SEBI REGISTERED INVESTMENT ADVISER

Good Morning! Have a Profitable Day!

16th February 2015

Ride the Profit Wave with our Five

Wave Profit

Strategy

Contact us at 9310010089/info@fivewaveprofit.com

Recommendation for Cash, Commodities, Currency, F&O & Global Indices/Stocks

www.fivewaveprofit.com

Email: info@fivewaveprofit.com

Mobile: 9310010089

Daily Market Outlook

Our recommendation is based on Elliott Wave Principle

Daily Market outlook includes view of Nifty/Bank Nifty for intraday, BTST, Very Short Term (Expiry to Expiry),

Stocks recommendation for our various plans with personal touch so that you can buy or sell accordingly. In

outlook we also include Option Strategy in Indices as well as for stocks futures.

From 18th Feb 2015 Daily News Letter is chargeable. Please contact for detail.

For Real Time updates with timing visit our web site

www.fivewaveprofit.com

Finally Nifty has achieved our given lower target of 7200 &

7120 too.(CHART ATTACHED).

CONTACT US FOR DETAIL MARKETS PREDICTION FOR CY 2016.

nd

22

NIFTY

october 2015

DETAIL REPORT FOR PAID CLIENT ONLY

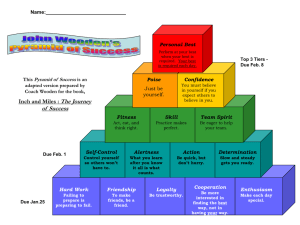

We have made handsome money in NIFTY under Five

Wave Profit Strategy (from 4th Jan to till date)

HOT STOCKS

Fresh Recommendation: 05th Feb 2016:

This service is only for Paid client.

Nifty view

16th Feb: Nifty should trade in the range of 7250

– 7000. Closing beyond range may force to move

in that direction. We don’t have lower target

below 6800. Only hold 25% of your shorts

position with strict SL. Avoid Fresh.

15th Feb: After 7120 we have next lower target of 6800. We do not have further

lower target below 6800. Let it achieve, there after we will review. One corrective

rise is due, now our intraday SL will be important. Trade according to levels only.

But remember in Long Term it’s falling corrective but right now avoid bottom

fishing. We will definitely update you all after confirmation only. Have patience

and sit on cash.

(Mail sent to paid client in detail with charts, please check your email and

for any further query please contact at 9310010089).

12th Feb: Nifty has finally achieved our given lower target of 7120 and hope

you all have booked 75% profit of your shorts position there. On Monday we

will share our latest view. For today just trade according to our intraday

level.

11th Feb: STBT 7250 & Long Term Lower target of 7200 all achieved. Now what

next. Short sellers are advise to Book 75% of your shorts position near give lower

levels. Our trend reversal upper SL will be very important to decide to further

directional move. Keep watching our website, very soon we will forecast the

bottom level of Nifty & Bank Nifty. But right now avoid any kind of bottom fishing

at your end. Just trade according to our levels only. Positional traders have

patience we will update you soon. Contact us for details.

10th Feb: We are coming close to given lower STBT target of 7250(yesterday

low 7275) and this week it should trade in the range of 7200-7450. Better to

square up your position same day, overnight position might be dangerous.

8th Feb: Trade according to our levels only, Intraday upper level 7470 and

STBT upper level 7500 also achieved on 5th Feb and further it might move up

to 7?00 as corrective follow strict SL.

5th Feb: In next few couple of days Nifty likely to trade in the range of 7250-7500,

according to our calculation Nifty might knock 7120 also. But condition is that,

Nifty should not break 7601 before achieving 7250. If it breaks 7601 before

achieving 7250 then the probability of 7120 will be very less.

We are bullish for CY 2016. But we will closely watch the moment of Nifty for next

2 to 4 weeks. So you are advise to trade with strict SL in our given range. Please

do not compromise with SL now. Have patience very soon we will announce the

bottom level of Nifty. BECAUSE WE ARE BULLISH FOR CY 2016 AND WE SEE NIFTY

??00 till Dec 31, 2016. Detail report for paid client only.

4th Feb: Prefer only intraday trade according to our Intraday SL. (if we give

upper SL then you’ll have to create short position else long. Quantity should

be small for at least next few couple of days. Avoid Positional long or short,

prefer only Intraday trades.

3rd Feb: After achieving our given upper target of 7600, Nifty has broken

intraday lower SL. Next few days it should trade range bound between 73507500.

02nd Feb: Nifty has achieved our intraday upper target of 7600(actual

7600.45). Maintain buy near our given intraday lower levels.

01st Feb: Maintain Buy on decline for the upper target of 7?00. Buy near

given intraday lower level and keep booking profit near given upper intraday

levels.

29th Jan: Next few couple of day Market will trade range bound between

7350-7550. Maintain buy on decline. Keep stock specific approach.

27th Jan: Trade according to our levels. In coming days we see Nifty above

7?00. Recommend Buy on decline with strict SL.

25th Jan: As we hold earlier that next 15hrs will be crucial. Now during this frame Nifty

has broken real time upper SL of 7400. Which was very crucial for research point of

view. For detail view contacts us. We advise to trade according to our levels only. AVOID

SHORT. WE HAVE BOOKED 100% PROFIT IN OUR SHORT POSITION.

22nd Jan: Yesterday Nifty has achieved both our levels upper 7350 as well as lower level

of 7270 and our intraday view was sell on rally at given higher levels, Now today

is

very important for research point of view. Please trade according to our levels only. But

remember we are very close to given lower long term target of 7200, so be alert. VERY

SOON WE WILL GIVE BOTTOM LEVEL OF NIFTY AND BANK NIFTY TO OUR PAID CLIENT,

SO THAT YOU CAN RIDE THE PROFIT WAVES WITH US IN 2016 ALSO.

(5trading hours)

21st Jan: NOW NEXT 9 TRADING HOURS IS VERY CRUCIAL. WE ARE VERY CLOSE TO OUR

LOWER LONG TERM TARGET OF 7200(low 7241). 100% PROFIT BOOKING IN SHORT

POSITION IS ADVISABLE NOW THOSE WHO SHORT IT NEAR NIFTY 8300 LEVELS. AVOID

FRESH POSITIONAL SHORT. FURTHER WE SEE NIFTY…UP TO ??00 IN 2016. (CONTACT

US FOR DETAIL NIFTY & BANK NIFTY VIEW FOR 2016).

20th Jan: FOR RESEARCH POINT OF VIEW NEXT 15 TRADING HOURS IS VERY CRITICAL

TO CHECK THE VELOCITY OF MARKET. KEEP IN MIND WE ARE VERY CLOSE TO OUR

GIVEN LOWER LONG TERM TARGET OF 7200, SO AGGRESSION OF SHORT SELLING

SHOULD BE LITTLE LOW FOR POSITIONAL POINT OF VIEW. HOLD ONLY 25% OF YOUR

POSITIONAL SHORTS POSITION. WE ARE FILTERING FEW STOCKS FOR CALENDAR YEAR

2016 FOR LONG. Ask for Bottom Out stocks.

19th Jan: 75% Profit Booking in short position is advisable near given

lower level. Avoid fresh positional short. Only prefer intraday trades for

next few couple of days. Risk reward is not favorable for Positional

short sellers as we are very close to our given long term target of 7200.

Because in 2016 we see Nifty above??00. Risk reward is not favorable

for positional short sellers.

CONTACT US FOR DETAIL 2016 VIEW.

18th Jan: We are coming close to our given lower levels. Book Part

Profit in short position and 100% in Jan series PEs.

15th Jan: Nifty traded remain range bound between our given intraday

levels. Next few couple of days it should trade range bound, take help

from our STBT or BTST range. Use every pull back to create shorts position.

Avoid short at lower levels, shorts are advisable only near given higher

range.

14th Jan: We still maintain sell on rally but only near given upper

range. Yesterday it has achieved both of our levels, upper as well as

lower. We recommend to trade according to our given levels only.

Take hint from our Intraday and STBT or BTST levels. But remember if

you talk about 2016, then risk reward is not favorable for short

sellers. But we will hold 25-50% of our shorts position in Nifty. And we

are advising our client to go long (stock specific)for medium to long

term, because this is the best time where few stocks are trading at

very attractive levels.

8th Jan: We are very close to our long term target of 7500/7200,

Concentrate on Profit Booking in your short position instead of fresh

aggressive short. Early 2016 is very crucial for traders as well as for

investors. Treat Index as an individual stock because few stocks are

completing their fall of long term, and they can make bottom in next

few couple of weeks.

7th Jan: Nifty has achieved our lower target of 7750. Traders those

who short Nifty/Bought PEs for STBT point of view should Book

Profit at given intraday lower levels. Avoid fresh short at lower

level, only short at given higher level and remember the Broader

trend is still bearish and we already given lower target of below

7500 and 7200. Keep stock specific approach for 2016 point of

view.

6th Jan: Nifty is trading very close to our lower target of

7750(7763), Almost 200 point down after our sell alert. Now

further it should trade range bound. Avoid fresh short. Keep

stocks specific approach for next few couple of days.

5th Jan: Yesterday we clearly mentioned that upside scope is 79508000, +/- 25 points. Now see the result. Yesterday Nifty is more

than 175 points down after achieving our corrective target of

7950. Now it is coming close to our target of 7750.

4th Jan: After achieving upper corrective target of 7950, Nifty

should trade range bound. we see Nifty minimum 7750 in

January series, up side 7950 to 8000 (+/- 25pts), Prefer Level

to level trades and follow our Intraday and BTST or STBT

range.

01st Jan: Nifty is not able to sustain above our given upper corrective

target of 7950 on closing basis. One correction is due now, so trade

cautiously on long side.

31st Dec: Nifty is showing sign of weakness near our given

upper corrective target of 7950. On lower side 7835 is an

important level. If Nifty breaks this level then we see 7500 in

one month. Strictly avoid overnight long position. Buy OTM

Nifty PEs of January month.

30th Dec: As discussed we are very close to our given target of 7950. So

avoid over night long position now. Prefer trades only intraday based on

our recommendation. WE ADVISE TO BUY NIFTY JAN 7900 PE.. and hold till

further update (best buy between 80-95), contact us for details.

23rd Dec: If nifty manage to sustain above 7850, then we see 7950 and

above.

After moving close to our given upper range of 7860(7846) Nifty has achieved

our lower range too 7780(7777). Maintain buy with small quantity. BUT

DON’T FORGET THAT NIFTY IS RISING CORRECITVE AND IT WILL…

Detail for paid client only

Intraday range: 7200-7060, SL 6869

View: Buy on decline.

Aggression: Moderate.

BTBT: 7000-7300, SL 6869 (7120 achieved on 11th Feb)

View: Buy on decline.

Bank Nifty view

16th Feb: After achieving 14500, we can see

up side up to 14700 in next few couple of

days. Trade according to our levels only.

Trend reversal upper SL is 14965.

15th Feb: 14200 achieved, further we don’t have fresh lower target.

Wait for corrective rise. We will short it again. Levels will be updated

soon.

12th Feb: Finally Bank Nifty has achieved our 3rd revised lower long term

target of 14200, hope you all have booked 75% of your shorts position

there. We had clearly mentioned yesterday that avoid bottom fishing till

update. We will up fresh view on Monday. For today according to our

Intraday levels only.

11th Feb: We are very close to our given Long Term lower target of 14200.

Our First unbelievable Lower Long term target of 16000 and Second 15000

already archived. Level was given to positional subscriber when Bank Nifty

was trading above 19000. Now our final lower target is 14200. So all

Positional to Medium term (one month to six months) traders are advise to

Book 75% Profit in your shorts position. What Next?. Please avoid any kind

of bottom fishing till our update. Trade according to our levels only and

Keep watching our trend reversal upper SL. Contact us for details.

10th Feb: This month Bank Nifty should trade in the range of 1460015800. Trade according to our Intraday SL.

8th Feb: During corrective rise it might move up to 15800, follow strict

lower SL, Do not forget that it is rising purely corrective. Contact us for

detail.

4th Feb: Next few couple of days Bank Nifty should trade in the range of

14500-15200 as lower SL already broken day before yesterday. Avoid

positional long or short both. Prefer only intraday trades according to our

Intraday SL.

3rd Feb: Yesterday Nifty has broken our real time lower SL of 15135. Now

further it should trade range bound. Stop further buying till update. Those

holding long should exit near given STBT/Intraday upper range.

02nd Feb: Buy Bank Nifty near our given lower intraday level for the

target of 15800-16000 in next few couple of days. Contact us for SL and

best buy level.

21st Jan: Book 100% Profit in short position near given levels. In

?5%

2016 we see Bank Nifty

(Guess if u can. Option 0, 1, 2, 3, 4 ) up

side from 14600 levels. Contact us for detail report.

20th Jan: What Next??? Contact us for details.

18th Jan: We are very close to our 3rd positional target of 15000, and our 4th

possible positional target is 14?00. 75% Profit Booking in shorts position is

advisable below15000 and 100% in PEs. Now further ???

01st Jan: Profit Booking near our given upper range is advisable. Can buy

slightly OTM PEs of Jan series.

31st Dec: Bank Nifty is unable to sustain above our given

STBT upper level of 17100. Avoid Long in Bank Nifty. For

next few couple of hours 16756 is an important lower level

to decide the further direction.

30th Dec: After achieving our given upper corrective target of

1??00 (17000). Next few couple of hours it should trade in

range. Take help from our BTST/STBT range.

23rd Dec: Bank Nifty has achieved both our levels yesterday.

Only trade according to intraday levels. Next few couple of

days it should trade range bound between 16???-1??00.

22nd Dec: After achieving 16200 on lower side and after that

16700 on upper side as corrective. We see Bank Nifty……??

Ask for details.

21st Dec: Don’t forget that Bank Nifty has achieved our lower

positional target of 16200 and after that it has also achieved

our corrective upper target of 16700, further it will trade

range bound. Take hint for range from our BTST and Intraday

levels on daily basis.

18th Dec: Bank Nifty achieved our BTST target of 16700. We

wont suggest all our clients/viewers to carry overnight

position in Bank Nifty too. Prefer intraday trades only for next

few couple of days.

17th Dec: After achieving our lower very short term target of

16700/16500 & finally 16200, It is spending time at higher

levels, In technical language we say it has entered in time

wise correction. Watch our intraday levels and prefer trades

accordingly. Aggressive & positional long might be

dangerous. Please keep booking Profit in your long position,

and also keep your position light on long side.

14th Dec: 3rd Positional target of 16200 .80) achieved.

Next we see Bank Nifty ?????????

11th Dec: Second positional target of 16500 achieved and

(16205

low is16260 which is very close to our target of 16200.

Hope all have enjoyed our levels. Short call was given near

Bank Nifty spot 17450 on 30th Nov 2015.

10th Dec: First positional target 16700 achieved, Hold for

next lower target of 16500 & 16200.

1st Dec: After achieving our upper target of 17450, We see

Bank Nifty 16700/16500 & 16200 in various time frame.

Still maintain Sell on rally for min 16500 in December

Series Detail for paid client.

10th Nov: After achieving our first lower target of

17200, we are very close to given SECOND lower

target of 16600(9th Nov Low is 165??). Short call was given near

Bank Nifty 18000.

Intraday range: 14600-14220, SL 13810

View: wait.

Aggression: -. Moderate

BTST: Range: 14100-14800, SL 13810 (14200 achieved on 11th Feb)

View: wait.

Aggression: Moderate.

Fresh Buy:

16th Feb:

IOC, IGL,

BHARTIARTL, TATAPOWER, IOC, FEDERALBANK,

COLPAL, ARVIND, ADANIPOWER, BOB, COALINDIA,

LT, TATASTEEL, HINDALCO, JSPL & MARUTI for at least

Positional Buyers Be ready.. AVOID SHORT IN-

one week. In these stocks either we see corrective rise or impulsive

trend. Just give us one week to catch the actual trend. So we advise to

avoid at least short. Contact us for best buy levels, SL and positional

target.

16th Feb: AXISBANK target 420 achieved. 12th Feb: Continue

ASHOKLEY.

11th Feb: Keep watching AXISBANK, BPCL & ASHOKLEY.

10th Feb: FRESH BUY CAN BE DONE IN AXISBANK…

9th Feb: ACC & AXISBANK tgt achieved..

8th Feb: ACC, AXIS…..for the price tgt of 1300 and 415, ask for sl, best

buy level & timing also.

6th Feb: Next is ??A??N??A... for next 10% up move. Will update soon.

5th Feb: Infosys we are very close to our given first upper target of

1200(on 4th Feb high was 1195).

4th Feb: BUY INFY FOR THE TARGET OF 1200 AND ABOVE. ASK FOR

BEST BUY LEVEL AND SL.

2nd Feb: BUY PIDILITE for the target of 585, M&M and Hindalco also.

Ask for best buy levels and sl.

01st Feb: ALL RECOMMENDED BUY STOCKS GOT BLAST. WHAT NEXT ??

28th Jan: AUROPHARMA, & INFY and many more.

27th Jan: INFY, SUNPHARMA and..

25th Jan: many more stocks are in our Buy List, like HDFBK,

PETRONET,

YESBANK,

AUROPHARMA,

HDFCLTD..and……..

contact us for best buy levels, sl and very short term target.

CONTACT US FOR BOTTOM OUT STOCKS.

21st Jan: BHEL, ATYRE & INFY.

30th Dec: ALL OUR RECOMMENDED PHARMA STOCKS DIVISLAB,

AUROPHARMA & LUPIN AND OTHER STOCKS LIKE BAJAJ-AUTO,

HAVELSS & CROMPGREAVES GOT BLAST…hope you all are enjoying.

Avoid fresh Long.

23rd Dec: LUPIN & AUROPHARMA.

22nd : DIVISLAB target 1172 achieved on 21st Dec, Now wait for

AUROPHARMA, Fresh watch LUPIN & GODREJIND.

21st Dec: AUROPHARMA & DIVISLAB…ask for levels.

15th Dec: BAJAJ-AUTO, AUROPHARMA, HAVELLS & CROMPAG on

decline.

14th Dec: watching AUROPHARMA, LICHSG, JSWSTEEL (got blast same

day) for long.

Intraday Recommendation

19th Nov 2015

For Paid client only

MOMENTUM SHARE

For Paid clients only

SELL ON RALLY STOCKS

16th Feb: Wipro is rocking. Book Profit Now.

22nd Jan: WIPRO & ASIANPAINT….near…..

21st Jan: HPCL GOT BLAST YESTERDAY LOW 787.15,

SHORT CALL WAS GIVEN AT 8?5 (835)…HIGH ON 19TH

JAN: 838… (28200/- m2m credit till yesterday..now

book profit..

19th Jan: HPCL but only above 8?0 for the very short

term target of 780, ask for sl and best short levels.

18th Jan:

HINDUNILVR got blast on down

side target achieved 775(15th Jan low 776.65), Short

call was given to our positional client at 8?5( 825, and

15th Jan high is 828.95)

15th Jan: SHORT HUL but only near 8?5 for the very

short term target of 775. Ask for SL and best short

levels.

8th Dec: HCLTECH, CIPLA,

???T?S(VOLTAS)…All are rocking.

31st Dec: We continue maintain our sell on rally view

in HCLTECH, CIPLA, ASIANPAINT, TISCO and many

more….

30th Dec: HCLTECH, CIPLA, ASIANPAINT, TISCO ???T?S

and many more…

23rd Dec: All got blast and target achieved. Wait for

further.

4th Nov: APOLLOTYRE, GRASIM, ICICIBANK,PNB, SBI

any many more.

26th Nov: RELCAP sl triggered. Short was given at 410. SL was 428. Wait for

further view. Avoid long and for further view.

Many more stocks are in pipe line.

13th Nov: WIPRO has finally achieved our first lower target

of 550(551), after small pull back it will come below 530 after that 500 and

4?0, use every corrective rise to create more short position, For detail

timing and levels contact us .

HEXAWARE (avg short price 255.60) Profit Booked @

143 & 131.

APOLLOTYRE See the price of

Apollotyre of 14th Dec, days low was 145.15, we had

boldly written on 10th Nov that we will Book Profit

between 145-150. (average sell price was 194.70).

10th Nov: We will Book Profit in APOLLOTYRE

between 145-150. (Total Profit earned 1,40,100 in one

lot in one and half month.)

30th Oct: DLF has finally achieved our first lower

target of 120, Still maintain sell on rally and advise

our client to hold short position for the given target

of

105. 10

th

Nov: We are coming close to our

given lower target of 105. Note down our point, we

will Book Profit in DLF at 105 and below.

Also hold TCS, HEXAWARE, ACC, BHARTIARTL,

ICICIBANK and many more stocks. Contact us for

levels.

29th Oct: BHARTIARTL, EXIDEIND, WIPRO & Many

more……

27th Oct: BHARTIARTL, ACC, DLF, LT & TCS….contact

us for levels.

14oct: Avoid Long in ICICIBANK (contact us for

levels).

And also avoid long in APOLLOTYRE, ONGC & CIPLA

now..contact us for best short levels & tgt.

1st October: Don’t touch WIPRO for long. We are

bearish in WIPRO for the very short term to short

5?0 / ??0. Contact us for

best short level is 6?0 and SL.

term lower target of

25th October: WIPRO is rocking now, 1st October

closing price was 599.75 and on 23rd October closing

price was 567.75. .. M2M 32*500

= 16000/-

per lot. Hold on the stocks for the given target of

5?0. Contact us for details.

21Sep : ACC short in the range of 1385-90 SL 1423

TGT 1310 (vst)

Can also short HDFC, contact us for details. (ACC

lower target of 1310 achieved on 29sep)..

Very soon we will update few more stocks to create short…which may

give good returns. Have patience !

Range Bound Stocks….

-

Contact us at 93010010089

Payment Details as under

Company Name: FIVE WAVE PROFIT

Bank Name: HDFC BANK

Account No: 50200015022910

RTGS/NEFT IFSC CODE: HDFC0000091

Please logon www.fivewaveprofit.com for more details

Our Services

1. FIVE WAVE PROFIT STRATEGY:

Charges: 15000/- and Expected Profit 50000/-

2. Indices Services: Nifty and Bank Nifty Plan

Charges: 50,000/- and Expected Profit: 200000/-

3. POSITIONAL CALL:

Charges: 35000/- Quarterly.

4. Five Wave Trading Strategy: (In house strategy for

active traders only).

Charges 30,000/- Per Month

5. Multi Bagger / Wealth Creation Stocks:

Charges: 50,000 Yearly.

6. Brokers & Sub-brokers Package:

Contact us for details.

7. Customize Services: (For HNI & UHNI only)

Minimum Capital required 25Lacs +.

Contact us for details

-----------------------------------------------------------------------------------------------------------Note: IUSL = Intraday Upper SL, ILSL = Intraday Lower SL

Conservative: Trade with low qty and low aggression

Disclaimer

Implementation of this website and/or services provided by us indicates your acceptance of our disclaimer.

fivewaveprofit.com is the result of independent performance of the Five Wave Profit. Every attempt has been

made

to

deliver

veracious

information.

All principle, theories, methods, graphics, Charts, Patterns & webzine etc. related to all equities, derivatives &

Commodities trade considered in fivewaveprofit.com are only illustrations and should not be regarded as specific

advice. There is no any method for trading or investing which has been devised, originated or prepared with

foolproof guarantee to make profit or to get free from loss. All forecasting is based on Statistics and Nature’s law

i.e., Elliott wave Principle derived from past performance of trading system or technique and those past

performance has no guarantee of future investment success. Five Wave Profit Consulting,

www.FiveWaveProfit.com and our other websites are not responsible for any losses made by traders. It is only

the outlook of the market with reference to its previous performance. You are advised to take your position with

your

sense

and

judgment

and

do

not

follow

us

blindly.

The methods, systems, technique, graphs, article, photos, videos or any other content in whole or in part in any

form cited in fivewaveprofit.com are all rights reserved. There is no permission of any addition, deletion,

duplication,

modification,

reproduction

and

distribution

of

webzines.

Using the information/illustration provided by fivewaveprofit.com in any form (i.e. – SMS, email, messenger,

phone calls, news letter, articles or posting for hyperlink embedded message) for making investment decision will

be

at

their

own

risk. We

have

rights

to

change

our

service

fee

without

any

prior

notice.

All the information’s provided by the Scientist, analyst or experts are believed to be authentic from very beginning

but one should not forget that every investment is risk bearing and hence caution is the watch-word before

making any trade or investment decision. The entire scientist associated with fivewaveprofit.com would not be

liable or responsible for any legal action or financial losses made by the users. If you are unable to accept all the

above responsibilities for yourself, then you should not follow the fivewaveprofit.com. IMPORTANT NOTE: Your

money is very important. Always trade safely.

Disclosure

We may or may not hold any positions in the stocks recommended above.