Estates & Trusts — Zamperini 2004S

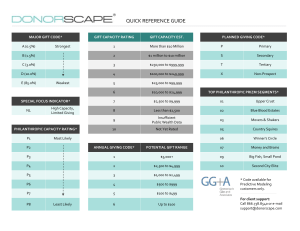

advertisement