ShareKhan Pre - Market Action

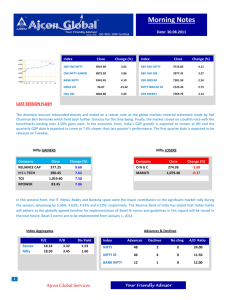

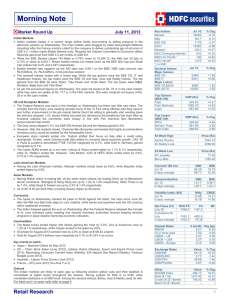

advertisement

4th March 2016 - Friday ShareKhan Pre - Market Action Trading Ideas: Long/Short Ideas identified on basis of Fundamental Trigger/News/Events Watch List: List of stocks identified for trading with positive and negative bias for the day Important News & Events (Both Domestic & Global) to keep you updated on News/ Updates: all the happenings in markets. Index Ideas: Nifty and Bank Nifty view for the day. Trading Ideas Jindal Steel & Power (CMP – 63.35) Adani may buy Jindal Power; valuation at Rs 20K crore Action to be taken: Long JSPL Stop loss: 62.4 Target: 65-66 RCOM (CMP - 55) RCom Disagreement with valuation of tower assets TPG group Action to be taken: Short RCOM Stop loss: 56 Target: 52-51 over News Update • Reliance Capital: Gets all approvals for increase in Nippon Life Ins stake to 49%. • Govt: To tax share buyback income between 20002013 as capital gain. • Tata firm in talks to buy JP Morgan MF's India assets • MINDA INDUSTRIES: To Acquire Lights & Technical Center From Rinder •ONGC To Consider Interim Dividend Plan On March 9 News Update • Anti-dumping duty likely on a chemical imports from 6 nations • Yes Bank buys over 5% stake in advisory firm IiAS • Maruti hikes prices by up to Rs34,494 to offset infra cess • DCB Bank acquires 5.81% stake in Annapurna Microfinance • GOVT: Looks To Revive HMT Machine Tools, Heavy Engg Corporation: PTI News Update • Coal India to buy back 5% govt stake next year • Firms rush to declare interim dividend to avoid dividend distribution tax • Govt to hike gas price for ONGC, RIL Watch List Stocks With +ve Bias CMP (Rs) Stocks With -ve Bias CMP (Rs) CIPLA 530 Havells 279 ONGC 197 Bajaj Auto 2253 Stock for Investment Stocks for Investment Stocks CMP (Rs) INDUSIND BANK 896 BRITANNIA 2842 BAJAJ FINSERVE 1675 SUN PHARMA 871 ULTRATECH 2944 Global Update Global Indices and news Street moved higher on •Wall Thursday, adding momentum to a recent recovery as the energy and financial sectors emerged into positive territory for the year. •Asian shares look set to post a third straight weeks of gains on Friday as investors scaled back cautious bets on the global economy after a string of positive US economic data and a recovery in oil and commodity prices. The rebound in risk asset prices could continue if the upcoming US employment report points to solid job gains, but not strong enough to encourage rate rises in the near term. •Key data to watch in US today are Employment Situation and International Trade. Index Close Prev Close Change Change Dow Jones 16944 16899 45 0.26% S&P 500 1993 1986 7 0.35% FTSE 6130 6147 -17 -0.27% Technical Update Technical view – Nifty –7475 Short Term Target for Nifty is 7512 Crucial Support area for Nifty is 7406 Intraday levels: Support 7443-7406 Resistance 7485-7512 All levels are spot levels Technical view Bank Nifty- 15177 Crucial Support for Bank Nifty is at 14767 Intraday levels: Support 15000-14767 Resistance 15367-15565 All levels are spot levels Derivative Update Future’s Activity Nifty Nifty CoC OI PCR(OI) INDIA VIX Current Previous % change 7449.55 7361.55 1.20% -4.54% -1.25% -264.32% 23283000 21811725 6.75% 1.00 0.93 7.53% -5.00% 18.04 18.99 Nifty added 14.71 lakh shares in OI. Option’s Activity Strike 7400 C 7500 C 7600 C Most active index call option Curr. IV Curr. OI % Chg. OI 16.08% 4565625 -3.33% 15.50% 5136300 2.30% 15.08% 3784725 4.79% % Chg. IV -3.57% -4.49% -4.80% Strike 7200 P 7300 P 7400 P Most active index Put option Curr. IV Curr. OI % Chg. OI 18.24% 5112750 23.56% 17.25% 3982725 23.90% 16.28% 3064050 97.23% % Chg. IV -1.55% -2.15% -2.74% On the options front in the February series 7000 PE stands with the highest number of shares in the open interest (OI). Whereas on call side 7500 CE stands with the highest number of shares in the open interest (OI). Securities in Ban For Trade Date 02-March-2016 1.JISLJALEQS FII : INDEX FUTURES INDEX OPTIONS STOCK FUTURES STOCK OPTIONS +259.69 cr. +455.00 cr. +256.07 cr. -32.43 cr. Market Level Higher 5-DAY VWAP Lower Range Range 7220 7220 7500 SGX Nifty +32.50 points at 7473.00 (Mar Fut.) Thank You ! Disclaimer The views expressed herein are solely of the analyst, Any review, retransmission, or any other use is prohibited. The information contained herein is from publicly available data or other sources believed to be reliable. Each recipient of this information should make such investigations as it deems necessary to arrive at an independent evaluation of an investment avenue referred to in this web cast and determine the merits and risks of such an investment. Further each recipient of this information may take their own decisions based on their specific investment objectives and financial position and using such independent advisors, as they believe necessary. This information is given in good faith and Sharekhan Ltd makes no representations or warranties, express or implied as to the accuracy or completeness of the information and shall have no liability to you or your representative(s) resulting from use of this information. The investment ideas discussed or views expressed may not be suitable for all investors Analysts and other employees of Sharekhan and Sharekhan may have holdings in the companies mentioned in the webcast. Sharekhan neither makes any representation as to the quality, liquidity or market perception on the securities/market, not does it provide any guarantee whatsoever. The risk arising out of the /participation in any financial instrument will rest fully with you without any form of recourse to Sharekhan. The views are for assistance only and are not intended to be and must not alone be taken as the basis for an investment decision.