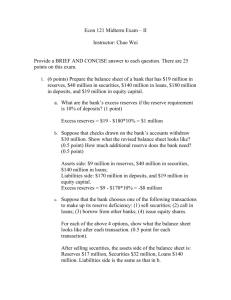

Econ 121 Midterm Exam – II

advertisement

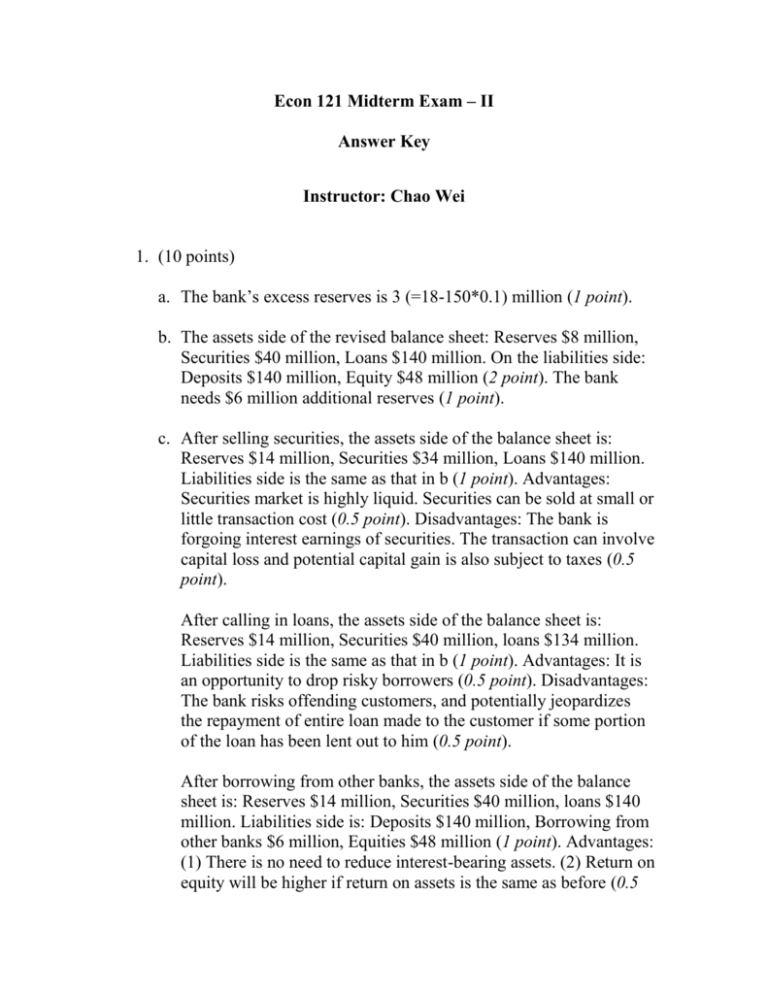

Econ 121 Midterm Exam – II Answer Key Instructor: Chao Wei 1. (10 points) a. The bank’s excess reserves is 3 (=18-150*0.1) million (1 point). b. The assets side of the revised balance sheet: Reserves $8 million, Securities $40 million, Loans $140 million. On the liabilities side: Deposits $140 million, Equity $48 million (2 point). The bank needs $6 million additional reserves (1 point). c. After selling securities, the assets side of the balance sheet is: Reserves $14 million, Securities $34 million, Loans $140 million. Liabilities side is the same as that in b (1 point). Advantages: Securities market is highly liquid. Securities can be sold at small or little transaction cost (0.5 point). Disadvantages: The bank is forgoing interest earnings of securities. The transaction can involve capital loss and potential capital gain is also subject to taxes (0.5 point). After calling in loans, the assets side of the balance sheet is: Reserves $14 million, Securities $40 million, loans $134 million. Liabilities side is the same as that in b (1 point). Advantages: It is an opportunity to drop risky borrowers (0.5 point). Disadvantages: The bank risks offending customers, and potentially jeopardizes the repayment of entire loan made to the customer if some portion of the loan has been lent out to him (0.5 point). After borrowing from other banks, the assets side of the balance sheet is: Reserves $14 million, Securities $40 million, loans $140 million. Liabilities side is: Deposits $140 million, Borrowing from other banks $6 million, Equities $48 million (1 point). Advantages: (1) There is no need to reduce interest-bearing assets. (2) Return on equity will be higher if return on assets is the same as before (0.5 point). Disadvantage: The bank now has smaller equity-Asset ratio, and subject to higher risk of insolvency if there are large loan losses (0.5 point). 2. (10 points) a. These agencies have much smaller capital to asset ratios compared to the banks. Describe how a small capital-toasset ratio affects the probability of insolvency. The company’s capital serves as a buffer against risks of substantial loss of assets. The company’s own capital is equal to its assets minus liabilities. In case of substantial losses of assets, a small capital-to-asset ratio increases the probability of insolvency, that is, the company does not have sufficient assets to pay off all holders of its liabilities. b. These agencies borrow at a rate that is above the U.S. Treasury rate but well below the highest rated private corporations, suggesting that the market perceives there is little default risk. Provide an explanation for the low default risk in light of your answer to the first part of this question. Is there a moral hazard problem created by the U.S. government? Explain your answer. The reason that they have a low default risk is because the investors perceive strong government ties of these two companies. Investors might believe that the U.S. government will bail them out in case of failing, given its strong government ties and the “too-big-to-fail” size of their business. This can lead to a moral hazard problem where the company insures mortgages that have a higher probability of failing in order to earn higher returns knowing that the government will pay off any debt the company might owe in case of bankruptcy. 3. Gap Analysis: Gap = Rate-sensitive Assets – Rate-Sensitive Liabilities = $30m - $15m = $15m Net profits increase by $0.6m (=15*0.04). 4. (12 points) There will be three moral hazard problems. Each problem is worth 2 points and remedy for each problem is worth 2 points as well. a. Joe as depositor versus Bank Magna. Magna is the borrower. There is a moral hazard problem in that Magna might take too much risk using Joe’s deposits. To reduce moral hazard problem, Joe should closely monitor Magna’s operations to make sure its investment portfolio is not too risky. Since Joe is also the shareholder, he also needs to make sure that other shareholders have a huge stake in the bank so that the bank has enough net worth to buffer against probabilities of bankruptcy. b. Joe as shareholder versus Bank Magna. There is a typical principleagent problem. Joe’s interests may not coincide completely with those of management. Management may claim too high bonus or engage in fraudulent accounting to make profits of its own, sometimes at Joe’s cost. To reduce this moral hazard problem, Joe should closely monitor the company’s operation. He can also support the management to take a large stake in the company by becoming shareholders. c. Net Worth Corporation versus Bank Magna. As a borrower, Net Worth Corporation might take on too much risk using bank loan. To reduce the problem of moral hazard, Magna should monitor Net worth closely, and require collateral or compensating balance from Net Worth Corporation. 5. Percentage change in market value of assets = -2%*4 = -8% Percentage change in market value of liabilities = -2%*6 = -12% percentage change in market value of net worth = 100*(-8%) – 90*(-12%) = 2.8 The market value will increase by 2.8 million if interest rates rise by 2 percentage points. The bank can engage in trading with financial instruments to reduce its exposure to the interest rate risk. The answers to 6 can be readily found in the textbook.