IFM9

advertisement

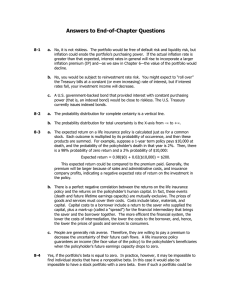

Chapter 2: Risk & Return Topics Basic risk & return concepts Stand-alone risk Portfolio (market) risk Relationship between risk and return 1 What are investment returns? Returns measure the financial results of an investment. Returns may be: ________________ ________________ Returns can be expressed in: ________________ ________________ 2 What is investment risk? Typically, investment returns are not known with certainty. Investment risk pertains to: Possibility of a ____________ Probability of earning __________ than expected ________________________ associated with returns 3 Risk Why is risk important? 4 Stand-Alone Risk Stand-alone (total) risk is the risk facing an investor who owns only _________ ______________. _________________________measure s the stand-alone risk of an investment. Coefficient of variation (CV) and variance are also measures of standalone risk. 5 Adding Stocks to a Portfolio What happens to the risk and return of an average 1-stock portfolio as more randomly selected stocks were added? 6 s1 stock ≈ 35% sMany stocks ≈ 20% 1 stock 2 stocks Many stocks -75 -60 -45 -30 -15 0 15 30 45 60 75 90 10 5 Returns (%) 7 Risk vs. Number of Stock in Portfolio sp Company Specific (Diversifiable) Risk 35% Stand-Alone Risk, sp 20% Market Risk 0 10 20 30 40 2,000 stocks8 Stand-alone risk = Market risk + Diversifiable risk Market risk is that part of a security’s stand-alone risk that ______________ be eliminated by diversification. Firm-specific, or diversifiable, risk is that part of a security’s stand-alone risk that __________________ be eliminated by diversification. 9 How is market risk measured for individual securities? Market risk, is the contribution of a security to the overall riskiness of a well-diversified portfolio. It is measured by a stock’s _________. 10 Beta In addition to measuring a stock’s contribution to the risk of a portfolio, beta also which measures the stock’s volatility relative to the ____________. 11 How is beta interpreted? If b = 1.0, stock has average risk. If b > 1.0, stock is riskier than average. If b < 1.0, stock is less risky than average. Most stocks have betas in the range of 0.5 to 1.5. 12 Use the SML to calculate an asset’s required return. The Security Market Line (SML) is part of the Capital Asset Pricing Model (CAPM). The equation for the SML is: ri = rRF + (RPM)bi ri is the required return on security i rRF is the risk-free interest rate RPM is the risk premium on the market bi is the beta for security i 13 Use the SML to calculate an asset’s required return. ri = rRF + (RPM)bi rRF = 7% rM = 15% RPM = rM – rRF = 15% – 7% = 8% bi = 1.25 ri = 7% + 1.25 (8%) = 17% 14 Has the CAPM been completely confirmed or refuted? No. There are difficulties in testing CAPM empirically: Investors’ required returns are based on future risk, but betas are calculated with historical data. Investors may be concerned about both stand-alone and market risk. 15