Zimb Johnson Bespoke Financial Planning Limited

advertisement

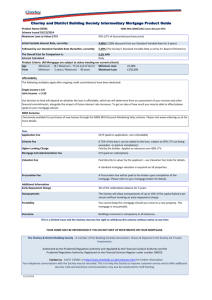

Zimb Johnson Bespoke Financial Planning Limited STATEMENT OF FEES Financial Planning Full initial review and detailed outline plan – ranging from £1,500 to £5,000 depending on complexity. Includes comment on all areas and generic recommendations. Investment planning (including pension investment) – £750 Risk Profiling, Asset Allocation and fund selection. Suitability report - £250 per product. Pension Transfer Analysis - Final Salary Schemes £1,000 - Money Purchase £500 Implementation Investments, single premium pensions and pension transfers are charged at up to 3% of the initial investment subject to a minimum of £250 initial charge. Annuities are charged at up to 1.5% of the purchase price or up to 2% for enhanced rate annuities. Reviews Ongoing review services are charged at up to 1% of funds under management subject to minimum levels for each review service. Top up fees are payable for lower funds under management for each service level. A retainer fee of £10 per month is charged for handling policy paperwork where no other income is being received. Group Schemes Set up and Presentation up to 20 staff - £1,000 Set up and Presentation up to 100 staff - £2,500 Set up and Presentation up to 200 staff £3,500 Group Risk schemes are charged at £25 per person subject to a minimum of £500 Ongoing pension charges – bespoke depending on service requirements Scheme Wind Ups – Individually costed – based on £500 per person including Section 32 transfer General Advice General research and obtaining quotations. Administration - £75 ph Paraplanning - £100 ph Advice - £250 ph An additional fee may be payable for complex research, calculations and advice but we will advise you of the amount prior to undertaking such work. Mortgages An initial fee of £250 for research, mortgage sourcing and general mortgage advice, including providing illustration on the cost of associated life cover 0.5% of the mortgage advance. We will generally receive a procuration fee from the mortgage lender. This will offset any fee payable to us. For example if a lender pays us 0.25%, you will be invoiced 0.25% totalling 0.5% fee. All services provided are on an advisory nature. This means that we do not seek discretionary powers but will advise you of any changes that we consider to be in your interest and to seek your consent before acting on your behalf in each case.