Measuring market (systematic) risk for individual securities Market

advertisement

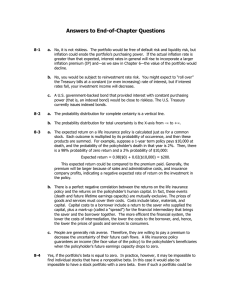

Measuring market (systematic) risk for individual securities Market risk, which is relevant for stocks held in well-diversified portfolios, is defined as the contribution of a security to the overall riskiness of the portfolio. measured by a stock’s beta (β) coefficient. For stock i: βi = (ρi,M σi) / σM Where βi indicates beta for stock i, ρi,M is the correlation coef between stock i and the market, σi is the standard deviation of stock i and σM is the standard deviation of the overall market. How is β interpreted? If β = 1.0, stock has average risk. If β > 1.0, stock is riskier than average. If β < 1.0, stock is less risky than average. Note: Most stocks have betas in the range of 0.5 to 1.5. How are betas calculated? Run a regression with returns on the stock in question plotted on the Y axis and returns on the market portfolio plotted on the X axis. The slope of the regression line, which measures relative volatility, is defined as the stock’s beta coefficient, or β. 1 Note: In addition to measuring a stock’s contribution of risk to a portfolio, beta also measures the stock’s volatility relative to the market. Calculating Beta in Practice Many analysts use the S&P 500 to find the market return. Analysts typically use four or five years’ of monthly returns to establish the regression line. Some analysts use 52 weeks of weekly returns. Other Web Sites for Beta Go to http://finance.yahoo.com Enter the ticker symbol for a “Stock Quote”, such as IBM or Dell, then click GO. When the quote comes up, select Key Statistics from panel on left. Now that we know how to find the β for a stock, what can we do with it? 1. Find the portfolio beta 2. Use β in the CAPM model to estimate the required return of each security 2 The Security Market Line (SML) is part of the Capital Asset Pricing Model (CAPM). Recall CAPM defines the relationship between systematic risk and return: SML: ri = rRF + (RPM) βi Where ri is the required return on security i rRF is the risk free rate RPM = (rM - rRF) Assume rRF = 8%; rM = 15%. RPM = (rM - rRF) = 15% - 8% = 7%. Find Required Rates of Return: 3 Expected versus Required Returns (%) Exp. Req. r r Alta 17.4 17.0 Undervalued Market 15.0 15.0 Fairly valued Am. F. 13.8 12.8 Undervalued T-bills 8.0 8.0 Fairly valued Repo 1.7 2.0 Overvalued 4 SML: ri = rRF + (RPM) βi ri = 8% + (7%) βi 5 2 Stock Portfolio (Find Portfolio Beta, βP) A. Calculate beta for a portfolio with 50% Alta and 50% Repo Formula: N βP = Σ wi βi i=1 B. Calculate the required return on this 2 stock portfolio Required Return on the Alta/Repo Portfolio? Formula: N rP = Σ wi ri i=1 6 Impact of Inflation Change on SML Recall: SML: ri = rRF + (rM - rRF) βi Where (rM - rRF)= RPM Note: rRF = r* + IP 7 Impact of Risk Aversion Change Has the CAPM been completely confirmed or refuted? - No. The statistical tests have problems that make empirical verification or rejection virtually impossible. - Investors’ required returns are based on future risk, but betas are calculated with historical data. - Investors may be concerned about both stand-alone and market risk. 8