President Hoover and the Great Depression

advertisement

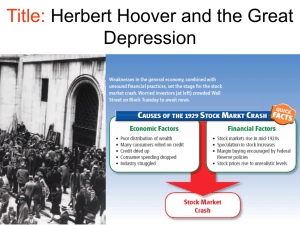

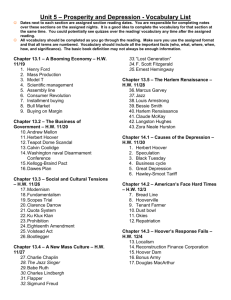

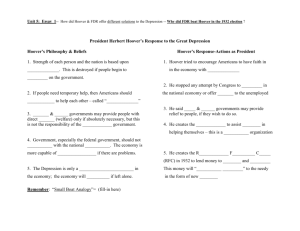

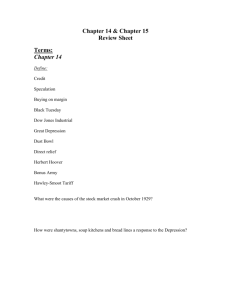

President Hoover and the Great Depression 1930s Junfeng Jiang ESL 100 D/E Teddy Chocos 05/14/2014 In 1929, economic expansion peaked. On October 24, 1929, the stock market bubble crashed, The Dow Jones index fell 23% in one day that known as “Black Thursday”. A month later, the stock market lost about 100 billion dollars; more and more people were worry about their life and work, and the United States entered The Great Depression. The website of history.com states that “ The Great Depression (1929-1939) was the deepest and longest-lasting economic downturn in the history of the western industrialized world”. The Herbert Hoover who was 31th President in the history of the United States had an inescapable responsibility for causing the Great Depression, because he underestimated the seriousness of the Great Depression; he indulged market and he didn’t allow too much government’s intervention, at the end, he led to high unemployment and poverty. Herbert Hoover had two types of economic thinking that let American economy went forward to hell when he was a President during the Great Depression, laissez-faire economy and volunteerism. “Columbia Electronic Encyclopedia claimed that Hoover, believing in the basic soundness of the economy, felt that it would regenerate spontaneously and was reluctant to extend federal activities.” Hoover was a firm supporter of laissez-faire economy that was a type of economic policy. It means that government might not give too much control on financial activities, because market would adjust or recover automatically even during the Great Depression. President Hoover also thought the policy of Laissez-faire economy was good for Americans, because he thought if government gave too much control on financial activities or market, it might influence the enterprise’s individuality and positivity. Therefore Hoover still kept his policy of laissez-faire economy even the United States was experience the Great Depression. He believed that the function of the government was ensuring freedom right and equality of opportunity. “The Author of Listening to Herbert Hoover, Anna Bernasek said that In 1928 on the eve of the Great Depression, Herbert Hoover coined the phrase "rugged individualism" to encourage Americans to help themselves and not look to government for assistance.” This was volunteerism. Hoover thought enterprises could help with each other; therefore he tried to persuade large banks and corporations to lend money to smaller banks and corporations and formed the National Credit Corporation in order to help banks and corporations. However, the National Credit Corporation failed, because large banks and corporations didn’t like to lend money to these small banks and corporations or they just lent these small banks and corporations a little money. As a result, there were half of banks closed down during the Great Depression. The policy of laissez-faire economy was a reason that let the Great Depression became more and more serious. However, Hoover also made a lot of wrong decisions such as failure trade policy and obsolete financial policy. Because of the stock market crashed, more and more businesspeople wanted to protect their products in the market; they thought the products that were from other countries took their market, so that they could not sell a lot of products. Therefore, they hoped that government could give them help to prevent these products that were from other countries. As a result, Congress and President Hoover agreed and signed the law that the government of the United States began to implement their new trade policy that they increased the thousands of tariff rate of imported products and tried to save American companies in the price war. However, due to the government of the United States started the new trade policy, there were too many countries had increased their tariff rate of imported products for revenge. As a result, the world trading system had collapsed. “The author of The Life of Herbert Hoover: Fighting Quaker, 1928-1933 - By Glen Jeansonne, Conard Rebecca, said He acknowledges that Hoover consistently overestimated the economy’s capacity to rebound and unwisely signed the Smoot-Hawley tariff bill against the advice of economists and his own better judgment.” The author thought this trade policy was unwisely and failure, it also influenced world trading system that had to become collapse. Therefore the new trade policy wasn’t useful for the countries that suffered the Great Depression; also the it would aggravate seriousness of the Great Depression, because this new trade policy was the irresponsible and selfish behavior, it was like a rapier that it could hurt each other. “The author of The Slide to Protectionism in the Great Depression: Who Succumbed and Why, Barry Eichengreen, claimed that the Great Depression of the 1930s was marked by a sharp outbreak of protectionist trade policies. Governments around the world-imposed tariffs, import quotas, and exchange controls to restrict spending on foreign goods. These trade barriers contributed to a sharp contraction in world trade in the early 1930s beyond the economic collapse itself, and a lackluster rebound in trade later in the decade, despite the worldwide economic recovery”. According to article, the protectionist trade policy was a very important reason that made the Great Depression more complex and serious. Due to the protectionist trade policy, American economic needed more time to recover and adjust. In this way, it explained that the ability of Hoover was very general; he even didn’t think the impact of the new trade policy roundly. In additional, Hoover also made a mistake in his financial policy—the gold standard. It was a very obsolete financial policy that came from in 19th century. “The website of economist defined that the gold standard was a monetary system that the standard economic unit of account is based on a fixed quantity of gold.” In other words, the gold standard was the connection between the gold and dollar. The President Hoover thought that the financial policy of the gold standard was still useful for American. However, there was not a sign that American economy would recover all the time. Due to stock market crashed, there were too many people feared to save money in the bank, therefore these people who were afraid had taken too much cash. At the same time, the central bank could not give people too much cash because of the financial policy that stipulate the percentage of gold must be in 40% or up. As a result, due to monetary deflation, people liked to stay at home rather than went outside and spent money. “The author of The Slide to Protectionism in the Great Depression: Who Succumbed and Why, Barry Eichengreen, claimed that In contrast, countries that abandoned the gold standard, allowing their currencies to depreciate, saw their balances of payments strengthen. They gained gold rather than losing it. Abandoning the gold standard also freed up monetary policy. With no gold parity to defend, interest rates could be cut. No longer constrained by the gold standard, central banks had more freedom to act as lenders of last resort.” The author said that American might be the last one country to recover due to the government of the United States still used the gold standard as their financial policy. In contrast, there were many countries began to recover, because these countries abandoned the gold standard as their financial policy, they were finding a new financial policy to replace their obsolete policy. Therefore, Hoover missed a chance to help Americans economy to recover. It showed that Hoover didn’t foresight and he could not solve issues quickly and decidedly. According to the events of Herbert Hoover, he was a very stiff and stubborn person. He didn’t have ability to reform and innovate. Due to his disability, he aggravated the level of the Great Depression and he failed to save American economy. Of course, he failed in the presidential election. There was a song that described the United States in that time “ Mellon pulled the whistle, Hoover rang the bell, Wall Street gave the signal, and the country went to hell”. It claimed that Hoover had to respond for causing The Great Depression. Work Cited 1. http://www.history.com/topics/great-depression 2. http://www.economist.com/blogs/freeexchange/2013/11/economic-history-0 3. http://www.nber.org/chapters/c11482.pdf 4. http://cid.bcrp.gob.pe/biblio/Papers/NBER/2009/Julio/w15142.pdf