 3. traveler’s checks B. M2 1. M1 2. Near Monies – financial assets that are highly liquid but not directly usable a. Savings deposits b. Money market funds c. Small time deposits – CDs C. M3 1. M1 and M2 2. large time deposits VI. Bank T accounts A. Financial spreadsheet that displays an institution’s financial B. Assets 1. economic resources, things of value 2. on the left side of the T-account C. Liabilities 1. debts 2. on the right side of the T-account position Work through this example: Suppose Narvaizville has a single bank that has: • $20,000 of deposits • $4000 of reserves • $16,000 of loans • Narvaizville’s central bank has 10% reserve requirement. Construct a T-account depicting this situation. Make sure you: • differentiate between required and excess reserves • Have assets equal to liabilities. Assets Required Reserves $2,000 Excess Reserves $2,000 Loans $16,000 Liabilities Deposits $20,000 Work through this example: Remember the reserve requirement is 10% What is the multiplier ? 1/rr = 1/.1 = 10 Assets Required Reserves $2,000 Excess Reserves $2,000 Loans $16,000 Liabilities Deposits $20,000 Work through this example: Suppose the bank in Narvaizville lends all its excess reserves (the amount you calculated in the previous problem) until it reaches the point where its excess reserves equal zero. How much additional money will the bank lend out? $2,000 How much money will this additional lending add to the money supply? $2,000 x 10 (multiplier) = $20,000 Work through this example: How much money will this additional lending add to the money supply? $2000 x 10 (multiplier) = $20,000 Assume that all of the money that is created will be deposited in the bank and that the bank will loan out all excess reserves. Create a t-account that shows this. Assets Required Reserves $4,000 Excess Reserves $0 Loans $36,000 Liabilities Deposits $40,000 Monetary Policy Tools 1. Reserve Requirement a. Banks that need reserve can borrow 1. from one another – pay federal funds rate 2. from the FED at the discount window 2. Discount Rate a. Interest rate the Fed charges on loans b. Normally set above federal funds rate to discourage borrowing from the FED 3. Open Market Operations a. Fed buys and sells U.S. Treasury Bills (Bonds) b. Buying increases the money supply c. Selling decreases the money supply https://www.youtube.com/wa tch?v=6OpzAD9Okds FOMC meeting Money Demand Curve 1. horizontal axis – quantity of money 2. vertical axis – NOMINAL (not real) interest rate 3. graphic representation of opportunity cost a. Higher interest rate – less cash demanded b. Lower interest rate – more cash demanded 4. changes in interest rate causes a movement along the curve a. b. c. d. Change in aggregate Price level Changes in Real GDP (spending) Changes in Technology Changes in institutions Money Supply a. Vertical line whose location is controlled by the FED b. Since FED controls Money supply curve they control interest rate Interest Rate and Equilibrium 1. Increase money supply moves curve right. a. Lowers interest rate b. Caused by FED action 1. buy bonds 2. lower reserve requirement 3. lower discount rate Interest Rate MS MS1 MD Quantity of money Interest Rate and Equilibrium 1. decrease money supply moves curve left. a. Raises interest rate b. Caused by FED action 1. sell bonds 2. raise reserve requirements 3. raise discount rate Interest Rate MS 1 MS https://www.youtube.c om/watch?v=_dNIDo8U FSc MD Quantity of money Demand for Money Draw a graph that represents BOTH the demand and supply of money. On the same graph Show what happens when the FOMC engages in an open market purchase of Treasure bills. • What happened to the equilibrium quantity of money? Increase • What happened to the equilibrium interest rate? .Decrease On the same graph Show what happens when the FOMC engages in an open market sale of Treasure Bills. • What happened to the equilibrium quantity of money? Decrease • What happened to the equilibrium interest rate? Increase Loanable Funds Equilibrium 1. interest rate at which quantity of loanable funds supplied equals quantity of loanable funds demanded Loanable Funds Draw a properly labeled loanable funds graph Interest rate Draw a properly labeled loanable funds graph S E D Quantity of loanable funds In each of the situations given: Sketch the change in the graph that will occur What happens to equilibrium interest rate? What happens to equilibrium quantity of loanable funds Interest rate • • • S E D Quantity of loanable funds In each of the situations given: • • • Sketch the change in the graph that will occur What happens to equilibrium interest rate? What happens to equilibrium quantity of loanable funds There is an increase in capital inflows into the country. In each of the situations given: Sketch the change in the graph that will occur What happens to equilibrium interest rate? What happens to equilibrium quantity of loanable funds R Q lf Interest rate • • • S S1 E D Quantity of loanable funds In each of the situations given: • • • Sketch the change in the graph that will occur What happens to equilibrium interest rate? What happens to equilibrium quantity of loanable funds The government reduces the government deficit In each of the situations given: Sketch the change in the graph that will occur What happens to equilibrium interest rate? What happens to equilibrium quantity of loanable funds R Q lf Interest rate • • • S E D2 D Quantity of loanable funds In each of the situations given: • • • Sketch the change in the graph that will occur What happens to equilibrium interest rate? What happens to equilibrium quantity of loanable funds There is an increase in private savings In each of the situations given: Sketch the change in the graph that will occur What happens to equilibrium interest rate? What happens to equilibrium quantity of loanable funds R Q lf Interest rate • • • S E D2 D Quantity of loanable funds