Chapter 01 Quiz A

advertisement

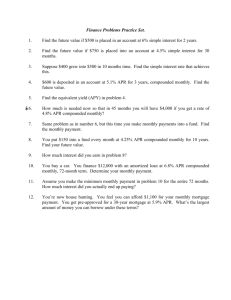

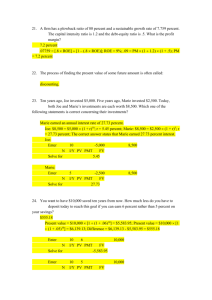

Chapter 6 Discounted Cash Flow Valuation Chapter 06 Quiz A Student Name _________________________ Student ID ____________ ________ 1. You are able to pay mortgage payments of $675 a month for thirty years. The interest rate is 9.5 percent, compounded monthly. What price house can you afford to buy if you have $5,000 cash available as a down payment? a. $72,712.50 b. $75,275.51 c. $80,275.51 d. $85,275.51 ________ 2. You are going to receive $6,000 at the end of each quarter for the next five years. What is the net present value of these payments at a discount rate of 7 percent, compounded quarterly? a. $63,564.09 b. $100,517.29 c. $102,276.34 d. $103,011.96 ________ 3. You want to retire on the day you have $1,000,000 in your savings account. You expect to earn 4 percent, compounded monthly, on your money during your retirement. Your plan is to withdraw $4,500 a month as retirement income from this account. How many years can you be retired until you run out of money? a. 33.80 b. 69.56 c. 202.34 d. 405.65 ________ 4. A preferred stock pays annual dividends of $1.75. How much are you willing to pay today to buy one share of this stock if you want to earn a 12.5 percent rate of return? a. $6.00 b. $14.00 c. $24.00 d. $72.00 ________ 5. A project will produce cash flows of $6,000, $7,500, $9,000, and $11,000 a year for the next four years, respectively. What is the value of these cash flows today at a discount rate of 8.5 percent? a. $24,588.74 b. $26,884.36 c. $27,559.03 d. $37,257.92 ________ 6. Today you are opening a savings account and depositing an initial $1,000 into it. You plan to deposit $4,000 into the account one year from today and deposit another $4,000 two years from today. How much will you have in your account ten years from today if you earn an 8 percent rate of return? a. $6,008.85 b. $12,220.96 c. $17,558.66 d. $19,430.32 ________ 7. What is the effective annual rate of 10.75 percent compounded continuously? a. 11.04 percent b. 11.19 percent c. 11.30 percent d. 11.35 percent ________ 8. What is the effective annual rate of 14.5 percent compounded semiannually? a. 15.03 percent b. 15.31 percent c. 15.50 percent d. 15.82 percent ________ 9. You borrow $135,000 for twenty years at 9 percent. This is an amortized loan with monthly payments. How much of the first payment goes to the principle balance of the loan? Assume that one month is equal to 1/12 of a year. a. $84.38 b. $87.50 c. $193.09 d. $202.13 ________ 10. You just purchased a 15-year annuity at a cost of $70,000. The annuity will pay you $1,050 at the end of each month, starting with this month. What rate of return are you earning on this investment? a. 15.42 percent b. 15.52 percent c. 16.45 percent d. 16.74 percent 6-1 Chapter 6 Discounted Cash Flow Valuation Chapter 06 Quiz A 1. Answers d .095 3012 1 1 / 1 12 APV $675 .095 12 $675 118.92668 $80,275.51 Enter 3012 N 9.5/12 I/Y Solve for PV 80,275.51 -675 PMT FV Price of house = $80,275.51 + $5,000 = $85,275.51 2. b .07 54 1 1 / 1 4 APV $6,000 .07 4 $6,000 16.7528813 $100,517.29 Enter Solve for 54 N 7/4 I/Y 6,000 PV PMT -100,517.29 FV 6-2 Chapter 6 Discounted Cash Flow Valuation 3. a .04 t 1 1 / 1 12 $1,000,000 $4,500 .04 12 .04 t 1 1 / 1 12 222.222222 .04 12 .04 t .74074074 1 1 / 1 12 t .04 .25925926 1 / 1 12 3.857142846 1.003333333t ln 3.857142846 t ln1.003333 333 1.349926714 .00332779t t 405.65 months 33.80 years Enter 4/12 -1,000,000 4,500 N I/Y PV PMT Solve for 405.65 Number of years = 405.65 / 12 = 33.80 years 4. b 5. b PV FV $1.75 $14.00 .125 1 1 1 NPV $6,000 $7,500 $9,000 1 2 3 (1 .085) (1 .085) 1 .085 1 $11,000 4 1 .085 $5,529.954 $6,370.915 $7,046.173 $7,937.317 $26,884.36 Enter 1 N 8.5 I/Y 2 N 8.5 I/Y 3 N 8.5 I/Y 4 N 8.5 I/Y Solve for Enter Solve for Enter Solve for Enter PV -5,529.954 PMT 6,000 FV PV -6,370.915 PMT 7,500 FV PV -7,046.173 PMT 9,000 FV PMT 11,000 FV PV 6-3 Chapter 6 Discounted Cash Flow Valuation Solve for -7,937.317 NPV = $5,529.954 + $6,370.915 + $7,046.173 + $7,937.317 = 26,884.36 6. c FV $1,000 (1 .08)10 $4,000 (1 .08)9 $4,000 (1 .08)8 $2,158.92 $7,996.02 $7,403.72 $17,558.66 Enter 10 N 8 I/Y -1,000 PV PMT FV 2,158.92 9 N 8 I/Y -4,000 PV PMT FV 7,996.02 8 N 8 I/Y -4,000 PV PMT FV 7,403.72 Solve for Enter Solve for Enter Solve for FV = $2,158.92 + $7,996.02 + $7,403.72 = $17,558.66 7. d EAR = e.1075 − 1 = 2.71828.1075 − 1 = .11349 = 11.35 percent Input for Texas Instruments BA II plus .1075, 2nd, ex, -1, =; EAR = 11.35 percent 2 8. a .145 EAR 1 1 = .15026 = 15.03 percent 2 Enter 14.5 NOM Solve for 9. EFF 15.03 2 C/Y d .09 2012 1 1 / 1 12 $135,000 C .09 12 $135,000 111.144954C C $1,214.63 Enter 2012 N Solve for Interest1 $135,000 9/12 135,000 I/Y PV PMT FV -1,214.63 .09 $1,012.50 12 First month’s principle = $1,214.63 – $1,012.50 = $202.13 6-4 Chapter 6 Discounted Cash Flow Valuation 10. c 1512 r 1 1 / 1 12 ; This cannot be solved directly, so it’s easiest to just use the $70,000 $1,050 r 12 calculator method to get an answer. You can then use the calculator answer taken to several decimal places as the rate in the formula just to verify that your answer is correct. Enter 1512 N /12 -70,000 1,050 I/Y PV PMT FV Solve for 16.45 With more decimals, the answer is 16.44722824 percent. 6-5 Chapter 6 Discounted Cash Flow Valuation Chapter 06 Quiz B Student Name _________________________ Student ID ____________ ________ 1. You want to pay mortgage payments of $750 a month for twenty-five years. The interest rate is 6.5 percent, compounded monthly. What price house can you afford to buy if you have $7,500 cash available as a down payment? a. $103,577.02 b. $104,178.69 c. $111,077.02 d. $118,577.02 ________ 2. You are going to receive $7,000 at the end of each quarter for the next eight years. What is the net present value of these payments at a discount rate of 9 percent, compounded quarterly? a. $158,463.72 b. $162,029.15 c. $477,809.07 d. $481,392.64 ________ 3. You want to retire on the day you have $800,000 in your savings account. You expect to earn 5 percent, compounded monthly, on your money during your retirement. Your plan is to withdraw $5,000 a month as retirement income from this account. How many years can you be retired until you run out of money? a. 21.85 b. 22.02 c. 262.23 d. 264.22 ________ 4. A preferred stock pays annual dividends of $3.65. How much are you willing to pay today to buy one share of this stock if you want to earn an 11 percent rate of return? a. $17.73 b. $23.64 c. $33.18 d. $59.09 ________ 5. A project will produce cash flows of $4,000, $4,500, $6,500, and $8,000 a year for the next four years, respectively. What is the value of these cash flows today at a discount rate of 7.5 percent? a. $18,837.57 b. $19,286.85 c. $23,915.49 d. $25,156.99 ________ 6. Today you are opening a savings account and depositing an initial $2,000 into it. You plan to deposit $3,000 into the account three years from today and deposit another $5,000 four years from today. How much will you have in your account five years from today if you earn a 10 percent rate of return? a. $11,857.02 b. $12,351.02 c. $14,526.10 d. $16,105.10 ________ 7. What is the effective annual rate of 12.5 percent compounded monthly? a. 12.50 percent b. 13.10 percent c. 13.24 percent d. 13.31 percent ________ 8. What is the effective annual rate of 14.7 percent compounded daily? a. 15.24 percent b. 15.53 percent c. 15.73 percent d. 15.83 percent ________ 9. You borrow $155,000 for thirty-five years at 7 percent. This is an amortized loan with monthly payments. How much of the first payment goes to the principle balance of the loan? Assume that one month is equal to 1/12 of a year. a. $80.31 b. $86.06 c. $984.48 d. $990.23 ________ 10. You just purchased a 25-year annuity at a cost of $80,000. The annuity will pay you $1,200 at the end of each month, starting with this month. What rate of return are you earning on this investment? a. 17.78 percent b. 17.82 percent c. 18.06 percent d. 18.10 percent 6-6 Chapter 6 Discounted Cash Flow Valuation Chapter 06 Quiz B 1. Answers d .065 2512 1 1 / 1 12 APV $750 .065 12 $750 148.1026946 $111,077.02 Enter 2512 N 6.5/12 I/Y Solve for -750 PV PMT 111,077.02 FV Home price = $111,077.02 + $7,500 = $118,577.02 2. a .09 84 1 1 / 1 4 APV $7,000 .09 4 $7,000 22.63767419 $158,463.72 Enter Solve for 3. 84 N 9/4 I/Y 7,000 PV PMT -158,463.72 FV b 6-7 Chapter 6 Discounted Cash Flow Valuation .05 t 1 1 / 1 12 $800,000 $5,000 .05 12 .05 t 1 1 / 1 12 160 .05 12 .05 t .666666667 1 1 / 1 12 t .05 .333333333 1 / 1 12 3 .995850622 t ln 3 t ln1.004166 667 1.098612289 .00415801t t 264.22 months Enter Solve for N 264.22 5/12 I/Y -800,000 5,000 PV PMT FV Number of years = 264.22 / 12 = 22.02 years 4. c 5. a PV $3.65 $33.18 .11 1 1 1 NPV $4,000 $4,500 $6,500 1 2 3 (1 .075) (1 .075) 1 .075 1 $8,000 4 1 .075 $3,720.93 $3,894.00 $5,232.24 $5,990.40 $18,837.57 Enter 1 N 7.5 I/Y 2 N 7.5 I/Y 3 N 7.5 I/Y 4 7.5 Solve for Enter Solve for Enter Solve for Enter PV -3,720.93 PMT 4,000 FV PV -3,894.00 PMT 4,500 FV PV -5,232.24 PMT 6,500 FV 8,000 6-8 Chapter 6 Discounted Cash Flow Valuation N I/Y Solve for PV -5,990.40 PMT FV NPV = $3,720.93 + $3,894.00 + $5,232.24 + $5,990.40 = 18,837.57 6. b FV $2,000 (1 .10) 5 $3,000 (1 .10) 2 $5,000 (1 .10)1 $3,221.02 $3,630.00 $5,500.00 $12,351.02 Enter 5 N 10 I/Y -2,000 PV PMT FV 3,221.02 2 N 10 I/Y -3,000 PV PMT FV 3,630.00 1 N 10 I/Y -5,000 PV PMT FV 5,500.00 Solve for Enter Solve for Enter Solve for FV = $3,221.02 + $3,630.00 + $5,500.00 = $12,351.02 12 7. c .125 EAR 1 1 .1324 13.24 percent 12 Enter 12.5 NOM Solve for 8. 12 C/Y d .147 EAR 1 365 Enter 14.7 NOM Solve for 9. EFF 13.24 365 1 .1583 15.83 percent EFF 15.83 365 C/Y b .07 3512 1 1 / 1 12 $155,000 C . 07 12 $155,000 C 156.5297092 C $990.23 Enter Solve for 3512 N 7/12 I/Y 155,000 PV PMT -990.23 FV 6-9 Chapter 6 Discounted Cash Flow Valuation Interest 1 $155,000 .07 $904.17 12 First month’s principle = $990.23 – $904.17 = $86.06 10. a 2512 r 1 1 / 1 12 ; This cannot be solved directly, so it’s easiest to just use the $80,000 $1,200 r 12 calculator method to get an answer. You can then use the calculator answer taken to several decimal places as the rate in the formula just to verify that your answer is correct. Enter 2512 N /12 -80,000 1,200 I/Y PV PMT FV Solve for 17.78 With more decimals, the answer is 17.7818277 percent. 6-10 Chapter 6 Discounted Cash Flow Valuation Chapter 06 Quiz C Student Name _________________________ Student ID ____________ ________ 1. You want to retire on the day you have $900,000 in your savings account. You expect to earn 6 percent, compounded monthly, on your money during your retirement. Your plan is to withdraw $5,750 a month as retirement income from this account. How many years can you be retired until you run out of money? a. 24.75 b. 24.91 c. 25.20 d. 25.50 ________ 2. Today you are opening a savings account and depositing an initial $5,000 into it. You plan to deposit $6,500 into the account two years from today and deposit another $8,000 four years from today. How much will you have in your account five years from today if you earn an 11 percent rate of return? a. $25,314.60 b. $26,194.89 c. $32,858.63 d. $29,602.37 ________ 3. You want to pay mortgage payments of $700 a month for thirty-five years. The interest rate is 3.8 percent, compounded monthly. What price house can you afford to buy if you have $10,000 cash available as a down payment? a. $172,466.25 b. $182,980.73 c. $186,466.25 d. $186,980.73 ________ 4. A preferred stock pays annual dividends of $1.20. How much are you willing to pay today to buy one share of this stock if you want to earn a 12 percent rate of return? a. $10.00 b. $20.00 c. $40.00 d. $120.00 ________ 5. A project will produce cash flows of $1,000, $1,500, $3,000, and $5,000 a year for the next four years, respectively. What is the value of these cash flows today at a discount rate of 9.5 percent? a. $7,927.09 b. $8,013.85 c. $12,013.85 d. $15,095.44 ________ 6. You are going to receive $9,000 at the end of each quarter for the next six years. What is the net present value of these payments at a discount rate of 11 percent, compounded quarterly? a. $49,161.30 b. $98,776.25 c. $156,607.17 d. $160,913.87 ________ 7. What is the effective annual rate of 10.20 percent compounded weekly? a. 10.20 percent b. 10.60 percent c. 10.69 percent d. 10.73 percent ________ 8. What is the effective annual rate of 15.25 percent compounded continuously? a. 16.36 percent b. 16.45 percent c. 16.47 percent d. 16.50 percent ________ 9. You borrow $300,000 for forty years at 8 percent. This is an amortized loan. How much of the first payment goes to the principle balance of the loan? Assume that one month is equal to 1/12th of a year. a. $72.12 b. $85.94 c. $2,072.12 d. $2,085.94 ________ 10. You just purchased a 20-year annuity at a cost of $75,000. The annuity will pay you $1,100 at the end of each month, starting with this month. What rate of return are you earning on this investment? a. 14.67 percent b. 17.00 percent c. 17.28 percent d. 17.60 percent 6-11 Chapter 6 Discounted Cash Flow Valuation Chapter 06 Quiz C 1. Answers d .06 t 1 1 / 1 12 $900,000 $5,750 .06 12 .06 t 1 1 / 1 12 156.5217391 .06 12 .06 t .782608696 1 1 / 1 12 .06 .217391305 1 / 1 12 4.599999997 1.005 t t ln 4.599999997 t ln1.005 1.526056303 .004987542t t 305.97 Enter Solve for N 305.97 6/12 I/Y -900,000 5,750 PV PMT FV Number of years = 25.50 2. b FV $5,000 (1 .11) 5 $6,500 (1 .11) 3 $8,000 (1 .11)1 $8,425.29 $8,889.60 $8,880.00 $26,194.89 Enter 5 N 11 I/Y -5,000 PV PMT FV 8,425.29 3 N 11 I/Y -6,500 PV PMT FV 8,889.60 1 N 11 I/Y -8,000 PV PMT FV 8,880.00 Solve for Enter Solve for Enter Solve for FV = $8,425.29 + $8,889.60 + $8,880.00 = $26,194.89 6-12 Chapter 6 Discounted Cash Flow Valuation 3. a .038 3512 1 1 / 1 12 APV $700 .038 12 $700 232.0946471 $162,466.25 Enter 3512 N Solve for 3.8/12 -700 I/Y PV PMT 162,466.25 FV Home price = $162,466.25 + $10,000 = $172,466.25 4. a 5. a PV $1.20 $10.00 .12 1 1 1 1 NPV $1,000 $1,500 $3,000 $5,000 1 4 2 3 (1 .095) (1 .095) 1 .095 1 .095 $913.24 $1,251.02 $2,284.96 $3,477.87 $7,927.09 Enter 1 N 9.5 I/Y 2 N 9.5 I/Y 3 N 9.5 I/Y 4 N 9.5 I/Y Solve for Enter Solve for Enter Solve for Enter Solve for PV -913.24 PMT 1,000 FV PV -1,251.02 PMT 1,500 FV PV -2,284.96 PMT 3,000 FV PV -3,477.87 PMT 5,000 FV NPV = $913.24 + $1,251.02 + $2,284.96 + $3,477.87 = $7,927.09 6. c .11 64 1 1 / 1 4 APV $9,000 .11 4 $9,000 17.4007967 $156,607.17 6-13 Chapter 6 Discounted Cash Flow Valuation Enter 64 N 11/4 I/Y Solve for 9,000 PV PMT -156,607.17 FV 52 7. d .102 EAR 1 1 ; EAR = 10.73 percent 52 Enter 10.20 NOM Solve for 8. c EFF 10.73 52 C/Y EAR = e.1525 − 1 = 2.71828.1525 − 1 =.16474 = 16.47 percent Input for Texas Instruments BA II plus .1525, 2nd, ex, −1 = 16.47 percent 9. b .08 4012 1 1 / 1 12 $300,000 C .08 12 $300,000 C 143.8203923 C $2,085.94 Enter 4012 N 8/12 I/Y 300,000 PV Solve for Interest 1 $300,000 PMT FV -2,085.94 .08 $2,000 12 First month’s principle = $2,085.94 – $2,000.00 = $85.94 10. b 2012 r 1 1 / 1 12 ; This cannot be solved directly, so it’s easiest to just use the $75,000 $1,100 r 12 calculator method to get an answer. You can then use the calculator answer taken to several decimal places as the rate in the formula just to verify that your answer is correct. Enter 2012 N /12 -75,000 1,100 I/Y PV PMT FV Solve for 17.00 With more decimals, the answer is 16.99823943 percent. 6-14