End-of-Chapter Summaries from Ayers/Collinge

advertisement

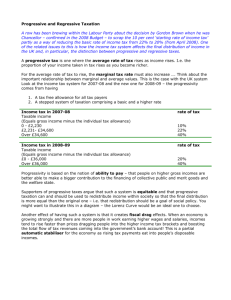

End-of-Chapter Summaries from Ayers/Collinge: Chapter 11, Fiscal Policy SUMMARY AND LEARNING OBJECTIVES 1. List the major sources of revenue for government in the United States. ●Taxes are used by government to pay the costs of providing public goods. Taxes also finance income redistribution through the provision of transfer payments. Safety-net programs that provide economic security transfer tax dollars to those in need. Welfare and unemployment compensation are examples. ●Two goals for taxes are equity and efficiency. Tax equity is about fairness. The goal of efficiency in taxation is to maintain incentives for people to be productive. To raise revenue efficiently, a tax should be designed to change people’s behavior the least. ●A marginal tax rate is different from an average tax rate. A marginal tax rate states the percent of additional income that is collected in taxes. An average tax rate states the percent of total income that is taken in taxes. ●Taxes take about 30 percent of GDP. The personal income tax raises the largest share of the federal government’s revenue. Federal personal income tax rates start at 10 percent for people with very low taxable incomes and increase to 15 percent, 27 percent, 30 percent, 35 percent, and 38.6 percent as incomes rise. This series of tax rates provides an example of marginal tax rates, since each of these rates applies to increments of income. ●The federal government also collects Social Security taxes, including a Medicare hospitalization tax. There is also a corporate income tax that takes about 30 percent of corporate profits. ●Tax incidence refers to who ultimately pays a tax. In the case of the corporate income tax, the tax ultimately reduces the income of shareholders. ●State and local governments also collect taxes. States’ individual income taxes, sales taxes, and revenues from the federal government make up most of the revenues states receive. Local governments tend to rely on property taxes and sales taxes for their revenues. 2. Explain the principles of tax equity and how they apply. ●The two fundamental principles of tax equity are the benefit principle and the ability-to-pay principle. The benefit principle provides the justification for earmarked taxes, such as the gasoline tax. It suggests that those who pay a tax should be the same as those who receive benefits from how that tax revenue is spent. The benefit principle cannot apply to redistributional programs, since the point of those programs is to provide assistance from taxpayers to the needy. ●The ability-to-pay principal states that those with more ability to pay taxes should actually pay more taxes. The federal income tax is modeled according to this principle, applying it with the further concepts of horizontal and vertical equity. ●Horizontal equity adjusts income to reflect a person’s special circumstances, such as if the person has high medical bills or a family to support. The idea is that people who are equally well off before paying taxes should be equally well off after paying taxes. Vertical equity attempts to pin down how much more people with a greater ability to pay should indeed pay. 3. Interpret why the U.S. income tax is structured as it is, and why critics suggest changing it. ●A tax may be progressive, regressive, or proportional. A progressive tax collects a larger fraction of income as income increases. The federal income tax is progressive since the marginal tax rate rises as a person’s income reaches a threshold level. For example, the income tax starts at 10 percent for low-income individuals and rises to 38.6 percent for those with relatively high incomes. ●A regressive tax collects a smaller fraction of income as income increases. For example, a tax that collects $1,000 from a person earning $10,000 and $10,000 from a person earning $1,000,000 is regressive since the first person pays 10 percent of his or her income toward the tax, while the second person pays only 1 percent of income toward the tax. ●A proportional tax collects the same fraction of income as income changes. If the person earning $1,000,000 in the previous example paid $100,000 in taxes, the same 10 percent as the lowincome person, then the tax would be proportional. ●A flat tax applies a single tax rate to all income. Thus, a flat tax is an example of a proportional tax. While the tax rate is the same for all taxpayers, recognize that people with higher incomes still pay higher taxes. A flat tax, if enacted, would be transparent (meaning easily monitored). In reality, any flat tax likely to be enacted would involve exempting low incomes. ●It can be difficult to tell whether a tax is progressive, regressive, or proportional. Depending on whether Social Security benefits are included with the tax, Social Security can be viewed as representing a progressive, regressive, or proportional tax. ●In pursuing the twin goals of equity and efficiency in the tax system, there are tradeoffs. More equity can mean less efficiency, and vice versa. In the pursuit of equity, government programs provide cash and in-kind benefits. An efficient tax does not distort relative prices within a country. Efficiency calls for a broadly based tax that virtually everyone must pay. 4. Show why workers pay more Social Security tax than they see withdrawn on their pay stubs. ●The Social Security tax is the second-largest source of federal revenue. Both employees and employers contribute toward Social Security taxes, each paying 7.65 of a worker’s gross pay to the federal government, for a total of 15.3 percent. The burden of employers’ contributions is shifted to workers in the form of lower worker pay. Thus, the ultimate incidence of the Social Security tax is on workers because the market wage rate declines by the amount of the employer’s share of the tax. ●The Social Security system is a pay-as-you-go system, with current workers paying for the benefits received by current retirees. It is predicted that the system will run out of money in the relatively near future. Individual retirement accounts promote saving for retirement. Personal Security Accounts, although politically contentious, might supplement Social Security if enacted into law. 5. Justify the use of consumption taxes, including the value added taxes of Canada and Europe. ●A consumption tax takes revenue for the government as people spend their money rather than as they receive income. Sales taxes are one form of a consumption tax. Many countries impose a consumption tax called a value added tax (VAT). As its name suggests, the VAT taxes value added, which is the difference between a firm’s previously taxed costs and its revenues. A VAT will yield the same tax revenue as a sales tax set at the same percentage. ●Whatever taxes are imposed, a broader tax base, associated with eliminating tax “loopholes,” combined with lower tax rates can reduce possibilities for inefficient behavior brought about by efforts to avoid taxes. 6. Discuss issues of market efficiency and tax equity as they relate to security costs. ●The terrorist threat imposes additional costs on firms in specific industries, such as the airline and pipeline industries. These costs could be paid for by government subsidies to firms. Subsidies often run counter to market efficiency.