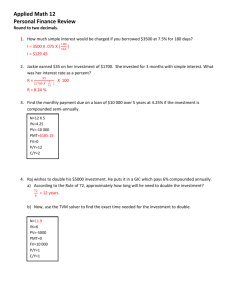

PROBLEMS

advertisement

AGEC 424 Chapter 5 Homework (key): second set As has been the case in many of the keys, these answers are often off due to the rounding involved in the key using data from tables. In contrast you are expected to use your calculator and show your calculator inputs and outputs. Amount Problems 1. The Lexington Property Development Company has a $10,000 note receivable from a customer due in three years. How much is the note worth today if the interest rate is a. 9%? b. 12% compounded monthly? c. 8% compounded quarterly? d. 18% compounded monthly? e. 7% compounded continuously? SOLUTION: PV = FV [PVFk,n] a. PV = $10,000 [PVF9,3] = $10,000 (.7722) = $7,722 b. PV = $10,000 [PVF1,36] = $10,000 (.6989) = $6,989 c. PV = $10,000 [PVF2,12] = $10,000 (.7885) = $7,885 d. PV = $10,000 [PVF1.5,36] = $10,000 (.5851) = $5,851 e. FV = PV (ekn) $10,000 = PV [e.07(3)] $10,000 = PV [1.2337] PV = $8,105.70 2. What will a deposit of $4,500 left in the bank be worth under the following conditions: a. Left for nine years at 7% interest? b. Left for six years at 10% compounded semiannually? c. Left for five years at 8% compounded quarterly? d. Left for 10 years at 12% compounded monthly? SOLUTION: FV = PV [FVFk,n) a. b. FV = $4,500 [FVF7,9] = $4,500 (1.8385) = $8,273.25 FV = $4,500 [FVF5,12] = $4,500 (1.7959) = $8,081.55 1 c. d. FV = $4,500 [FVF2,20] = $4,500 (1.4859) = $6,686.55 FV = $4,500 [FVF1,120] = $4,500 (3.3004) = $14,851.80 3. What interest rates are implied by the following lending arrangements? a. You borrow $500 and repay $555 in one year. b. You lend $1,850 and are repaid $2,078.66 in two years. c. You lend $750 and are repaid $1,114.46 in five years with quarterly compounding. d. You borrow $12,500 and repay $21,364.24 in three years under monthly compounding. (Note: In c and d, be sure to give your answer as the annual nominal rate.) SOLUTION: FV = PV [FVFk,n] a. $555 = $500 [FVFk,1] FVFk,1 = 1.1100 k = 11% b. $2,078.66 = $1,850.00 [FVFk,2] FVFk,2 = 1.1236 k = 6% c. $1,114.46 = $750.00 [FVFk,20] FVFk,20 = 1.4859 k = 2% knom = 8% d. $21,364.24 = $12,500.00 [FVFk,36] FVFk,36 = 1.7091 k = 1.5% knom = 18% 4. How long does it take for the following to happen? a. $856 grows into $1,122 at 7%. b. $450 grows into $725.50 at 12% compounded monthly. c. $5,000 grows into $6724.44 at 10% compounded quarterly. SOLUTION: PV = FV [PVFk,n] a. b. c. $856 = $1,122 [PVF7,n] PVF7,n = .7629 n = 4 years $450.00 = $725.50 [PVF1,n] PVF1,n = .6203 n = 48 months = 4 years $5,000 = $6,724.44 [PVF2.5,n] PVF2.5,n = 0.7436 n = 12 quarters = 3 years 2 5. Sally Guthrie is looking for an investment vehicle that will double her money in five years. a. What interest rate, to the nearest whole percentage, does she have to receive? b. At that rate, how long will it take the money to triple? c. If she can't find anything that pays more than 11%, approximately how long will it take to double her investment? d. What kind of financial instruments do you think Sally is looking at? Are they risky? What could happen to Sally's investment? SOLUTION: FV = PV [FVFk,n] a. 2 = 1 [FVFk,5] FVFk,5 = 2 k= 15% b. FVF15,n = 3 n = 7.9 years (approximate with 8 years) c. FVF11,n = 2 n = 6.6 years (approximate with 7 years) d. Investments with anticipated returns like these are probably growth-oriented stocks with considerable risk. She could lose money. 20. What are the monthly mortgage payments on a 30-year loan for $150,000 at 12%? Construct an amortization table for the first six months of the loan. SOLUTION: PVA = PMT [PVFAk,n] $150,000 = PMT [PVFA1,360] = PMT(97.2183) PMT = $1,542.92 Year 1 2 3 4 5 6 Beg Bal PMT INT Prin Red $150,000.00 149,957.08 149,913.73 149,869.94 149,825.72 149,781.06 $1,542.92 1,542.92 1,542.92 1,542.92 1,542.92 1,542.92 $1,500.00 $42.92 1,499.57 43.35 1,499.13 43.79 1,498.70 44.22 1,498.26 44.66 1,497.81 45.11 End Bal $149,957.08 149,913.73 149,869.94 149,825.72 149,781.06 149,735.95 28. The Orion Corp. is evaluating a proposal for a new project. It will cost $50,000 to get the undertaking started. The project will then generate cash inflows of $20,000 in its first year and $16,000 per year in the next five years after which it will end. Orion uses an interest rate of 15% compounded annually for such evaluations. a. Calculate the “Net Present Value” (NPV) of the project by treating the initial cost as a cash outflow (a negative) in the present, and adding the present value of the subsequent cash inflows as positives. b. What is the implication of a positive NPV? (Words only.) c. Suppose the inflows were somewhat lower, and the NPV turned out to be negative. What would be the implication of that result? (Words only.) 3 (This problem is a preview of a technique called Capital Budgeting, which we’ll study in detail in Chapters 9, 10, and 11.) Solution: a. Use the CFj portion of your calculator CF0 = -50,000 CF1 = 20,000 CF2 = 16,000 … CF6 = 16,000 I = 15 Compute NPV = 14,029.98 b. A positive NPV means that on a present value basis the project’s cash inflows exceed its outflows. That implies it’s a good deal for the company. In essence it is expected to increase the firm’s wealth and value to stockholders. Since that’s what management is supposed to do, they should accept the project. c. A negative means just the opposite. It implies that, on balance, the project will cost the firm money. Hence it should be rejected. 32. Janet Elliott just turned 20, and received a gift of $20,000 from her rich uncle. Janet plans ahead and would like to retire on her 55th birthday. She thinks she’ll need to have about $2 million saved by that time in order to maintain her lavish lifestyle. She wants to make a payment at the end of each year until she’s 50 into an account she’ll open with her uncle’s gift. After that she’d like to stop making payments and let the money grow at interest until it reaches $2 million when she turns 55. Assume she can invest at 7% compounded annually. Ignore the effect of taxes. a. How much will she have to invest each year in order to achieve her objective? b. What percent of the $2 million will have been contributed by Janet (including the $20,000 she got from her uncle)? SOLUTION: a. First we need to know how much she will need to accumulate by the time she reaches 50 so that amount can grow to $2 million by the time she reaches 55. n = 5; I/Y = 7; PMT = 0; FV = 2,000,000 CPT PV = $1,425,972.36 That number becomes the FV in an ordinary annuity with a $20,000 PV n = 30; I/Y = 7; PV = 20,000; FV = (1,425,972.36) CPT PMT = $13,484.19 b. Janet will have contributed $20,000 + 30 x $13,484.19 = $424,525.70, and 424,525.70/2,000,000 = 21.23% 4

![Practice Quiz 6: on Chapter 13 Solutions [1] (13.1 #9) The](http://s3.studylib.net/store/data/008331662_1-d5cef485f999c0b1a8223141bb824d90-300x300.png)

![Practice Quiz Compound Interest [with answers]](http://s3.studylib.net/store/data/008331665_1-e5f9ad7c540d78db3115f167e25be91a-300x300.png)